Consumer deal activity expected to pick up in 2025, food and beverage to remain strong – North America Consumer Trendspotter

- Effects of US tariffs, immigration policies unclear

- Growing activity since 2Q24

- Snacking among niche hot spots

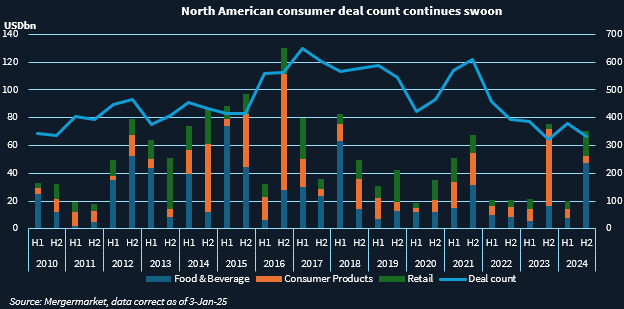

Deal activity in 2024 was down in North America’s consumer space, but activity is expected to pick up, sources told Mergermarket.

In the aftermath of the pandemic, deal activity in the consumer space was rapid and frequent because of strategics and sponsors attempting to take advantage of the resurgence of business that followed.

In 2021, consumer deal activity totaled USD 118.6bn compared to USD 90.1bn in 2024, according to Mergermarket data. But even those numbers are dwarfed by consumer activity from a decade ago, which peaked at USD 185.8bn in 2015.

Sponsor buyout activity was its lowest in more than a decade last year, totaling USD 3.9bn compared to 7.4bn in 2023 and 27.0bn in 2015.

Sponsor exits amounted to USD 6.1bn in deal volume, roughly in line with 2023 and the lowest dollar amount since 2011. The number of sponsor exits, however, rose 36% year-over-year to 49.

Consumer dealmaking in 2024 started slowly but picked up by the second half, which supports optimism for deal activity in the new year, said Frank Petraglia, head of consumer and retail deal advisory and strategy at KPMG.

“As we got into Q2, we really did start to pick up in our activity and a lot of that activity is coming to market now,” he said.

More appetite for food and beverage deals

Food and beverage deal activity is one subsector that did not succumb to the conditions of the broader consumer space in 2024.

“There has been a steady trend of deal activity in food and beverage starting in 3Q24 with a handful of deals getting announced every couple weeks; that is a trend which we have not seen in at least three years,” said Morgan LeConey, head of US consumer and retail at Macquarie Capital.

The subsector saw USD 54.9bn across 269 deals in 2024, the highest volume since 2019. This included megadeals such as Mars’ proposed USD 35.9bn acquisition of Kellanova [NYSE:K], which was announced in August and is expected to close in the first half of 2025.

Snacking is a sector that will continue to see heightened M&A activity, LeConey said, particularly snacking companies displaying revenues north of USD 100m and solid profitability.

“We’ve seen a lot of deal activity around snacking including mega transactions in the space, such as Mars-Kellanova, but also a recognition snacking is increasingly in line with where the consumer is going in terms of trends,” said LeConey.

LesserEvil, a privately held better-for-you popcorn and snacks company, is an example of a standout snacking asset that could transact in 1H25. This news service previously reported that LesserEvil was expected to explore a sale in 2025 through Jefferies and could see Mondelez International [NASDAQ:MDLZ], Kraft Heinz [NASDAQ:KHC], Utz Brands [NYSE:UTZ], Mars, PepsiCo [NASDAQ:PEP] and Campbell Soup Company [NASDAQ:CPB] as potential buyers.

Mike Ellis, co-head of Proskauer Rose’s global Private Equity and M&A Group, noted that 2025 could see companies investing more into supply chain efficiency and local manufacturing capabilities to avoid the consequences of tariffs.

Finally, the continued rise of weight loss drugs such as Ozempic could also have a significant impact on food and beverage M&A, Ellis and LeConey said.

Potential universal insurance coverage for weight loss drugs could hinder snacking M&A as the number of snacks people buy decreases, Ellis said. LeConey added that companies may have to be slightly more conservative on their estimates for growth to compensate for the potential risk and should focus on evolving their portfolio to align with GLP-1’s popularity.

Nestlé’s [SIX:NESN] Boost brand recently launched a pre-meal drink that helps consumers suppress their hunger and create a feeling of being full by promoting the body’s natural production of the hormone GLP-1.

The Trump effect

The incoming administration of US President-elect Donald Trump should not affect deals in the middle market consumer space, but large deals might have a little more leeway than under current President Joe Biden, said Robert Schmidt, managing director at Bridgepoint.

For example, supermarkets Kroger [NYSE:KR] and Albertsons’ [NYSE:ACI] terminated a planned USD 24.8bn deal in December after the Federal Trade Commission secured a key court ruling against the merger.

In a less strict regulatory environment, Albertsons and Kroger maybe look at smaller acquisitions to bring them into new markets, said Keith Daniels, managing partner at Carl Marks Advisors, adding he believes the deal may have garnered more support under Trump’s administration.

However, tariffs that Trump expects to impose on other countries could hurt dealmaking because of increased prices passed onto consumers since large trade partners like China will shift their manufacturing to Southeast Asia.

Demand could also be stifled by tariffs, Schmidt noted. “We are not able to pay the wages that other countries are,” he said. “The trend for the onshore companies is going to be finding ways to leverage technology and reduce headcount with fewer people, which will negatively impact the job environment.”

Additionally, changes to immigration policy could disrupt the food system, which relies on undocumented workers in areas like agriculture and meat packing, while potential changes to ingredient labeling requirements could also create inflationary pressures.

Until there is more clarity and certainty around these policy changes, there may be delays in M&A processes for companies with higher exposure to these risks, potentially causing more processes launching in 2Q25, LeConey said.