Biotech IPO window shows green shoots, with momentum building for 2026

- Many issuers pencil in listings over next 2 years

- Follow-ons provide bulk of biotech transactions

- Convertible deals for sector reach all-time high

Biotech activity in the US equity capital markets is showing renewed signs of life following a multiyear drought.

Molecular diagnostics firm BillionToOne’s successful initial public offering on the Nasdaq is seen as a possible marker of a tentative reopening for the sector, but capital-markets practitioners caution that a true rebound remains contingent on macro stability heading into 2026.

Kaush Amin, managing director and head of private markets investing at US Bank, said this area of life sciences has endured a protracted period of volatility stemming from shifting reimbursement policies and political noise, which may finally be approaching a bottom.

“The biotech space was supposed to be coming back from the trough. But then we had Liberation Day, and then we’ve had a bunch of policy changes with respect to the payment side with the insurance companies, Medicare, Medicaid, and then [US Health Secretary] RFK Jr — his views on vaccinations and a lot of complications out there,” Amin said.

“But my overall take is, I think biotech has taken the hits, and in 2026 we expect it to start coming back from the lows that we saw back in 2024,” he said.

ECM advisors say the recent BillionToOne offering — which priced above range, upsized, and has traded strongly — provides a badly needed proof point for issuers and investors.

Gunderson Dettmer partner Andrew Thorpe said the BillionToOne transaction, which he advised, underscores that quality stories can still clear the market, even under extraordinary circumstances. Thorpe noted that BillionToOne and two other drug-discovery IPO filers managed to go public during the federal government shutdown via Section 8(a), which allows registration statements to go effective automatically after 20 days.

Taking a company public during a government shutdown was a slightly “harrowing” experience as it was uncharted waters for both issuers and their advisors, he said.

The market cooperated, and investors had more time — 20 days — to diligence the pricing range for BillionToOne than in a normal IPO. “I’ve been practicing for 26 years and thought I’d seen it all. That is something I can tick off. Now I’ve really seen it all,” Thorpe said.

BillionToOne’s valuation has more than doubled since pricing. By contrast, MapLight Therapeutics — which filed earlier and was required to use a fixed pinpoint price instead of a pricing range that regulators decided to allow a week later — is down roughly 25%.

Normalization, not a boom

Despite pockets of activity, practitioners emphasize that the market remains far from the 2020–2021 surge. “I wouldn’t characterize it as an IPO boom,” Thorpe said. There’s been meaningful activity, but it’s “more of a return to normal.”

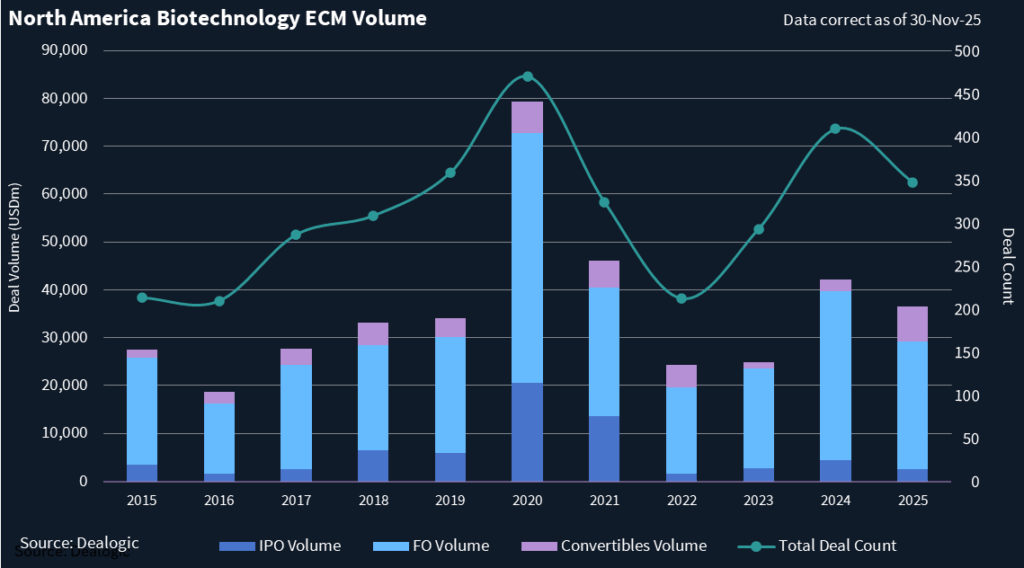

There have been nine biotech IPOs in North America this year, collectively raising USD 2.44bn, according to Dealogic. That’s down from 27 deals that raised USD 4.39bn in 2024, and 13 listings that raised USD 2.64bn in 2023.

