Brazil’s M&A activity signals rebound in the short term, advisors say

- Interest rate cut in US seen as turning point

- Macroeconomic scenario suspended deals until mid-year

- Deal volume increases in 3Q24

Brazil’s M&A market is expected to rebound in the short term, according to lawyers and financial advisors.

Sao Paulo-based law firm TozziniFreire Advogados has seen a promising interest in acquisitions and partnerships start to return in 2H24, said partner Carla do Couto. “Uncertainty has lowered a bit,” added partner Marcela Ejnisman in the same interview.

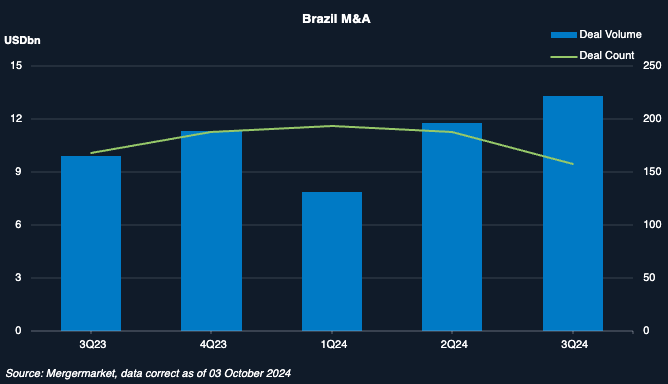

According to Mergermarket data, Brazil’s M&A for 3Q24 totalled USD 13.3bn across 158 deals, a 34% increase by deal volume and a 6% decline by count compared with 3Q23.

The country recorded the highest quarterly M&A volume in 3Q24 since 2023, led by the USD 2.79bn acquisition of Santos Brasil Participacoes by Merit Corp Sal and CMA CGM.

In 2024, many deals were suspended or slowed their pace until mid-year due to the macroeconomic scenario, said Renata Homem de Melo, partner and head of corporate and M&A at the Sao Paulo-based law firm FAS Advogados. Brazil’s fiscal challenges and expectations regarding interest rates have had a negative impact, particularly on foreign investment, she said.

Although there are signs of a recovery in M&A transactions in 2H24, this recovery is starting from a suppressed base, which means that it will probably not lead to significant growth, Homem de Melo said. “Transaction volumes should increase as economic conditions stabilize, and significant growth is more likely to occur in 2025,” the FAS partner said.

Turning point

Sao Paulo-based financial advisory firm Auddas expects 2025 to be the “turning point,” said Head of M&A Fernando Pereira. “Finally, after a long period of rising interest rates in the US, we see the beginning of a period of monetary loosening,” with the Federal Reserve having cut interest rates by 50bps on 25 September, even earlier than the market expected, Pereira added. This will lead large institutional investors to once again allocate more capital to stocks and private companies, the financial advisor noted. “Since the participation of foreign buyers in M&A transactions in Brazil is quite significant, of approximately 30% in 2023, this movement should make 2025 the year of a resurgence,” Pereira added.

The economic scenario has made recovery difficult and there has been a disparity between the multiple buyers and sellers, said Luiz Fernando Loureiro, head of institutional relations at Sao Paulo-based Nello Investimentos and former country manager of Wells Fargo.

Furthermore, M&A deals have become much more challenging, said Ricardo Chamon, partner at Sao Paulo-based CSA Advogados. “Nowadays, I hardly see any easy money or easy negotiations in M&A,” Chamon said. “Everything is very well thought out, studied, calculated and exhaustively negotiated, without optimism, in a very realistic and conservative way, sometimes even pessimistic,” he added.

Chamon said, however, that he is involved in several deals and seeing many transactions being negotiated. “Although it may seem otherwise, I’m not negative regarding the current moment or in perspective,” Chamon said, cautioning that it is a tough scenario, very demanding in all aspects and in relation to everyone involved, which should last for a long time.

Companies are using debt for acquisitions instead of cash, Tozzini’s Couto said, adding that “the bar has become much higher for small companies.” There is also the situation of funds that have already been set up and need to complete their investments, she added.

For Chamon, more than ever, “cash is king.” The novelty is the practical effect of legal uncertainty, which has always existed in any transaction involving business in Brazil, but has taken on an even greater and indefensible proportion in the current context, he said. As an example “among many,” the CSA Advogados partner cited “the political and legal soap opera” of the removal of payroll tax exemptions in 17 sectors. After many back-and-forths, the legislation will tax payroll for companies that were benefiting from the exemptions by 5% in 2025, 10% in 2026 and 20% in 2027, according to press reports.

Sectors

Technology as a whole and particularly cybersecurity are hot sectors, said Tozzini’s Couto, citing also digitalization for healthcare and other sectors that demand more digitalization. Upcoming legislation on artificial intelligence is expected to affect M&A among other business processes, she added.

Another promising segment is the sports betting sector, Couto said. “Some companies are already operating legally and this can generate M&A,” she noted. “Companies from abroad are coming to Brazil. There is clearly strong potential for M&A and partnerships between banks, telecom operators and media companies,” Couto said.

Tozzini’s Ejnisman added to the list of promising sectors for M&A retail, which has suffered a beating, and random sectors like manufacturing, production goods, infrastructure, renewable energy companies and data centers.