Dealspeak APAC – Real estate and take-private deals steal the APAC limelight

In an otherwise bleak dealmaking environment, real estate healthcare, construction, telecom and retail provided M&A practitioners with bright opportunities for business across the Asia-Pacific in 2024 year-to-date (YTD).

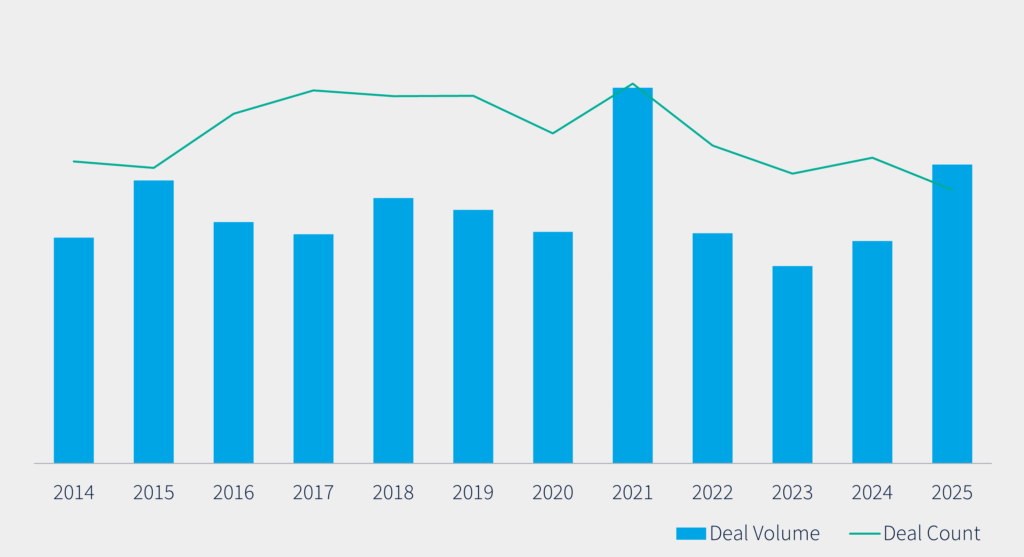

Deal volume in APAC plunged 38% year over year to USD 124.1bn in 2024 YTD, the lowest since 2013. Deal count slid 18% to 2,149 transactions, the smallest number since 2004. The data reflect low activity in China – down 38.9% year-on-year in terms of deal volume – as well as in private equity, coupled with less than stellar performance elsewhere.

It was not all doom and gloom for investors and bankers, who tapped into specific industries or capitalized on the low valuations of companies listed in China or Hong Kong by taking some private.

The real estate, healthcare, construction, and telecom sectors recorded notable increases in deal volume. The technology sector remained a major driver of M&A activity – USD 17.6bn across 599 transactions – despite dropping 56% in deal volume and 17.1% in deal count year-on-year.

In the midst of every real estate crisis, lies great opportunity

Chinese authorities highlighted the role of M&A in restructuring the troubled real estate sector, with overly-indebted property developers – in particular privately-owned firms – seeking to divest assets to raise money and repay debt. Among others, state-owned insurer New China Life Insurance set up USD 1.4bn fund for property investments.

Real estate M&A volume across APAC jumped 42.7% year-on-year to USD 21bn, becoming the largest sector in the region. The top deal in APAC during 1Q24 was the sale of a 60% stake in Dalian Wanda Group’s mall unit, Newland Commercial Management, by a consortium led by private equity firm PAG, at the end of March.

To reshape its economic growth model, China is undertaking a revamp that aims to reduce its reliance on the real estate sector, which has been a long-standing concern. Instead, the focus is shifting towards investment in innovation-driven development within high-value sectors.

By doing so, China intends to address the issue of excessive debt within the property sector and mitigate the risks of economic bubbles. This strategic shift also aligns with China’s objective of achieving technological self-sufficiency, especially in light of geopolitical tensions with Washington.

