CoreWeave’s blockbuster listing brings AI to IPO market – ECM Pulse North America

- Investors to scrutinize pricing power and long-term revenue beyond Microsoft partnership

- IPO tests public market appetite for AI infrastructure plays amidst industry shifts

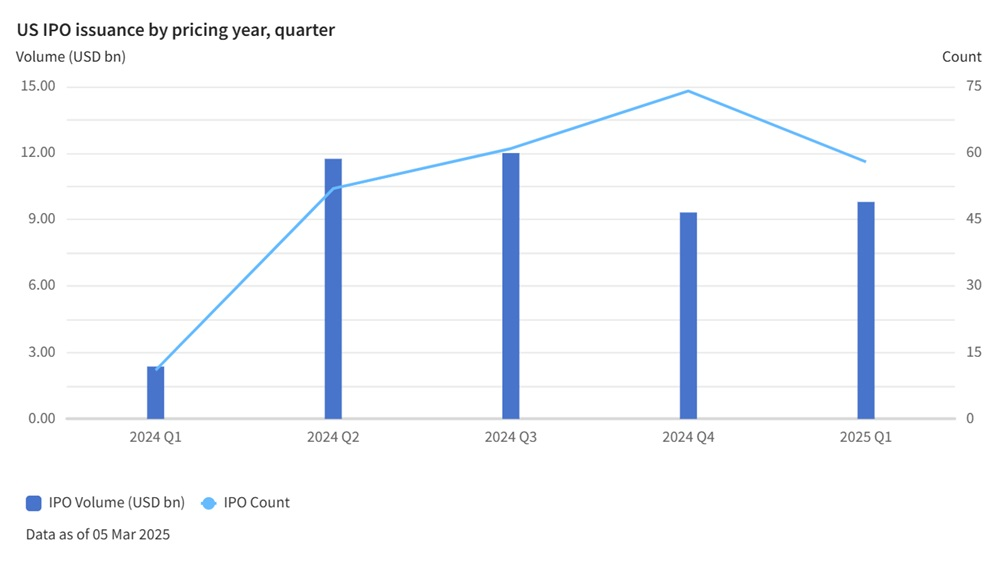

CoreWeave, the GPU cloud provider at the center of the AI infrastructure boom, is being widely watched as the first AI-focused IPO of this year to see whether the sector has shaken off structural growth concerns prompted by Chinese competitor DeepSeek earlier this year.

The Nvidia [NASDAQ:NVDA]-backed company, which provides access to data centers and high-powered chips for AI workloads, filed its US IPO paperwork yesterday, in what will likely be an approximately USD 3bn deal. In November, CoreWeave was valued at USD 23bn after a USD 650m secondary share sale, but its valuation could rise to USD 35bn in an IPO.

The offering will serve as a test for public market appetite for AI infrastructure plays, as the fast-growing industry continues to garner chunky investments.

Equity story solid but Microsoft focus a risk

Investors say CoreWeave has built a reputation for rapid growth, strong execution, and unique positioning in the GPU cloud sector. CoreWeave’s success has largely been fueled by its deep integration into Microsoft [NASDAQ:MSFT]’s AI ecosystem. A major customer and strategic partner, Microsoft has been a cornerstone of the company’s business, leveraging CoreWeave’s GPU infrastructure to power AI workloads.

This news service previously reported that the company has faced doubts about concerns over customer concentration.

Those worries became more resonant after analysts suggested last month that Microsoft was walking back on some data center leases. With Microsoft’s evolving cloud strategy casting a shadow over its long-term demand outlook, investors are expected to scrutinize its ability to diversify revenue streams and maintain pricing power in a market that remains supply-constrained, for now at least.

Investors are asking what comes next. Existing contracts remain in place, but the real question is about future procurement; if Microsoft pulls back, who will step in to replace that demand? How does CoreWeave plan to secure long-term revenue beyond its most important partner?

