Companies hedge IPO bets with dual-track SPAC conversations

- Uncertain macroeconomic backdrop drives shift to more disciplined market

- Advisor mix shifts, with more capital markets bankers involved in valuation work

- Digital assets, life sciences among sectors seeing an increase in deal discussions

A growing number of companies eyeing the public markets are hedging their bets with a new twist on the dual-track strategy: preparing simultaneously for a traditional initial public offering and a merger with a special purpose acquisition company, or SPAC.

The approach, which gained momentum in the first half of 2025, reflects both the difficulty of listing in a volatile macroeconomic backdrop and a more disciplined SPAC market that has quietly staged a comeback.

“There are a number of companies in the queue that have prepared for an IPO and are ready to become public companies that would like to control their own destiny,” said Jocelyn Arel, who leads Goodwin’s SPAC practice. “Instead of dual tracking with M&A; they are dual tracking with a traditional IPO as well as a de-SPAC.”

The SPAC option allows companies to maintain their ambitions of going public, at the same time as presenting some of the simpler exit optionality of a private market sale.

Some issuers complete an SEC IPO review but pivot to a de-SPAC if the IPO window doesn’t open, Arel added. Others prepare both paths at once — building boards, strengthening finance teams, ensuring governance — to maintain flexibility.

“There is more recognition that a de-SPAC is a true IPO alternative, and companies are preparing as such: ensuring they’re ready to be public companies and meet market demands,” she said.

There has been a corresponding shift in the advisor mix, Arel added. A few years ago, sell-side M&A bankers sought out de-SPACs as they explored how to extract as much value as possible. Now there are more capital markets bankers doing the valuation work, she said.

Turning of the tide

The renewed interest comes as SPACs shed the reputational baggage that accompanied the 2020–2022 boom.

Gone are the days where dealmakers scramble to find financing at the last minute. Sponsors are structuring deals with stronger fundamentals, and many of them are securing full funding at the deal announcement, with third-party valuation checks, and committed private investment in public equity (PIPE) financing.

That discipline, along with a friendlier regulatory tone under the Trump’s administration, is helping restore credibility to a structure that not long ago was written off by many investors.

Under the current administration, the Securities and Exchange Commission has adopted what Arel calls “a more collaborative, flexible examiner approach,” a shift from what she described as an adversarial stance under the prior leadership. While the filings still face rigorous scrutiny, companies say the process is less rigid and more fluid.

Recent deal flow suggests momentum is building.

Digital assets and life sciences stand out as sectors that view de-SPACs as an attractive path to the public markets, life sciences especially, since they traditionally go public earlier and often attract specialized SPACs with zero-warrant structures, Arel noted.

Will Braeutigam, a senior partner at Deloitte, said more than 40% of SPAC deals completed in August included straight equity PIPEs, compared with roughly 20% in July.

“We had not seen common equity PIPEs for a long time,” he said. “The fact that they are reappearing suggests the SPAC market could be starting to open up. Without that, it remains a broken vehicle.”

Braeutigam cautioned that PIPE capital needs to expand beyond niche sectors if SPACs are to stand alongside IPOs and direct listings as true alternatives.

“The only way that happens is with a healthy PIPE market where common shares are issued for cash,” he said. “There are signs of improvement, but I want to see more data before I am convinced.”

