British Business Bank mobilises new capital to scale UK growth companies

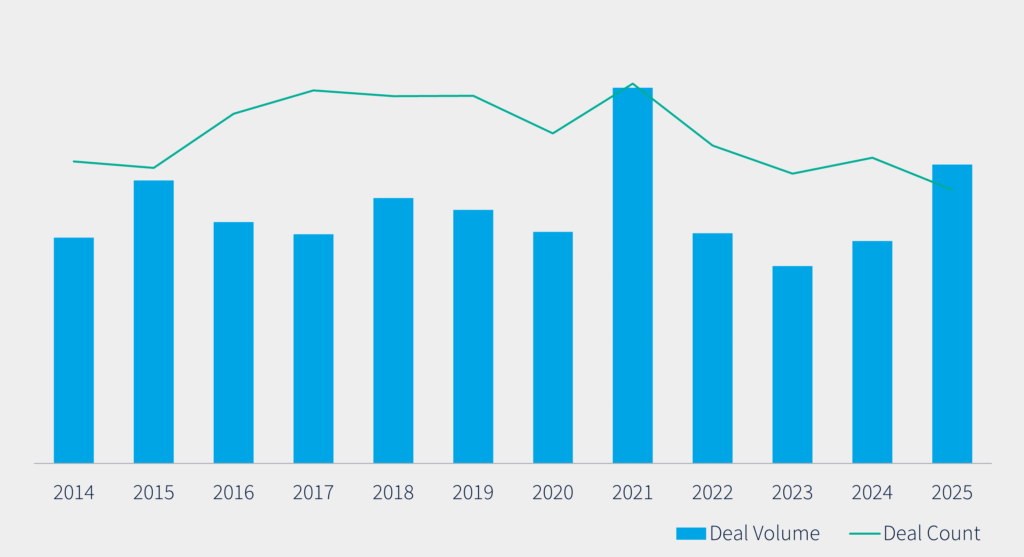

When the British Business Bank (BBB) was created eleven years ago, it carried a clear mandate: to fill gaps in funding for small and medium-sized enterprises from the UK and catalyse private sector investment.

Now, the public finance institution (PFI) is expanding its role as a cornerstone of UK venture and growth financing, launching new initiatives to scale high-potential companies into M&A-ready targets, unlock domestic pension capital, and deploy strategic firepower across priority sectors, CEO Louis Taylor told Mergermarket.

The upcoming British Growth Partnership (BGP) will see the bank advance its mission by opening a series of venture funds to external limited partners (LPs) for the first time, after growing to be the UK’s largest LP in venture and growth capital funds over the past decade. LPs invest in venture capital (VC) funds.

The BGP will target later-stage growth rounds in companies from Series C+, doing so primarily alongside trusted existing relationships – which include more than 47 managers, 89 fund investments, and over 1,500 underlying companies, Taylor said.

He earlier told Mergermarket that the bank is aiming to raise hundreds of millions of pounds under the funds.

At the core of its mission, the PFI exists to ensure that equity provision is available to entrepreneurs in regions outside main cities, because of the inequality in funding that is disproportionately focused on the London-Oxford-Cambridge triangle, Taylor said.

In addition to the BGP, the BBB supports the UK SME ecosystem through a range of equity and debt financing, as well as through its Nations and Regions investment funds and other legacy programmes.

In 2024/25 alone, it reported deploying over GBP 881m in equity commitments, GBP 385m of debt commitments, and GBP 2,015m of guarantee commitments.

“The BGP is a small part of what we do,” Taylor said, adding that it positions them as a bridge between UK businesses and private capital, with the goal of encouraging the creation of similar imitators and competitors in the market.

Scaling strategic investment

Following the UK’s 2025 Industrial Strategy and Spending Review, the BBB is also scaling up investment across key strategic sectors by deploying up to GBP 4bn under a newly formed British Business Bank Industrial Strategy Growth Capital.

The new initiative will enable larger investments of up to GBP 60m, compared to previous rounds capped at GBP 15m.

The BBB has already been deploying to defence tech since 2018 when its National Security Strategic Investment Fund (NSSIF) launched, but the UK Modern Industrial Strategy 2025, which prioritises defence, will see more of the bank’s capital directed into the sector.

The strategy outlines eight priority areas overall: advanced manufacturing, clean energy, creative industries, defence, digital and tech, financial services, life sciences, and professional services.

Taylor highlighted underfunded areas in UK venture – deep tech, life sciences, and defence – where funding trails the US on a GDP-weighted basis.

This follows the Spending Review announcement that the BBB’s financial capacity will also rise to GBP 25.6bn, allowing annual investments to grow to around GBP 2.5bn.

Looking ahead, Taylor emphasised the importance of retaining UK ownership: “We want to ensure companies can stay in the UK rather than gravitating to where their capital came from, which are usually largely US venture funds. We should be able to stand back in 10 years’ time, and this market will be served by UK private sector investors.”

Increasing UK pension exposure to illiquids

The BGP was launched alongside recent pension reforms aimed at channelling UK pension capital into unlisted domestic assets. It’s part of the BBB’s broader strategy to unlock more of the UK’s GBP 3.8tn pension market for venture and growth investment, supporting the shift from defined benefit (DB) to defined contribution (DC) schemes.

While DB plans promise a set retirement income, DC schemes accumulate contributions over time and deliver a retirement income that depends on investment performance.

Despite this transition, most DC pensions still have limited exposure to private markets due to cost and liquidity constraints – leaving UK businesses reliant on foreign investors. Currently, only around 2% of UK DC capital is allocated to unlisted UK equities.

“The advantage that the UK has, which so few other countries do have, is that we have the largest funded pension market in Europe,” said Taylor. “But we have not effected the transition very well in terms of the amount of money DC schemes put into private markets. We aim to influence this by demonstrating the strong performance of portfolios like ours.”

The aim is to eventually bring every UK pension to invest in the programme, according to Taylor. “We want to crowd private money into UK growth and get UK institutions to realise this goldmine of opportunity that we’re sitting on – innovative companies that they’re currently missing,” he said.