Data center dealmaking explodes on AI demand — Dealspeak North America

Surging demand for data centers is driving dealmaking to new heights, as investment firms explore creative deal structures in this flourishing corner of technology.

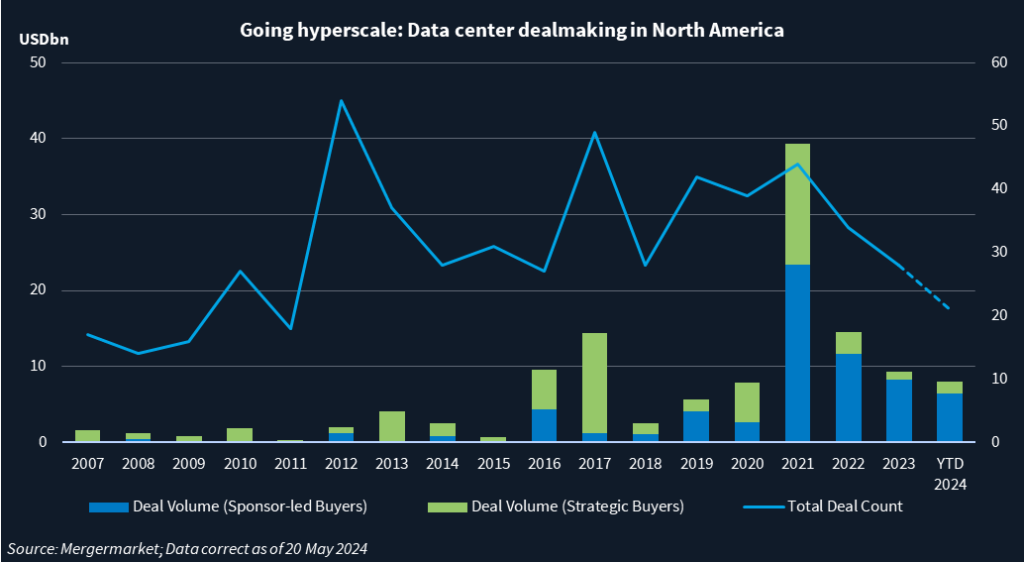

This year is on track to be the second biggest year ever for data center M&A in North America by dollar volume, according to Mergermarket data, and it could become the busiest by number of transactions.

The digital transformation occurring across industries globally has resulted in an unprecedented level of investment into data centers over the last three years. The growing use of artificial intelligence along with advancements in computing and cryptocurrency mining are expected to keep deals flowing.

Private equity firms are particularly active, accounting for most data center dealmaking of late. Since 2021, financial sponsors collectively spent nearly USD 50bn on data center buyouts in the region.

Blackstone [NYSE:BX], Brookfield Infrastructure Partners [NYSE:BIP], Carlyle [NASDAQ:CG], EQT [NYSE:EQT], KKR [NYSE:KKR], and Silver Lake are among the private equity groups acquiring data centers along with fiber, power grids, and other digital infrastructure assets that keep information moving.

Digital infrastructure is among the “hottest asset classes in the economy,” according to Greenberg Traurig’s Kemal Hawa. Valuations for data centers continue to be high but are “certainly not irrational,” although the rising cost of debt can pose challenges for sponsors, he says.

Better together

Increasingly, private equity firms are forming joint ventures with infrastructure funds and other groups to bankroll large transactions.

In April, Silver Lake and DigitalBridge [NYSE:DBRG] led a USD 6.4bn investment into Denver-based Vantage Data Centers, which operates and develops hyperscale data center campuses across five continents. Silver Lake launched Vantage in 2010 as a single data center campus in Northern California, recruited its management team, and scaled the business before DigitalBridge acquired it in 2017. Now the two firms are investing in Vantage alongside each other.

Another example of financial groups joining forces is Global Infrastructure Partners and KKR’s USD 15.3bn purchase of CyrusOne in 2021 that took the data center real estate investment trust (REIT) private.

Joint ventures are a common vehicle used by Digital Realty [NYSE:DLR], another data center-focused REIT. In December, it formed a JV with Blackstone to develop four hyperscale data center campuses in Frankfurt, Paris, and northern Virginia at an estimated cost of USD 7bn.

Digital infrastructure strategics are also partnering up, as Equinix [NASDAQ:EQIX] did in April when it formed a USD 600m JV with PGIM Real Estate to expand its hyperscale platform in Silicon Valley.

These ventures can be structured any number of ways and, eventually, may be sold to one of the invested parties or to a third-party buyer, advisors say.

Buying and selling

While Digital Realty and Equinix have historically been consolidators in the space, they could become M&A targets for large technology firms making digital infrastructure investments, according to Clark O’Neill, a senior partner and managing director at Boston Consulting Group.

For years, analysts have speculated that big tech companies could spin out their digital infrastructure units to maximize shareholder value or appease regulators who want to divvy up their businesses.

Amazon Web Services and Microsoft‘s [NASDAQ:MSFT] cloud computing division Azure have been floated as spinout candidates over the last decade, but since they are hugely profitable and synergistic with their other business lines, management is reluctant to let them go, an advisor points out.

Power dynamics

Access to electricity generation is also crucial.

Goldman Sachs estimates data center power demand will grow 160% by 2030 because the vast computations needed for AI require far more electricity than regular search queries.

It has already driven some dealmaking. In March, Amazon [NASDAQ:AMZN] acquired Talen Energy‘s [OTCQX:TLNE] nuclear-powered data center campus in Pennsylvania for USD 650m.

O’Neill predicts tech companies will make more bets on alternative power.

Well-capitalized tech companies are developing their own power projects, as that can lower development costs and regulatory burdens while improving power availability and quality, adds Travis Wofford, vice chair of the global M&A practice at Baker Botts.