Boom time for crypto ECM with issuance set to soar

Crypto-related activity in the equity capital markets is entering one of its most prolific periods on record.

Supportive regulation, investor demand for infrastructure plays, and strong stock performance are all fueling issuance, market participants say.

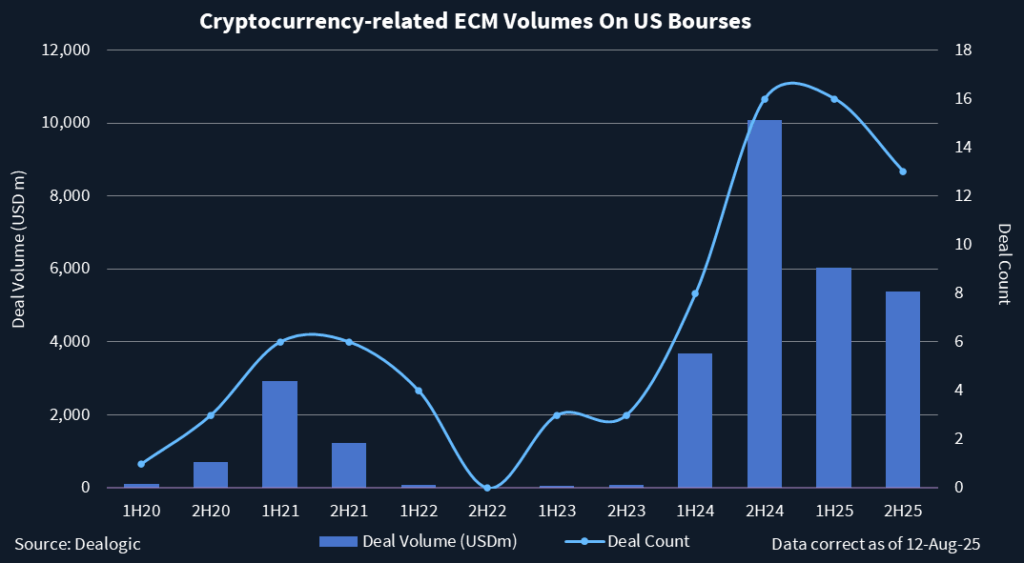

ECM issuance on US bourses for blockchain-related businesses reached USD 11.41bn for the year to date (through mid-August). Of that, USD 6.03bn came in 1H25 and USD 5.39bn has come since then. The market is on pace to challenge 2024’s record USD 13.75bn, which ended with the most active half-year ever in 2H24.

Much of 2025’s haul has come from sizeable convertible raises, including from Coinbase and MARA Holdings. But increasingly, a select IPO lane is emerging.

The summer run began in June with Circle’s USD 1.21bn blockbuster IPO, which delivered an exceptional first-day pop and captured investor appetite for stablecoin infrastructure.

Momentum accelerated after the US Senate passed the landmark Genius Act, which created a regulatory framework for stablecoins and fueled a rally in the stock.

This month, Bullish, the cryptocurrency exchange operator backed by billionaire Peter Thiel, became the latest to tap US public markets, raising more than USD 1.1bn on its 13 August debut.

Jeff Dorman, chief investment officer at Arca, said IPO candidates in the space are now more mature, with stronger revenue and cash-flow profiles, but face a deal-by-deal assessment from investors.

He pointed to stablecoin and Bitcoin infrastructure as the most compelling themes, while warning that fee-dependent brokerages face intensifying competition and margin compression. Custody-focused models, he added, could fare better than exchanges in attracting investor interest.

Other market participants share this bullish outlook.

Steve Maletzky, managing director at William Blair, mentioned exchanges, treasury platforms, and other back-end infrastructure providers as likely beneficiaries of a friendlier US regulatory climate.

“We expect to see an increase in crypto-related and crypto-adjacent, not just crypto in the coin or mining space, but more so in the picks and shovels that facilitate the space, specifically in and around the exchanges, software, and treasuries,” he said.

In general, deregulation, the price of Bitcoin, and the growing acceptance of stablecoins will continue to be the primary forces behind the sector’s momentum, a sector advisor said.

After years of delays due to regulatory pressure, companies can now execute on IPO plans. But the advisor cautioned that he doesn’t expect to see hundreds of companies come to market. Many big companies will come out of this, he said, adding that he only expects a group of 10 to 15 that list and survive as publicly traded crypto firms.

Several names have already filed or confidentially filed ahead of more near-term issuance. BitGo, a custody-focused model, filed for IPO this week. Exchange Gemini, founded by Cameron and Tyler Winklevoss, confirmed it confidentially filed IPO paperwork with the SEC earlier in the summer. Crypto asset manager Grayscale also filed confidentially for a listing.

In the medium term, Kraken, another exchange, remains a potential candidate for next year as it seeks further private funding ahead of a public debut.

Blockdaemon is seen as a likely 2026 IPO by investors, too. The blockchain infrastructure provider secures more than USD 10bn in staked assets for clients, recently partnered with Fireblocks to enhance institutional access to staking, and has a financial profile fit for an IPO, one investor noted. It was valued at USD 3.3bn in its last funding round that closed in 2022.

Ledger, a France-based cold storage hardware provider backed by top US venture firms, is also eyeing a US listing, potentially as soon as next year.