Numbers point to momentum

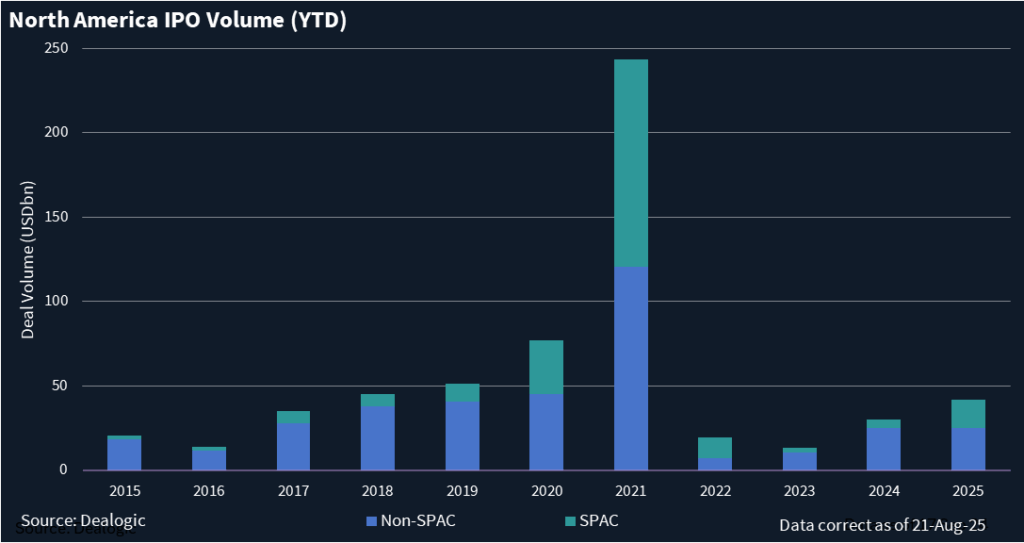

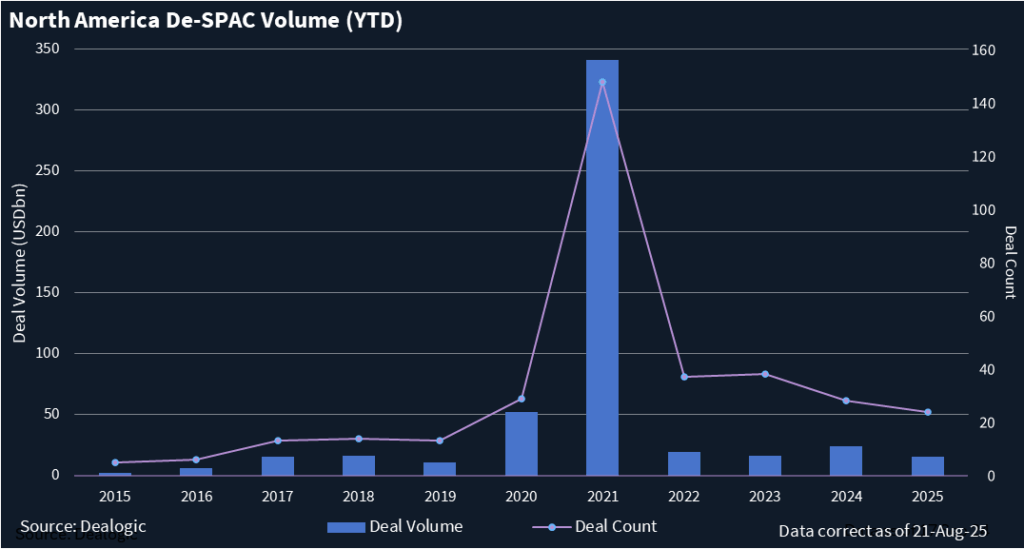

SPAC issuance is ticking higher.

Year to date, 82 SPAC IPOs have raised over USD 16.5bn in North America, according to Dealogic. That is the most issuance on record outside of 2020 and 2021.

This new generation of SPAC vehicles has ample capital to pursue merger partners, noted Mike Bellin, US IPO services leader at PwC. He added that clients are actively engaging with multiple SPACs, particularly in financial technology, infrastructure, and cryptocurrency.

Two dozen de-SPAC mergers with a combined value of USD 15.22bn have been announced in North America so far this year. While that figure trails the past several years in both volume and value, it remains above pre-boom levels.

Although de-SPAC activity has lagged, Bellin expects momentum to pick up later this year and into early 2026 as newly minted SPACs close in on their targets.

Jessica Chen, a partner at White & Case, noted that the overall caliber of sponsors has improved. “The less reputable players have mostly exited,” she said.

Still, Braeutigam emphasized that quality sponsors and guaranteed capital remain critical.

“De-SPACs are generally more expensive, take longer, and are more complex than traditional IPOs,” he said. “The supposed benefit is pricing certainty, but if that price isn’t backed by guaranteed capital, we’ve seen the result: orphaned vehicles with no liquidity or analyst followership, making survival as a public company very difficult.”

Crypto enters the frame

Increasingly, investors are using SPACs and other vehicles to bring digital assets into the public markets.

Last week, venture capitalist Greg Kidd acquired control of NYSE American-listed Know Labs with 1,000 Bitcoin — worth about USD 115m, plus USD 15m in cash. The deal, one of the largest public-company acquisitions funded with crypto, will transform the medical diagnostics player into a Bitcoin treasury strategy.

“From a lawyer’s perspective, that was interesting because we had to deal with a contribution of digital assets, the tax treatment, and how do you do an acquisition like that,” said Daniel Forman, a partner at Lowenstein Sandler who worked on the deal.

The strategy is gaining traction.

In July, French telecom company Sequans raised USD 384m in debt and equity while adding Bitcoin to its balance sheet.

Forman said crypto treasury strategies are increasingly eclipsing the mining-focused listings that dominated earlier SPAC cycles.

Lowenstein Sandler is advising multiple other digital-asset treasury transactions that are in the works, from SPAC mergers to reverse takeovers to PIPEs, he added.

Lessons from the boom

The revival is not without cautionary notes.

Braeutigam said one of the most important lessons from the last SPAC cycle is that companies must be careful when presenting long-term projections to investors.

“Any time you communicate publicly about growth expectations, you will be valued on them,” he said. “If you fall short — whether due to execution or infrastructure — you will face tough questions and possibly lawsuits. In some cases, that can wipe out half a company’s market capitalization overnight.”

With roughly 100 SPAC IPOs projected annually — compared with 600 during the peak — the market is regaining its footing at a more sustainable pace.

Repeat sponsors are re-entering, PIPEs are reappearing, and companies are increasingly keeping both IPO and SPAC paths open. “SPACs aren’t faster or cheaper. They require the same rigor as IPOs,” Arel said. “The difference is flexibility and timing.”