Clinical trials: Labcorp’s drug-development spinoff underscores investor interest

Labcorp’s [NYSE:LH] plan to spin off a business focused on conducting drug trials for pharmaceutical companies highlights the rising interest in the contract research sector.

The clinical development business – which Labcorp entered with its USD 6.4bn acquisition of Covance in 2014 – is expected to become a separate publicly listed company in the second half of next year, Labcorp announced 28 July.

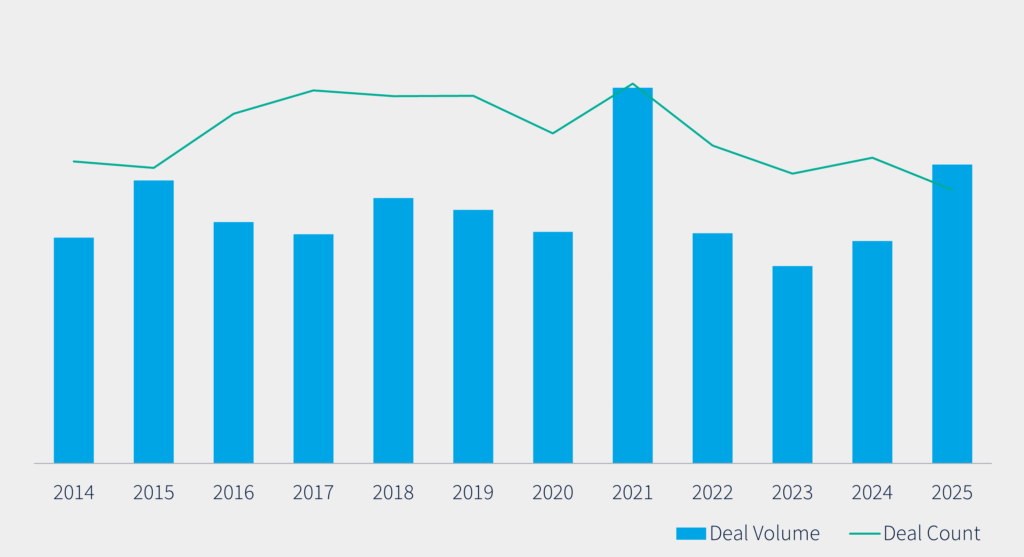

It comes as dealmaking in the space reaches fever pitch. Last year, buyers signed 17 transactions worth a record USD 43.5b for North America’s contract research organizations (CROs), according to Dealogic. That included PPD’s USD 21bn sale to Thermo Fisher Scientific, PRA Health’s USD 12.3bn purchase by Ireland’s ICON, and Parexel’s USD 8.5bn acquisition by a private equity consortium.

The surge in M&A is driven by rising demand for clinical trials, as biotech firms pour billions into gene therapies and cancer treatments. The number of clinical trials worldwide has risen to more than 409,000 in March 2022 from only 2,119 in the year 2000, according to Statista. The rapid development of the COVID-19 vaccines also boosted business.

CROnsolidation

Labcorp had considered strategic alternatives for the whole company last year, after activist pressure from shareholder Jana Partners.

During that review, Syneos Health [NASDAQ:SYNH], another CRO, held talks to merge with Labcorp’s drug development business, according to a report last November. Labcorp ended its review in December, opting to keep its existing structure instead. Labcorp now believes the time is right to pursue a spinoff.

The USD 3bn-revenue business, which will focus on managing phase I-IV trials, is expected to grow in the high-single digits organically in a market that already exceeds USD 25bn by revenue, its CEO Adam Schechter told investors. The standalone business is also expected to grow through acquisitions. Might it revisit a Syneos merger?

Clinical software

Clinical trial software – used by CROs to improve enrollment and management of patients during clinical trials – is another fast-growing category attracting investor attention. Such software can also facilitate virtual participation in clinical trials from a patient’s home, a trend that gathered pace during the pandemic, as well as a hybrid of at-home and in the medical center.

Last year, a record 16 transactions worth USD 1.16bn for North American-based clinical trial software providers took place, according to Dealogic. By value, it was dwarfed by the USD 5.9bn that exchanged hands in 2019, when Medidata sold to France’s Dassault Systems [EPA:DSY] for USD 5.7bn.

Other providers of clinical trial software include IBM [NYSE:IBM], Veeva Systems [NYSE:VEEV], as well as Clario, borne out of eResearch Technology’s 2020 acquisition of BioClinica.

Smaller software providers garnering attention include Abry Partners-backed Anju Software, which is on the lookout for acquisitions of up to USD 50m. Others are ConcertAI, a Boston-based company that raised USD 150m in Series C funding in March, and Suvoda, a fast-growing software provider for complex clinical trials that could look to raise up to USD 200m in capital. Any of those could find themselves under the buyers’ microscope.