Buyer demand returning forcefully after macro swings chilled 1H25 dealmaking – North American Healthcare Trendspotter

- Biopharma continues to field the most activity

- Multiples have ‘evolved significantly’

- High-quality HCIT assets can provide shelter from macro uncertainty

Although M&A continues to face geopolitical and macroeconomic headwinds such as new US administration decisions, and uncertainty around reimbursement and regulatory challenges, healthcare dealmakers are seeing robust interest from buyers, pointing to a healthy and positive outlook for 2H.

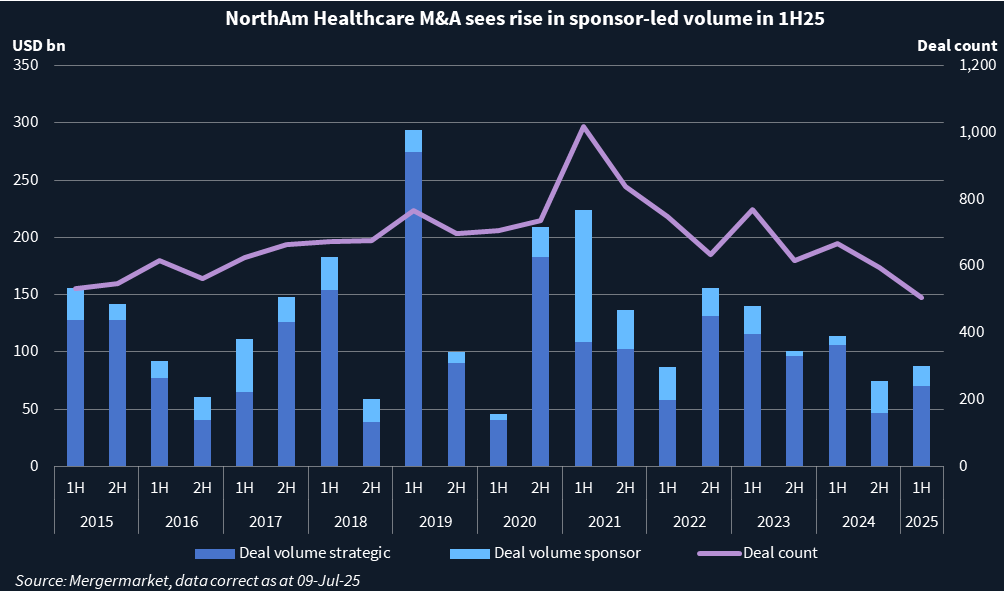

The North American healthcare sector saw a decline in both deal volume and count in 1H25 with USD 88bn across 506 deals, the lowest 1H deal count since 1H15, vs USD 113.7bn across 666 deals in the same period last year, according to Mergermarket data.

In the sector – comprising pharma and biotech, healthcare services, information technology and medtech – the USD 15.5bn Johnson & Johnson’s acquisition of Intra-Cellular Therapies, a developer of therapies for neuropsychiatric and neurodegenerative disorders, is the largest deal so far this year, according to Mergermarket data.

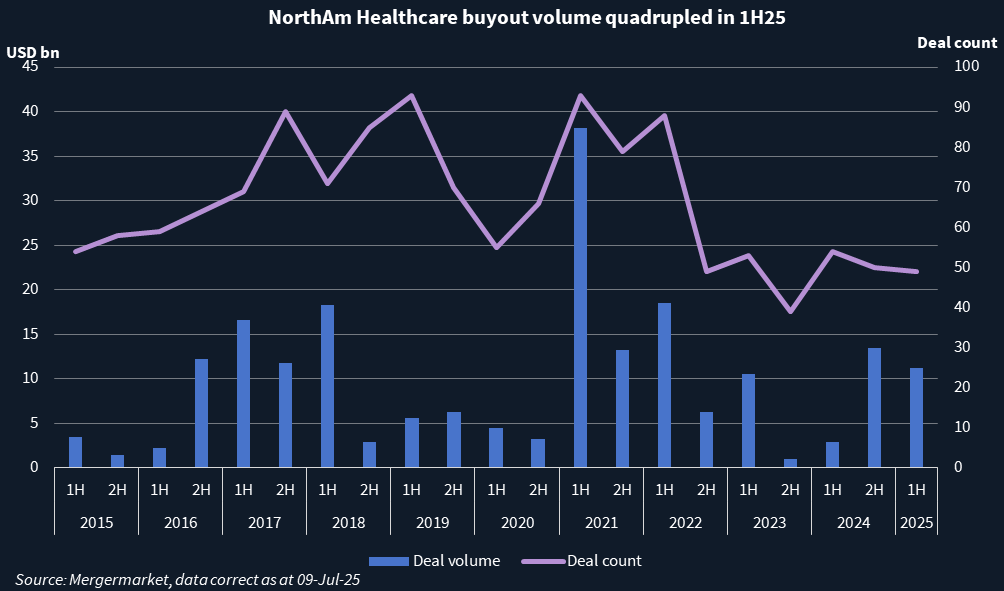

Financial sponsor buyout activity almost quadrupled by deal volume in 1H25 as compared to the same time last year (USD 11.2bn) but saw a 9% fall in deal count, according to Mergermarket data. The top buyout deal was the acquisition of a 90% stake of Modernizing Medicine by ClearLake Capital Group from Warburg Pincus in March.