But, in terms of deal size, this year is above the USD 1.68bn raised across 17 listings in 2022. The pandemic years of 2020 and 2021 remain outliers, with USD 20.5bn and 13.56bn raised across 72 and 82 deals, respectively.

Thorpe’s colleague Ryan Gunderson said while there has been a modest improvement recently, optimism is largely pegged to 2026, with many clients penciling in potential filings in the months ahead.

But inflation, tariffs, and interest-rate uncertainty remain headwinds. “This year has been a little down overall, but there’s been a pickup in the second half, so maybe we are seeing some thawing” of what has been an icy market, said Gunderson.

“We hear many clients saying 2026 or 2027 might be when they go out,” Thorpe said.

The shift in investor preferences since the peak of the pandemic market has pushed early-stage biotech issuers to remain private longer. “In 2020–2021, you could take something pretty early — even Phase 1 — public. That’s harder now,” said Thorpe, explaining that Phase 2 or Phase 3-ready assets have become the standard for IPO candidates.

Companies lacking the data maturity to go public are relying more heavily on insider rounds or lead-investor bridge financings to reach appropriate clinical milestones, he said.

Meanwhile, revenue-generating life-science businesses — such as diagnostics — face a different rubric.

While there is no hard revenue threshold, Thorpe said investors want clean financials and predictable growth, with many companies seeking to show at least a stable trailing year. A notional milestone of roughly USD 100m in annual revenue is common, but growth visibility matters more than absolute scale, according to Gunderson.

Preparatory IPO work is expected to intensify in early 2026, echoing historical patterns.

The first quarter of the new year will be prep-heavy, and listings will probably pick up around March or April, Thorpe said.

Gunderson added that filings typically ramp after January’s JPMorgan Healthcare Conference, held annually in San Francisco.

For now, bankers and advisers describe a cautious but more constructive backdrop, supported by improving sentiment and selective investor risk-appetite. But the consensus remains that any sustained reopening will require macro stability — and a clearer window — before biotech IPO volumes can meaningfully recover.

This year, North America has so far recorded 347 ECM biotech transactions totaling USD 36.52bn in deal value. While this is below the USD 42.2bn raised across 409 deals last year, it remains well above the levels seen in 2023 and 2022.

Follow-ons remain the workhorse

Follow-on issuance continues to outpace IPOs and is broadly viewed as the healthiest segment of the biotech ECM landscape.

Thorpe pointed to recent substantial raises, including Guardant Health’s USD 750m equity-and-convertible deals and Arcus Biosciences’ USD 288m follow-on, noting robust investor receptivity. “There’s quite a bit of capital-markets activity in the follow-on space,” he said.

There have been 292 follow-on transactions in North America so far this year that generated USD 26.7bn in deal value, according to Dealogic. While down from last year’s more than USD 35bn across 353 deals, 2025 is well ahead of 2023 and 2022 and has even surpassed the number of follow-ons in 2021, while nearly matching that year’s deal value.

Since follow-on deals can be completed quicker than IPOs, there is less market volatility to contend with which has kept that segment of the ECM market active, Gunderson said.

Convertible debt deals are another bright spot. Although they aren’t at the same level of follow-ons in terms of size or number, convertible biotech deals have never been better.

The sector has seen 46 convertible debt deals that have raised USD 7.37bn in North America so far in 2025, which is the most on record, according to a review of Dealogic data.

Gunderson noted that investor sentiment across the broader life sciences sector is largely bifurcated: “It’s a bit of a ‘have and have-not’ environment. Strong companies are able to raise; others that might have raised money in the past are finding it harder,” he said.