Confidence holds as US IPO market pushes through shutdown – ECM Pulse North America

- Issuers stay active behind the scenes

- Market tone remains constructive, supported by resilient earnings and stable rates

Even as the government shutdown enters its fifth week, US equity capital markets continue to move.

Instead of grinding to a halt, new issues have kept moving beneath the surface, bolstered by steady confidence from both issuers and investors.

“Honestly, I was sceptical a week or two ago about how much companies would really use this new rule,” said Shari Mager, KPMG’s national Capital Markets Readiness leader.

She referred to the Securities and Exchange Commission (SEC)’s guidance that companies may rely on Rule 430A even when going effective automatically, a clarification that allows them to launch with a price range on the cover page and insert the final price in the prospectus after the 20-day period.

“But the activity we’ve seen in October changed my perspective. It shows renewed bullishness and willingness to move forward despite the uncertainty.”

The limited SEC staffing has slowed reviews, and fewer than a handful of IPOs have gone effective since early October. Still, background work is ongoing. Issuers are updating financials, preparing drafts, and positioning themselves to move as soon as full operations resume.

“We’ve seen only about three IPOs go effective since the shutdown, but interestingly, there’s been a significant uptick in filings across the board,” Mager said. “That includes S-3s, S-4s, and secondaries. Companies want to be ready. They’re putting themselves in the queue.”

Mager added that with the backlog growing daily, the SEC may need to adopt “creative or new procedural strategies” to process filings once normal operations restart. Clients already in or near the IPO process have not changed course, although many recognize that timelines may stretch.

On 29 October, Medline Industries became the most prominent company yet to file publicly for an IPO, giving itself the option to launch as soon as mid-November. One ECM banker involved described the upcoming listing as “the most interesting test of the market” given the broader uncertainty. “They bought it for around USD 30-plus billion, and they want a USD 50bn valuation now.”

Another transaction, Navan, managed to navigate the bureaucratic pause entirely. The company began trading on 30 October after completing one of the few well-flagged IPOs during the shutdown. Its shares fell in early trading, but the very fact it reached the market at all is seen as a positive signal.

“While everyone’s annoyed, and if we didn’t have a shutdown, maybe we’d have 20 deals right now, the fact that the market’s resilient enough that you’re actually seeing deals happen and investors play in them, those are all good facts,” said a senior ECM banker. “Can you imagine if it was like the way things used to be, a true shutdown with no business getting done?”

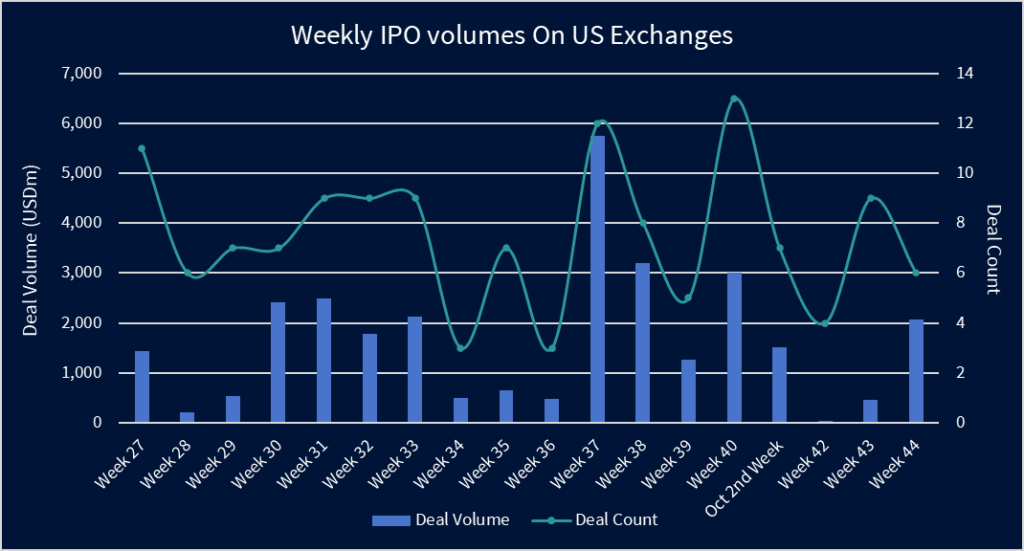

According to Dealogic data, US IPO issuance fell to just USD 30.8m across four deals in mid-October (Week 42), marking the quietest stretch since early summer. Activity then rebounded, with USD 451.2m priced in Week 43 and USD 2.06bn recorded through the week ending 1 November.

Even higher-risk equity stories are advancing, proof that investor appetite extends beyond the most defensive names. This news service recently reported that Beta Technologies, the Vermont-based electric aircraft developer, is preparing to list on Nasdaq in early November and is viewed as a test of market resilience for early-stage growth companies. Despite its pre-profit profile, investors are said to be responding positively to the company’s long-term potential, buoyed by strong backing from strategic and institutional shareholders.

The persistence of deal flow, even in limited form, increasingly shows how much the market has matured since earlier cycles. The ability to keep transactions moving, at least in preparation, is viewed as a sign of both technical adaptation and investor readiness once the window reopens fully.

Earnings season has provided additional support even as macro headwinds persist. With around two-thirds of S&P 500 companies having reported through the week ending 31 October, earnings are trending higher year-over-year, with most companies surpassing earnings-per-share expectations. Strength has been concentrated in the technology, consumer, and financial sectors.

Equity markets remain firm, with the S&P 500 near record levels and treasury yields broadly stable.

According to Steven Halperin, managing director at Moelis, the alignment among rates, growth, and technology continues to underpin valuations.

“Lower rates help growth and valuations, especially as we approach peak multiples for the S&P,” he said.

“The market can continue rising through higher economic growth, lower rates, or AI-driven efficiency gains. We’re near neutral policy levels now, and the Fed will likely pause. Inflation’s still around 3%. If trade tensions keep easing, particularly between the United States and China, that could further support sentiment.”

For now, the tone across syndicate desks is pragmatic. The backlog may be building, but issuers and investors are treating the lull as preparation rather than paralysis.

“Markets are cyclical, they have windows for new issues, and they open and close. The toughest part for many companies is being ready when the window opens,” the ECM banker said.