Management has consistently emphasized that demand for its infrastructure far exceeds supply, giving CoreWeave the ability to be selective about its partnerships. In addition, the company has already demonstrated its willingness to diversify, having struck partnerships with businesses like IBM.

But in a market where competition for AI infrastructure is intensifying, and capital expenditure high, the ability to sustain these strategic relationships and attract new enterprise customers will be critical.

The company’s capital strategy has also been a point of discussion in investor meetings. Scaling AI infrastructure is expensive, and CoreWeave’s model is capital-intensive by nature. It has so far been able to secure substantial financing, including billions in debt raised to expand its GPU clusters.

Roadshow conversations suggest that CoreWeave’s broader customer pipeline remains robust. One indicator of confidence has been Core Scientific [NASDAQ:CORZ]’s recent decision to exercise its final option to expand its infrastructure partnership with CoreWeave, securing additional data center capacity in Texas.

The move has been viewed as a bullish signal, reinforcing the notion that demand for CoreWeave’s compute power remains strong. But as the company moves toward the public markets, it will need to address lingering questions on whether it can maintain momentum.

CoreWeave is expected to be comped against DigitalOcean [NYSE:DOCN], as well as Nvidia and Astera Labs [NASDAQ:ALAB], given deep integration into AI compute, though these names are more hardware-driven than CoreWeave’s services business.

Interest in the IPO has been strong so far and long-only institutional investors are expected to be among the primary buyers, as AI infrastructure remains one of the most sought-after investment themes of the year.

According to its filing, CoreWeave’s revenue grew to USD 1.92bn in 2024, compared with USD 228.9m a year earlier. Its net loss widened to USD 863.4m in the same period from USD 593.7m in 2023.

DeepSeek stress test

CoreWeave has long been awaited as the first real stress test of this type of equity story, given the extensive investment pouring into AI infrastructure and the rapid pace of developments in the sector. It’s riding the wave of Nvidia enthusiasm following its blockbuster quarterly earnings recently, but at the same time, the evolving DeepSeek saga adds a layer of complexity that could shift market dynamics just as momentum builds.

DeepSeek’s cost-effective AI alternative model rocked industry stalwarts earlier this year and sector valuations have been hard hit by a rotation away from US equities into other markets like Europe.

Major investor Nvidia and main client Microsoft are down over 16% and 7% year-to date (YTD) respectively. Astera Labs, the last AI-focused IPO, is down 48% YTD.

Wider industry concerns may impact CoreWeave’s valuation or even its ability to come to market. If there is a wider rethinking on AI stocks, it would have a knock-on effect to other issuers beyond CoreWeave.

This is particularly pertinent given one of the main implications of the DeepSeek innovation earlier this year was AI innovation being achieved with less computing power.

Investors are wary of how sustained demand for AI infrastructure will be, as concerns grow that enterprise spending on AI models could normalize after last year’s frenzied buildout. The downturn in AI stocks isn’t just about valuation; it’s also about whether companies like CoreWeave can justify continued heavy investment in GPU clusters if demand expectations reset.

Another IPO candidate in the pipeline selling AI infrastructure is Cerebras Systems, which filed last fall with Citigroup and Barclays advising. The listing, which was delayed by a US national security review of UAE-based G42‘s minority investment in the chipmaker, could also come back later this year.

US-based data center operator Switch has also been exploring a potential IPO that could value it at around USD 40bn, including debt.

Despite concerns about inflated valuations, investor enthusiasm remains high, particularly for companies positioning themselves at the forefront of the cloud-AI revolution.

One investor said this is part of the evolution of a sector that is still shaping up. “We have seen at times, and with DeepSeek for instance, the momentum around AI unwind a little bit, which is bound to happen from time to time. My sense is the stocks may dip and then rally up again and vice versa. But business specific, I think the company is well positioned,” he said.

“For the first time, we’re seeing cloud infrastructure purpose-built for AI at scale, and that’s a huge shift,” he added.

CoreWeave did not respond to a request for comment.