Canadian dealmakers look to Covid playbooks, retrenchment and US targets following Trump tariff threats

- Ongoing deals delayed as potential impacts assessed

- PE expected to pullback and focus on portfolio companies

- Choice between decoupling from US or doubling down

Canadian dealmakers are dusting off their COVID 19 playbooks as they weigh up the potential impact of US President Donald Trump’s proposed tariffs.

Some auctions are on pause as they weigh up the impact on valuation caused by tariffs, while corporates weigh up the benefits of seeking targets stateside to gain the coveted “Made in America” stamp or to find routes to decouple entirely from the US, they said.

Canada was one of the first countries to be targeted, and then given a 30-day reprieve on Trump’s tariff plans. The 25% tariff on imports from Canada, and a 10% levy on Canadian energy imports were delayed to 4 March. Tariffs on all steel and aluminum imports into the US soon followed, as well as potential reciprocal tariffs on Canada’s digital services tax, a 3% levy on foreign technology company sales in the country.

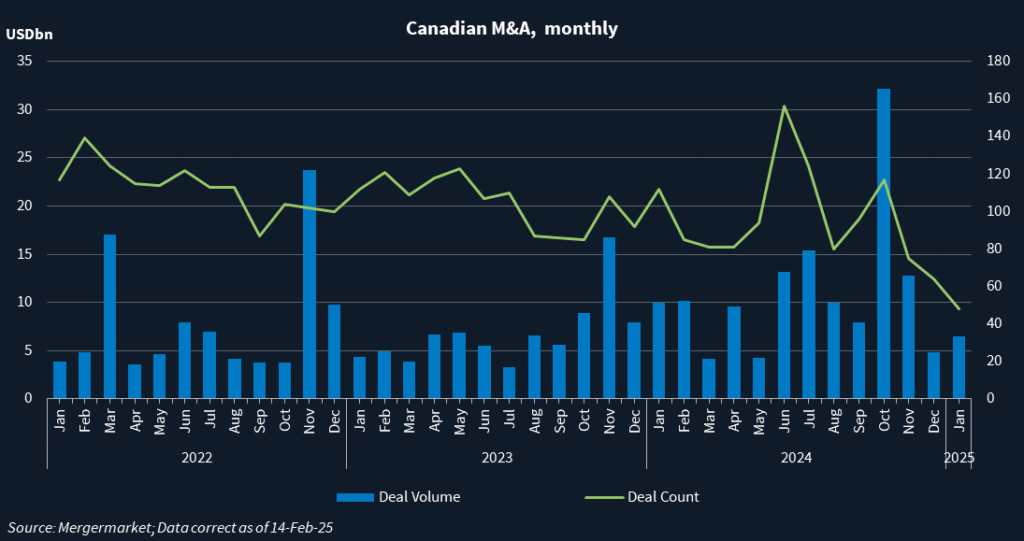

The uncertainty created by this has thrown cold water on the hopes that Canada’s positive M&A momentum from 2024 would carry over into 2025. Canadian M&A volume and deal count has pulled back significantly since October 2024.

Initial shock

The immediate jolt from Trump’s across-the-board tariff announcement resulted in a 1.6% depreciation of the Canadian dollar against the US dollar and a nearly 1% drop in the S&P/TSX Composite Index. The fall in domestic currency and equities, combined with the potential for increased supply chain costs from US inputs, have forced buyers and sellers to assess the impact on valuation, three dealmakers said.

The most vulnerable sectors to tariffs are primary metals, food and beverage manufacturing, chemicals, machinery, and aerospace, as reported by this news service. With Canada sharing the longest border in the world with the US, the companies most affected by the tariff uncertainty are those that generate a big chunk of their revenue stateside or have suppliers there, said a Toronto-based banker.

Canadian dollars to defend, decouple, or deploy?

Canadian companies and their advisors have come to realize that despite the US-Mexico-Canada trade agreement, negotiated during Trump’s first term to replace the North American Free Trade Agreement, their tariff-free access to the US market is no longer a given. Suddenly, having a strong market presence in the US is seen as a liability because of the extra import duties that likely will be required, whereas before 1 February it was considered a good business strategy, the banker noted.

As a result, some businesses might start dusting off their COVID-19 playbooks to reshore their supply chains, noted a Canadian dealmaker. “If you source more from countries where you incur freight charges, you may revisit those options if tariffs are applied from the US and if the Canadian government responds with retaliatory tariffs,” he said.

The decoupling might have already started.

On 13 February, the Globe and Mail reported that Alberta Investment Management (AIMCo), a Canadian pension fund with about CAD 160.6bn (USD 113.2bn) in assets under management, was closing its offices in New York and Singapore to save costs, just one year after a ribbon-cutting ceremony was held for the New York office.

Similarly to the COVID-19 pandemic, sponsors are expected to hit the brakes on new investments as they focus on evaluating the impact of potential tariffs on their portfolio companies, said a local M&A advisor.

A partner at a middle market US private equity firm admitted that a lot of hedging is required to manage a Canadian portfolio company that manufactures in Canada and imports into the US. The partner explained their firm is evaluating whether it makes sense for its Canadian portfolio company to open a US warehouse to shift some profit generation from Canada to the US to avoid tariffs.

Meanwhile the Canadian dealmaker questioned whether the might of the capital held by Canadian pension funds, despite depreciation, could be deployed to help strengthen Canadian businesses and help with the decoupling effort.

PE firms were significant drivers behind Canada’s 64% year-over-year jump in deal volume in 2024 and were expected to be prolific dealmakers in 2025.

Desperately seeking stateside supply

Other companies are taking defensive moves by seeking targets that will secure “Made in America” tags, two of the dealmakers said.

“If these (foreign) companies don’t want to pay (tariffs), there’s only one thing they can do. Build their factories in America, hire Americans with great high paying jobs,” the nominee for US commerce secretary Howard Lutnick said in January at a Washington rally celebrating Trump’s inauguration.

Trying to take advantage of this shift, Vancouver-based, asset-based lender Maynbridge Capital is accelerating its plans to raise a US-based debt fund specifically for foreign companies looking to acquire assets in the US. “I suspect that’s probably a lot of what’s going to happen over the next 12 to 18 months,” said Dean Shillington, president of Maynbridge.

Traditionally risk-averse local banks are unlikely to fill the gap as they too are expected to retrench on M&A financing during the current climate, leaving Canadian business, particularly small and mid-sized ones, with few funding options, Shillington said.

Mangrove Lithium, an emerging lithium conversion company backed by Mitsubishi [TSE:8058], is evaluating whether to build its second manufacturing facility in the US, in part due to the threat of tariffs, CEO Saad Dara said. “You always have contingencies, and you always have different plans”.

Delta, British Columbia-based Mangrove was founded with the goal of enhancing North America’s lithium supply chain and bolster regional security.

But whether its decoupling from the US or buying into the Made in America trend, that all takes time, and not all businesses will have deep enough pockets to endure, which will likely result in an uptick in fire sales, bankruptcies and liquidations, the Toronto-based banker said.