Dealspeak North America – NVIDIA’s venture investments surge with AI boom

NVIDIA [NASDAQ:NVDA], the crown jewel of the semiconductor industry, has developed a strong venture capital arm to boost the ecosystem around its computing platform.

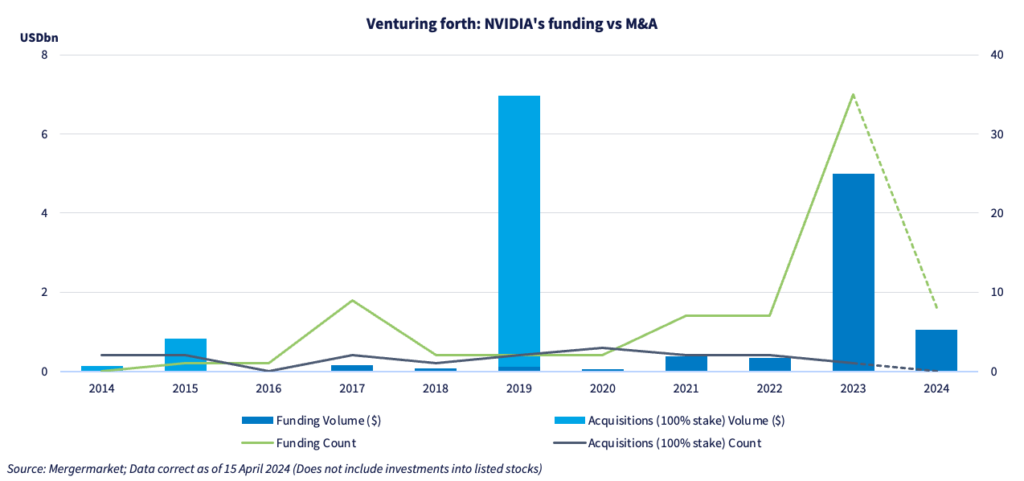

Ignited by the boom in artificial intelligence, the chip designer’s participation in funding rounds and share placements has surged. Last year, NVIDIA invested in 35 startups, more than three times the preceding year, according to Mergermarket data. Its venture commitment has continued in the year to date, with participation in another eight funding rounds, including Figure AI (USD 675m) and Kore.ai (USD 150m).

The chipmaker invests through its corporate development team, led by Vishal Bhagwati. It also invests through its venture arm, NVentures, run by Sid Siddeek, which has put money into at least 19 companies since its first commitment in September 2022. It previously used GPU Ventures for some corporate investments, but has retired that name, even as much of that team and investment focus remains.

Nothing ventured, nothing gained

Of the 36 investments it made in 2023, only one was an outright acquisition: the purchase of OmniML for undisclosed terms last June. The rest involved startup funding, according to Mergermarket data. The biggest rounds in which it participated were Inflection AI (USD 1.3bn), Databricks (USD 500m), Generate Biomedicines (USD 273m), Cohere (USD 270m), Hugging Face (USD 235m), Skydio (USD 230m), CoreWeave (USD 221m), Genesis Therapeutics (USD 200m), and AI21 Labs (USD 155m).

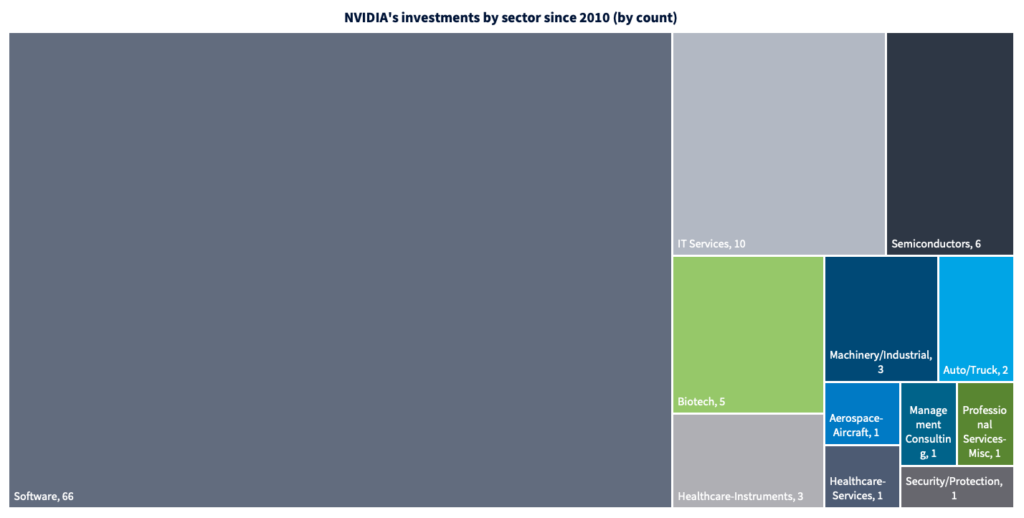

Last year, 17 investments were in software, six were in technology services, five were in biotech, and a further two each were in industrial machinery, healthcare instruments, and professional services, according to Mergermarket. Other investments came in autonomous drones and delivery robots.

Investments in AI software are again dominant this year, although notable forays have included industrial automation (Figure AI), robotic surgical systems (Neocis), healthcare technology (Artisight), and AI chatbots (Kore.ai, Perplexity.ai).

Mergermarket’s data does not include NVIDIA’s recent investments into public companies, such as SoundHound AI [NASDAQ:SOUN], Recursion Pharmaceuticals [NASDAQ:RXRX] and, most notably, Arm Holdings [NASDAQ:ARM], the UK-based chip designer it tried buying for USD 40bn before regulatory roadblocks nixed the deal in 2022. NVIDIA disclosed a USD 147.3m investment in ARM in February.

Let them eat cake

Since OpenAI introduced ChatGPT in December 2022 and, with it, the grand promise of generative AI, NVIDIA’s share price has jumped sixfold. Its market capitalization now stands at USD 2.18tn, making it the third most valuable company globally behind only Microsoft [NASDAQ:MSFT] and Apple [NASDAQ:AAPL]. When it comes to making the data-center computing power needed for generative AI, NVIDIA is by far the leader.

NVIDIA’s innovation was to pair graphics processing units (GPUs), typically used for gaming and video, with central processing units (CPUs) to create an accelerated computing platform. Nvidia has built its platform mostly organically with a few acquisitions in between. Its most significant acquisition was the USD 6.9bn deal for Mellanox, a provider of network adapters, switches and cables, in 2019. That gave it network connectivity around its GPUs based on the InfiniBand protocol, regarded as faster than Ethernet.

Malcolm deMayo, vice president of financial services at NVIDIA, described the platform as a “three-layer cake”, in an interview last fall. The first layer is hardware, which connects CPUs with GPUs using a high-speed data highway called NVLink, which includes memory. The second layer is software that includes libraries, frameworks, and pre-trained AI models into which customers can quickly load their data. The final layer is a growing suite of software development kits (SDKs) that helps clients create their own applications, such as an AI assistant or chatbot for a specific use case.

After seeing the platform’s runaway success, every semiconductor company is now thinking about how to partner with NVIDIA or competitors such as Advanced Micro Devices [NASDAQ:AMD], Broadcom [NASDAQ:AVGO] or Intel [NASDAQ:INTC] to piece together a rival solution.

“You can count on the fact we’re talking to NVIDIA,” one semiconductor executive noted. “For the problems they’re trying to solve, they don’t have enough people. Adding to what they have would be an interesting competitive move.”