CVC could address slowing exit momentum with Multiversity, Etraveli, GEMS sales – LTE Charts of the Week

LTE Charts of the Week showcase the power of Mergermarket’s Likely to Exit (LTE) predictive analytics engine. Find more financial sponsor exit opportunities by activating a two-week trial to Mergermarket or log in if you are a subscriber.

- CVC, EQT and KKR have five predicted exits among sponsors across Europe

- Spotlight on CVC with Multiversity, Etraveli and GEMS as next potential deals

- CVC has total of USD 36bn of exits since 2020

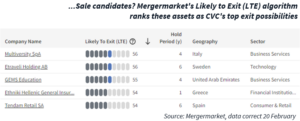

CVC has the joint-highest number of portfolio assets ripe for exit alongside EQT and KKR in Europe, according to Mergermarket’s Likely to Exit (LTE) algorithm.

London-based CVC boasts five portfolio companies with a Likely to Exit score above 50 – ranking it alongside the other two sponsors.

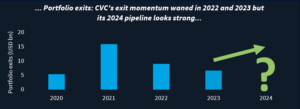

CVC’s exit activity has lost some momentum in recent years, with portfolio sales declining from USD 15.8bn in 2021 to USD USD 6.6bn during 2023. Cumulative exits over the four years totalled USD 36bn, according to Mergermarket deals data.

Potential exits for CVC are plentiful with Italy’s Multiversity still on the agenda despite a minority stake sale falling flat in 3Q last year. Multiversity has an LTE Score of 56 out of 100. Valuation may have been the sticking point for potential suitors with CVC reportedly wanting a deal that valued the online university group at EUR 4bn.

CVC’s Swedish portfolio company Etraveli is another asset that could be ripe for exit with an LTE Score of 56. The travel and flight booking platform provider has engaged JP Morgan to assess its options.

Meanwhile, Dubai-based education provider GEMS Education has an LTE Score of 55. Indications are a recent debt financing is paving the way for potential suitors, such as Brookfield, to step in and take CVC’s 30% stake, as reported by Mergermarket.

LTE Scores are generated using a machine-learning algorithm developed by ION Analytics data scientists, engineers, and journalists leveraging 20+ inputs from more than a decade of proprietary Dealogic deal data and M&A intelligence. Find out more about the score’s predictive capabilities in Mergermarket‘s LTE Predictive Scoring Whitepaper.

Note: Data correct as of 20 February 2024

Source: Mergermarket.ionanalytics.com