Biotech deal size falls to smallest since 2017, but recovery looms – Dealspeak North America

- Big Pharma evades USD 5bn+ blockbuster deals

- Private, earlier-stage drugmakers targeted instead

- Down rounds expected as investors focus on ‘winners’

Biotech deals are shrinking in size as Big Pharma shies away from blockbuster transactions.

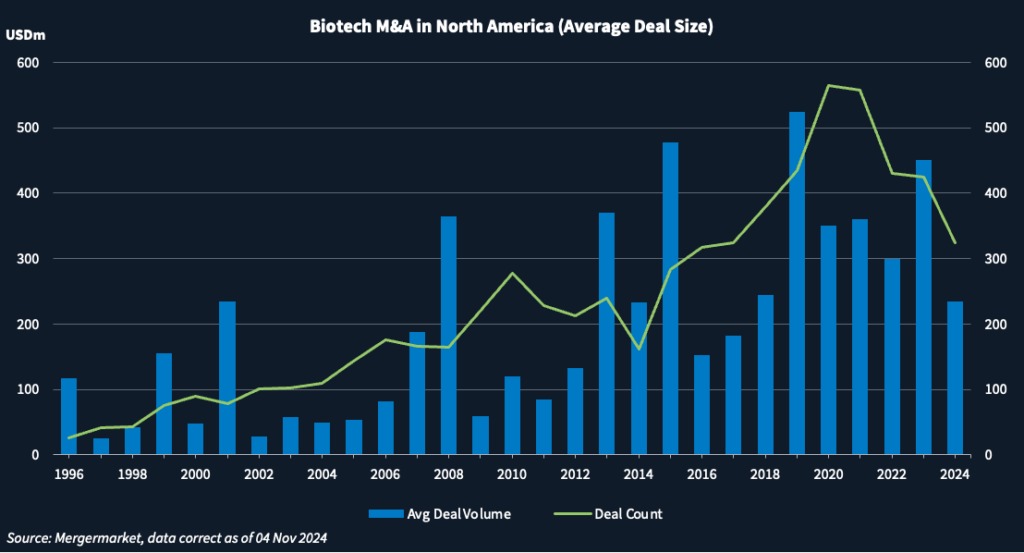

For the year to date, the average deal size has sunk to USD 234m, according to Mergermarket data. That is the lowest level since 2017 (see first chart).

After the exuberant valuations of 2021, the biotech market has been in a downturn.

“Transaction size is smaller because there are a lot of distressed assets. There are so many companies out there available for a low price,” said Pacylex Pharmaceuticals CEO Michael Weickert.

Many expect an increase in down rounds as startups are forced to reset to more reasonable valuations in the year ahead.

Venture investors will look to free up capital for their ‘winners’ by selling stakes in startups they don’t think make the cut, said Jonathan Norris, managing director of HSBC Innovation Banking, at last month’s Bio Investor Forum in San Francisco.

One bright spot is that big pharmaceutical companies have been more actively targeting private companies, many of which are earlier stage and undertaking preclinical or Phase 1 studies, added Norris.

Sub USD 5bn

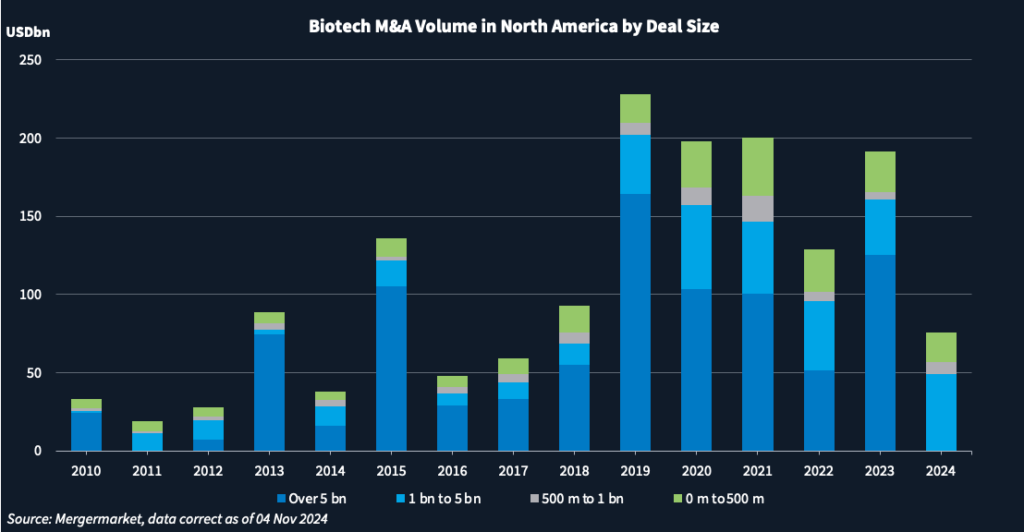

No deal in excess of USD 5bn has been announced this year, the first time that has happened since 2011 (see chart below).