“This year began with unrealistically high expectations for biopharma M&A volumes, driven by pent up buyer demand and expectations of a more constructive regulatory environment,” said Tom Davidson, global co-head of investment banking at Leerink Partners. “Demand accelerated into midyear across biopharma, med tech, tools and diagnostics after buyers acclimated to macro policy uncertainty, which [initially] chilled demand, resulting in a relatively subdued first half,” Davidson said.

While activity was lower for the period than the market expected back in 4Q24, deal flow and quality saw improvement in late 1H25, said Chad Moore, managing director at Stout. This uptick is expected to carry into 2H25 as banker backlogs appear to be increasing with deals expected to come to market 2H25 and 1H26, Moore said. The market can also expect to see an uptick of sponsor-backed deals in the middle market, which are ripe for monetization, an industry banker noted.

Biopharma M&A will continue to be the most active sector within healthcare, while healthcare services is seeing strong demand from financial sponsors for high quality assets, according to several dealmakers. Revenue cycle management within HCIT will also continue to be active with assets fetching higher than historic multiples for tech enabled RCM players, said an industry banker.

“Dialogue between buyers and sellers has clearly accelerated, notably in biopharma,” said Davidson.

Buyer interest from both strategics and financial sponsors remains strong across all healthcare sectors, dealmakers said.

The volume of sponsor-led M&A deals rose by 21% to reach USD 18.1bn across 135 deals compared to USD 7.9bn across 150 deals over the same period last year, according to Mergermarket data. Strategics captured 79% of the total deal volume in 1H25, down from last year’s 93% share.

Sponsors are under increasing pressure to sell assets to offer returns to LPs before buying new assets, industry bankers said. Private equity-backed platform-sized companies are strong participants of M&A as firms balance returning capital to LPs with deploying committed funds, said Jefferson Rives, managing director and head of healthcare technology at Truist Securities. Additionally, large sponsors will be looking for bolt-on acquisitions for recently acquired platforms to further scale, dealmakers said.

The Intra-Cellular sale, in particular, “highlights the return of CNS [central nervous system] as a growth therapeutic area,” said Subin Baral, EY-Parthenon global life science deals leader.

Oncology is consistently an attractive subsector for biopharma M&A, dealmakers said. However, CNS and immunology have become more interesting to buyers recently due to GLP-1 drugs, which are used to treat diabetes and weight-loss, and other new classes of anti-obesity drugs opening the potential for big valuation surges, Baral said.

Across healthcare services, dealmakers are seeing an uptick in activity from healthcare investors in areas with less reimbursement risk or exposure to rising labor costs, said Ryan Duane, director of healthcare services at William Blair. Healthcare logistics, procurement and transportation, as well as medical equipment maintenance and repair, are among attractive subsectors, Duane said.

“Health tech continues to be a standout sector within healthcare,” said Rives. Revenue cycle management, payor tech, post-acute, specialty EMRs, AI and governance are among those receiving financial sponsor attention, dealmakers said.

HCIT is isolated from public policy, the One Big Beautiful Bill Act, uncertainty around reimbursement around Medicare and Medicaid, and the effects of tariffs to a large extent, said an industry banker.

“Thus, the sector continues to see robust deal activity and solid returns from a middle market private equity perspective,” said Dudley Baker, managing director at Houlihan Lokey. Banner deals of HCIT companies this year include SmarterDx-Access Healthcare, Office Ally and the Forcura-Medalogix merger, said Baker.

Hot sectors in pharma services include PharmaTech, particularly tools to improve process/workflow efficiency; research enablement organizations; specialty CDMO; supply; and logistics, Moore said.

“Multiples have evolved significantly across sub-sectors over the last few years,” said Paul Moskowitz, a partner and member of the healthcare vertical at Bain Capital.

Payor and provider services companies have underperformed due to regulatory/reimbursement headwinds and are generally trading – with some exceptions such as infusion – at high-single-digit or low-double-digit multiples, down from mid-teens or more several years ago, Moskowitz said. Medtech companies have also bifurcated, with many small- and mid-cap companies with tariff impacts and slowing growth compressing to high-single-digit multiples from the mid-teens, he added.

The highest-quality HCIT and pharma services businesses, with 15% growth or more, can fetch multiples in the high teens to low 20s, or more when there is strategic interest, according to Moskowitz. HCIT software multiples have averaged record levels in the mid-20s over 2024 and 2025 because of “the scarcity and strategic value of high-growth systems of record like ModMed, Qgenda, Dotmatics, Healthedge, and others,” he said.