DACH M&A advisors deploy complex structures during wait for rate cuts – Advisory Viewer

Advisors in Germany, Austria, and Switzerland (DACH) have been thinking about complex deal structures to get transactions over the line as they wait for the European Central Bank (ECB) to begin a new cycle of interest rates.

Expertise with a variety of transaction structures and a track record in complex transactions is more important than previously to win mandates, according to Burc Hesse, Partner at Latham & Watkins. M&A processes have become more burdensome than in the past, with deals taking longer to get to the finish line, he added.

Dealmakers need to be more mindful about potential regulatory implications to transactions, and consider those at an earlier stage than was common before, according to Christian Atzler, Chair of Baker McKenzie‘s EMEA M&A Group and the co-head of the Corporate/M&A Practice Group in Germany. This includes more scrutiny from an anti-trust perspective as well as from foreign direct investment (FDI) reviews, he added.

The move toward complexity is not without risks for dealmakers, with the execution of earnout structures proving more difficult than many expect during negotiations, as reported.

Although the market has seen fewer mega-deals during the wait for lower interest rates, advisors have stayed busy with small and mid-sized deals, restructuring and refinancing processes, and all-portfolio deals, Hesse said.

All-portfolio deals can be an option for vintage funds, private equity (PE) firms without plans to raise new funds, or smaller funds with investment teams that are no longer the right size to manage the portfolio, Hesse said. Continuation funds are also a source of mandates, he added.

One German PE deal that has been in the news recently involved Accel-KKR backed continuation funds for two Germany-based assets managed by LEA Partners, Zvoove and OneQrew, as reported.

There are a number of aged PE investments that have not met classical key performance indicators (KPIs) and at some point will need to be divested, potentially also at lower valuations, Hesse said. Fund investors are requesting to see proceeds, he added.

In the DACH tech space, advisors who can offer clients access to a US investor base have a competitive advantage for sellside mandates, according to Atzler.

An example came earlier in May, when Uber Technologies [NYSE:UBER] agreed to acquire Delivery Hero‘s [ETR:DHER] Taiwan-based foodpanda business for USD 950m cash and buy USD 300m worth of new ordinary shares in the German-based company, as reported.

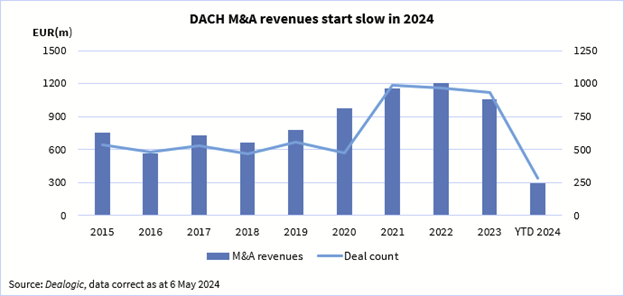

Slow start to 2024

M&A fees in Germany are off to a slow start to the year, 33% down year on year (YoY) to EUR 300m in the year to date [YTD; 6 May 2024], according to Dealogic Revenue data*.

Industrials maintained its 11-year reign as the most lucrative sector for fees, increasing its market share to 41% in the YTD compared to 26% in 2023. It was followed by technology, also a long-time top-three performing sector for investment bankers.

The surprising new entrant, in an early signal for green shoots in Germany’s economy, was consumer and retail with about EUR 30m in fees to its credit. The sector last appeared in the top-three in 2004. Fees from strategic players jumped to 70% of the total pie from 45% in 2023.

Despite a slow start to 2024, DACH M&A advisors expect an increase in deals in the second part of the year. There is a huge pile of dry powder that needs to be deployed, said Hesse.

DACH dealmakers are getting ready for the ECB and other central banks to start cutting rates, said Gregor von Bonin, Partner at Freshfields. “We have seen an increase in the number of M&A mandates that we have received in the past few weeks,” he said.

The real estate sector is showing signs of recovery, largely due to deleveraging and restructuring situations. Healthcare and energy transition are attracting the interest of deal makers, von Bonin said. The energy sector is also seeing project financing of greenfield investments as opposed to M&A, he added.

Other active areas include the small-cap segment, particularly with deals that do not require significant debt financing, as well as strategic buyers thinking about “disruptive drivers” like digitalization, electrification, artificial intelligence (AI), and environmental, social and governance (ESG) investment criteria, said Atzler

Utility and energy has been to date the largest target sector in terms of announced deals with 24 deals worth EUR 5.9bn crossing the line, according to Mergermarket data. In healthcare there have been 45 deals with a total value of EUR 5.1bn which was followed in third place by tech with 151 deals and EUR 1.4bn in value.

Germany’s M&A volume in the YTD [8 May 2024] is down by 51% compared to the same period last year, with 555 deals and a value of 17.6bn. In 2023, deal volumes were up 39% up compared to 2022 with a total of 629 deals worth EUR 35.8bn.

To date in 2024 the largest deals have been the proposed takeover of wind and solar operator Encavis [ETR:ECV] by investment firm KKR & Co [NYSE:KKR] with an estimated value of EUR 4.2bn and Novartis’ [SWX:NOVN] offer for MorphoSys [FSE:MOR; NASDAQ:MOR] with an estimated deal value of EUR 2.6bn.

When interest rates do finally turn, there is a strong pipeline of potential exits, as reported. One name to watch is MainTech Systems, which has a score of 71 out of 100, according to Mergermarket‘s Likely to Exit (LTE) predictive algorithm.* Its administrator has been seeking a buyer since last year, as reported.

by Laura Larghi with analytics by Santosh Shetty and Anjali Piramal

*Dealogic Revenue Data: Dealogic uses a proprietary revenue model to estimate investment banking fees across four key products: M&A, equity capital markets (ECM), bonds or debt capital markets (DCM), and loans. Revenues derived from any geography/sector indicate fees generated by fee-payers based on that geography/sector. M&A fees are calculated 10% upon announcement and 90% upon completion.

**Mergermarket’s LTE predictive analytics assign a score to sponsor-backed companies to help track and predict when an exit could occur through M&A, an IPO, a direct listing or a deSPAC transaction.