Bitcoin miners: Access to power makes them targets for AI computing giants — Dealspeak North America

Cloud computing platform CoreWeave’s USD 1.6bn offer to acquire bitcoin miner Core Scientific [NASDAQ:CORZ] on 6 June is a taste of the future.

Bitcoin miners, say executives, will be targeted by deep-pocketed AI computing giants – not just other competing miners – who want data-center infrastructure with access to low-cost power.

Backed by NVIDIA [NASDAQ:NVDA], CoreWeave has raised USD 12bn in equity and debt and last month was reportedly valued at USD 19bn.

The offer, which Core Scientific rejected, came just nine days after Colorado-based bitcoin miner Riot Platforms [NASDAQ:RIOT] made a USD 849m hostile bid for Toronto-based rival Bitfarms [TSX:BITF]. Until then, Hut 8’s [NASDAQ:HUT] merger with US Bitcoin, announced in February 2023, had been one of the few company-level transactions between Bitcoin miners. Most dealmaking had involved the sale of assets as indebted miners struggled when bitcoin’s price cratered in 2022.

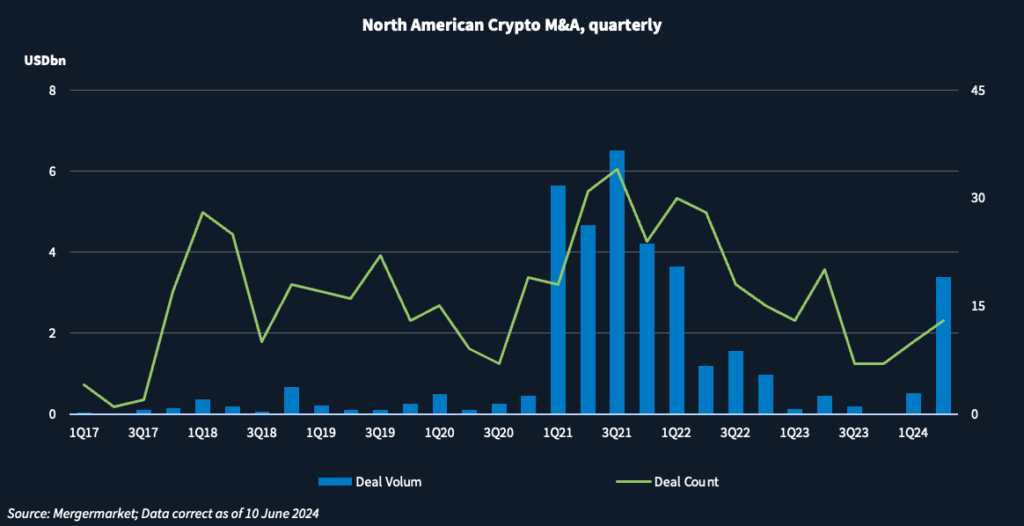

After the ‘crypto winter’ of 2022 and much of 2023, M&A activity involving crypto companies – which includes bitcoin miners, but also those involved in other blockchain technologies, such as Ethereum – has begun to rise again, Mergermarket data show.

Tailwinds and challenges

A slew of approvals from the Securities and Exchange Commission (SEC) for bitcoin exchange traded funds (ETFs) in January and then an Ethereum ETF in May suggests crypto has become a safer asset class. Demand for those ETFs has driven up prices to all-time highs.

BlackRock’s launch in March of its first tokenized fund on a public blockchain was another vote of confidence. “It’s a very good indicator that it will be safe to operate a blockchain-focused company in the US,” says Chris Kelly, co-owner of NBA team Sacramento Kings, who is now turning to investing in blockchain technology through his Kelly Ventures I fund.

The bitcoin halving on 20 April – the number of bitcoin mined daily then dropped to 450 from 900 – will put further upward pressure on price, but it also doubles the energy needed to mine it.

That could put pressure on the 21 publicly listed bitcoin mining companies to consolidate. The seven that have market caps of around USD 1bn likely will be whittled down to four over the next three or four years, predicts CleanSpark [NASDAQ:CLSK] CEO Zach Bradford. “Those players will continue to have access to capital, making the cost of capital cheaper, giving them an innate advantage in this capital-intensive business. The others will fall off.”

Several smaller, privately held bitcoin miners – already struggling for access to capital – are looking to sell. “I receive one or two approaches a week,” says Dan Roberts, co-CEO of IREN (formerly Iris Energy) [NASDAQ:IREN], a bitcoin miner with 260MW in operating data centers, another 250MW under construction, and a further 2,500MW in the pipeline. Many are too small to interest him – one recent hopeful had a capacity of less than 50MW and another had 185MW.

Power play

Potential acquirors won’t be limited to bitcoin miners. Cloud computing and tech giants such as Alphabet [NASDAQ:GOOG], Meta Platforms [NASDAQ:META], Microsoft [NASDAQ:MSFT], and Amazon [NASDAQ:AMZN] – not to mention emerging AI cloud service providers such as CoreWeave and Lambda Labs – need data centers with access to low-cost power.

“They might target bitcoin miners,” notes Patrick Fleury, CFO of zero-carbon bitcoin miner Terawulf [NASDAQ:WULF]. “We trade pretty cheaply.”

Processing ChatGPT requires ten times more electricity than regular search, he notes. “At the heart of their business is power consumption.”

It typically takes four-to-eight years to develop access to electricity. For faster access, data center developers are willing to pay a premium that exceeds what crypto miners are valued by a factor of up to six, according to a Morgan Stanley report. For many miners, a “shift or sale to AI operations may prove more compelling” because AI returns are more certain and the bitcoin halving could reduce profit potential, says the report.

Virtually all miners have looked at converting some of their data center capacity to AI applications. The unit economics for both are compelling, although Bitcoin just about edges it for now, says IREN’s Roberts.

IREN is talking to unnamed partners akin to CoreWeave and Lambda Labs about hosting their AI cloud services, adds Roberts. Bitdeer Technologies [NASDAQ:BTDR] is working on some AI partnerships, says CSO Haris Basit, who calls AI “a call option.” Separately from its takeover battle, Core Scientific has signed a series of 12-year contracts to provide 200MW of infrastructure for CoreWeave’s high-performance computing (HPC) services, which would bring USD 3.5bn in revenue.

Crypto is having another moment in the sun. Bitcoin’s biggest boosters could not have imagined it would be this bright.