Healthcare soars as take-private trend grows

Healthcare was the third most attractive sector in APAC with 170 transactions worth USD 12.3bn, up 30.5% year-on-year in terms of deal volume. The proposed take-private of Hong Kong-listed China Traditional Chinese Medicine Holdings by Sinopharma for nearly USD 3bn was the top deal in the sector and the fourth largest in APAC in 2024 YTD.

The deal, if it goes through, would be one of the biggest privatization deals for a Hong Kong-listed firm since 2020. An increasing number of companies listed in Hong Kong are considering going private as attractive valuations entice investors into buyout deals.

The Hang Seng Index (HIS) P/E ratio hovered around 9.3, compared to the Shanghai Composite Index’s 12, S&P 500’s 25.78 and Nikkei’s 23.07 as of 20 March 2024.

CIMC Vehicles Group plans to buy back all H shares and delist from the Hong Kong market, while Singapore’s Royal Golden Eagle, owned by Indonesian billionaire Sukanto Tanoto, has bought an 83.5% stake in Chinese tissue maker Vinda and will later fully acquire and privatize it.

Sportswear company Li Ning and Hong Kong-based telecom services provider HKBN were also reportedly considering delisting. French skincare company L’Occitane and US luggage maker Samsonite also mulled take-private options but eventually shelved such plans.

Previously lapsed Hong Kong targets in recent years that may see renewed takeover interest include Giordano, China Youzan, Chinese Estates and China Glass Holdings, according to Dealreporter.

Earlier in January, the China Securities Regulatory Commission (CSRC) voiced support for delistings of mainland China-listed companies through M&A deals amid persistent low valuations, although government intervention later stabilized the market.

However, former government official Chen Wenling warned that anticipated interest rate cuts by the Fed later this year could attract money back to China and result in foreign players harvesting high-quality assets on China’s A-share market on the cheap.

Construction, telecom and retail among the bright spots

Deal volume in the construction and building sector surged by 66% year-on-year to USD 9.6bn, although the number of deals plunged 30% to 109 over the same period. Two deals – both involving Australia-based targets – featured among the top 15 transactions in APAC.

Compagnie de Saint-Gobain, a French multinational supplier of construction materials, made a non-binding indicative offer in February to acquire Australia’s CSR Ltd for USD 2.9bn. The same month, Seven Group announced a proposal to acquire the rest of the shares in cement company Boral Limited that it doesn’t own yet, in a deal worth almost USD 2bn.

The telecommunications and retail sectors also performed strongly. Telecom deal volume jumped 2.7x year-on-year to USD 8.3bn, largely thanks to the acquisition of a 63% stake in Star India – a joint venture with Disney – by Viacom 18 Media and Reliance Industries for USD 4.5bn, the second largest deal in APAC for 2024 YTD.

Mega mergers, PE exits and battery deals

M&A activity in the APAC region is expected to bounce back later this year. Large deals such as the sale of up to a 51% stake in Indian commercial lender Yes Bank could materialize. Global private equity firms are also expected to attempt to exit investments at high-multiples in Japan and India, and snap up opportunities in China at bargain prices.

Carlyle reportedly started the USD 800m sale process for Japanese cosmetic supplier Tokiwa Corporation. KKR was reportedly weighing the divestment of its controlling holding in India’s JB Chemicals & Pharmaceuticals, a company valued at USD 3bn. It is also planning to exit India education services provider Lighthouse Learning at a USD 800m-USD 1bn valuation.

In addition, the new energy revolution is leading large conglomerates to raise funds for their battery units. SK on, the battery business of South Korean energy company SK Innovation, is reportedly seeking to bring in investment worth KRW 2trn (USD 1.5bn).

India’s Tata Group is also said to be planning a spinoff of Agratas Energy Solutions, its battery unit, with a potential listing likely to value the battery business between USD 5bn and USD 10bn.