Deal focus: Anacacia defies Australia’s consumer woes with high-end golf acquisition

- MGI Golf marks the first deal from the GP’s fourth fund, which is targeting USD 200m

- Local sports investment group Athletic Ventures participates as co-investor

- Proactive sourcing, diplomatic negotiations were keys to accessing niche opportunity

Australian gross household income has increased 25% over the past five years, according to government data, but it has not kept pace with mounting pressure on household budgets. For the average Australian, this includes a 36% lift in tax payments, a 64% rise in interest payments, and 21% higher housing costs.

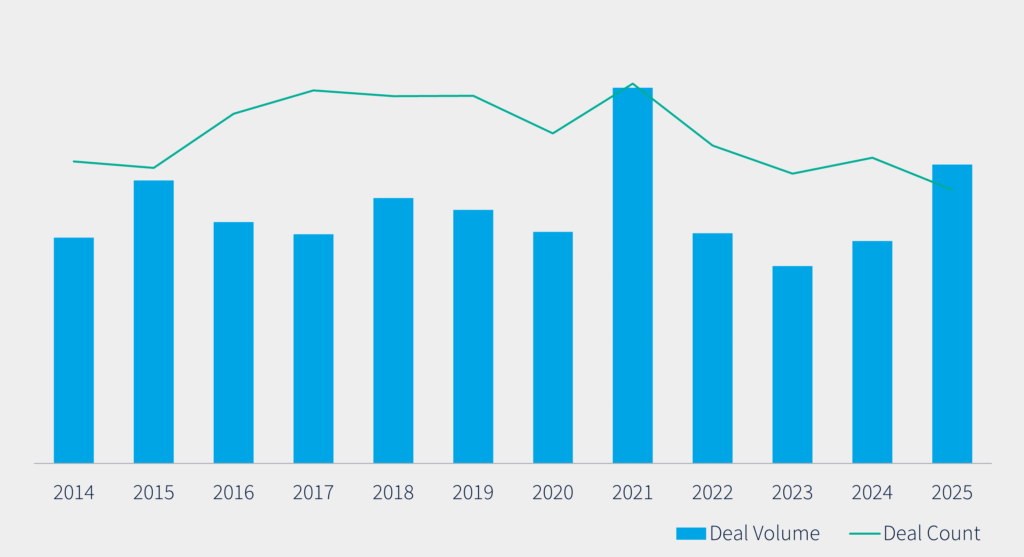

Private equity investment in Australian consumer businesses amounts to only USD 77.6m in 2024 to date, according to AVCJ Research, putting the sector on track for its weakest full-year showing since 2013. The annual average for the past 10 years is USD 798m.

“It’s very tough if you’re trying to sell consumer products to young families that are under mortgage stress and rental issues,” said Jeremy Samuel, founder and managing director of Anacacia Capital. “But if you’re selling luxury products or products aimed at the affluent baby boomer generation, there can be very strong uptick.”

That’s why despite challenging economic times, Samuel added, high-end sporting goods supplier MGI Golf has maintained double-digit percentage growth and strong margins. “They’re really addressing a market that is less impacted by cost-of-living constraints,” he said.

Anacacia acquired an 80% stake in the business at an approximately AUD 100m (USD 66m) valuation earlier this month in a management buyout that included local sports specialist Athletic Ventures as a co-investor. Samuel declined to comment on financial details.

The remaining 20% will be retained by the founding family, which has historically held 100%. Ian Edwards, who founded the company in 1993, will move to a non-executive role. His daughter Carrie Edwards-Britt will stay on as CEO.

Cruising the fairway

MGI is best known for motorised golf buggies, which use gyroscope, artificial intelligence, and GPS technologies to self-navigate the contours of the course without falling over. The idea is to capture a niche market of affluent players, eager to get exercise by walking between holes but wary of aggravating backpain by pulling a traditional trolley.

The company claims a 90% market share in Australia and around 30% in the US, where, along with Canada, Europe and Asia, sales are said to be growing quickly. The core buggy business is supported by a relatively small line of laser-enabled rangefinder gadgets under the brand Sureshot.

The plan is to focus on organic growth, most significantly through geographic expansion in North America, Europe, and Asia. North America already represents more than half of revenue, which currently tops AUD 50m a year. As such, Australian, US, and Canadian law firms were all brought into the due diligence process.

Sourcing the opportunity proved to be the most delicate aspect of the deal. Anacacia discovered Ian Edwards was ready to sell on cold calling him and then began developing a relationship. This led to an exclusivity agreement toward the start of 2024 and six months of due diligence.

The emphasis was on confidentiality in bilateral negotiations, minimising distraction to the ongoing business, and protecting the interests of customers, suppliers, and employees. Leadership succession and a global operations buildout were on the menu but only where there was a meeting of minds around continuity and family.

“For many business owners, they want a fair price, but there are lots of other factors that are also important to them around legacy, getting the right partner, positioning the business for the next chapter of growth, and looking after staff,” Samuel said.

“Anacacia has carved out a niche in the Australian market of getting to know family businesses really well and understanding the needs of founders reaching retirement. So, we can tailor a solution that’s fair to them, us, and our investors. And this creates co-investment opportunities as well.”

Fund IV debut

This is the first deal from Anacacia’s fourth fund, which has a target of AUD 300m and reached a first close of undisclosed size last October. Samuel described the vehicle as “halfway through fundraising” and set to do rolling closes with support from a mix of family offices, endowments, and pension funds, predominantly representing Australia.

MGI sets the tone for the strategy in the sense that co-investment opportunities are expected to be a feature. Athletic Ventures, which effectively clubs together individual investors from the world of Australian sports, is participating as a member of an Anacacia-led syndicate, and its exposure is part of the 80% stake. It is not an LP in Anacacia’s latest fund.

Family-owned businesses and succession scenarios will continue to be core. Samuel claims that all of Anacacia’s deals are proprietary and exclusively negotiated. In this segment, the best targets are agile disruptors in niche corners of major industries that need a culturally aligned sponsor.

“By partnering with Anacacia, hopefully they get the best of both worlds. They can maintain the innovative edge that helps them to succeed where multinationals have struggled,” Samuel said.

“By the same token, they can ensure they’ve got some institutional ownership, governance is first class, they’re attracting the best management teams, and that they’re ultimately positioned as sustainable for the long term.”