Bond Highlights 1Q25

There has been a recent sense of encouragement coupled with a tinge of disappointment for investors craving new bond supply. Global bond issuance volumes fell year-on-year (YoY) in 1Q25 despite a solid backdrop of several consecutive weeks of fund inflows, rampant collateralised loan obligation (CLO) formation, and tight spreads offering potential cheap coupon costs.

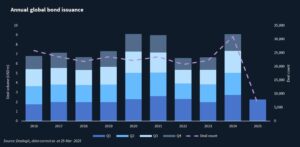

Global bond issuance volumes in 1Q25 fell YoY to USD 2.272tn versus USD 2.739tn in 1Q24 (see chart below). The amount of supply has still been decent, as volumes remain comparable with USD 2.31tn in 1Q22 and USD 1.987tn in 1Q23.

High-yield (HY) bond markets have seen conducive issuance conditions given a recent sustained period of strong inflows. HY funds recorded two weeks of outflows, but this followed seven previous weeks of back-to-back inflows, according to a BofA report on 21 March. Investment-grade (IG) funds also recorded an outflow for the weekly period ending 19 March, which was only the fifth week of outflows since the back end of 2023, according to BofA.

There remain other supportive issuance drivers. The potential for issuers to achieve relatively tight coupons is possible given the iTraxx Crossover in Europe is indicated in the low 300 basis points (bps) range. CLO formation continues to be rampant, boosting demand for new paper, particularly floating-rate notes (FRNs). In addition, interest-rate cuts by central banks appear to be on the cards, and are adding to the supportive technical. The European Central Bank (ECB) has already lowered interest rates in 2025, while the US Federal Reserve and Bank of England are also expected to consider rate reductions this year.

There remain signs that global bond issuance could pick up in the coming weeks, as investors have more cash to invest. In Europe, the long-awaited syndication of a EUR 7.45bn debt package backing the acquisition of Opella, Sanofi’s consumer healthcare products unit, by Clayton Dubilier & Rice (CD&R) has arrived. The deal comprises a EUR 5.45bn-equivalent Term Loan B (TLB) and a EUR 2bn-equivalent senior secured seven-year note, and will meaningfully boost European issuance volumes if it prices.