This year’s biggest deal was Alpine Immune Sciences’ USD 4.95bn sale to Vertex Pharmaceuticals [NASDAQ:VRTX] in April, followed by a USD 4.47bn bid for Cymabay Therapeutics from Gilead Sciences [NASDAQ:GILD] in February, and Morphic Holding’s USD 4.06bn purchase by Eli Lilly [NYSE:GILD] in July.

Those transactions pushed aggregate volume for deals valued in the USD 1bn-to-USD 5bn band to USD 49bn, the second highest for that range on Mergermarket record, behind only 2020.

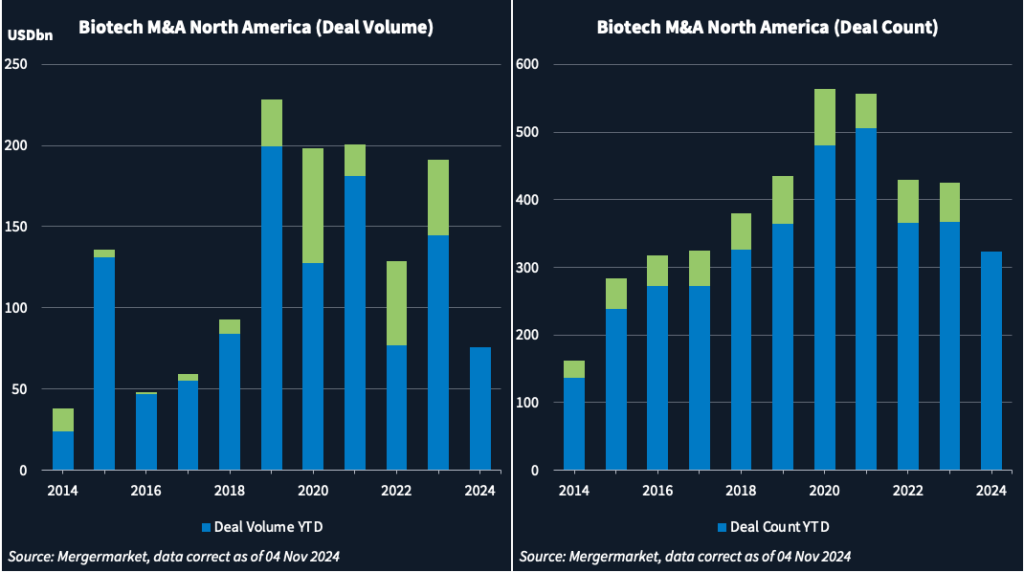

To further illustrate the biotech downturn, dealmaking volume overall has declined ever since peaking in 2019, while deal count has waned since reaching its zenith in 2020. (see charts below)

From affliction to recovery

During the irrational exuberance of 2019-2021, valuations inflated. Investors had to pull the trigger quickly, which pushed up prices higher and led to poor decisions.

Then came the Ukraine war and market uncertainty as interest rates soared and stock market valuations soured.

The XBI, the S&P Biotechnology Select Industry Index, sank from USD 166 in early 2021 to USD 62 by mid-2022. It then traded sideways until October 2023, before recovering to USD 100 on 4 November.

With interest rates starting to fall and today’s US election promising more political certainty, industry executives say we are entering a healthier dealmaking environment.

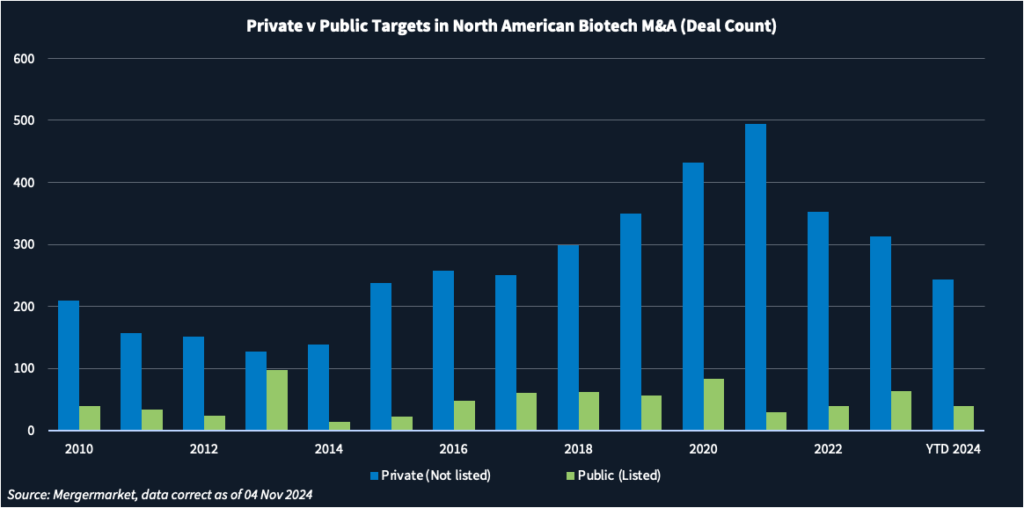

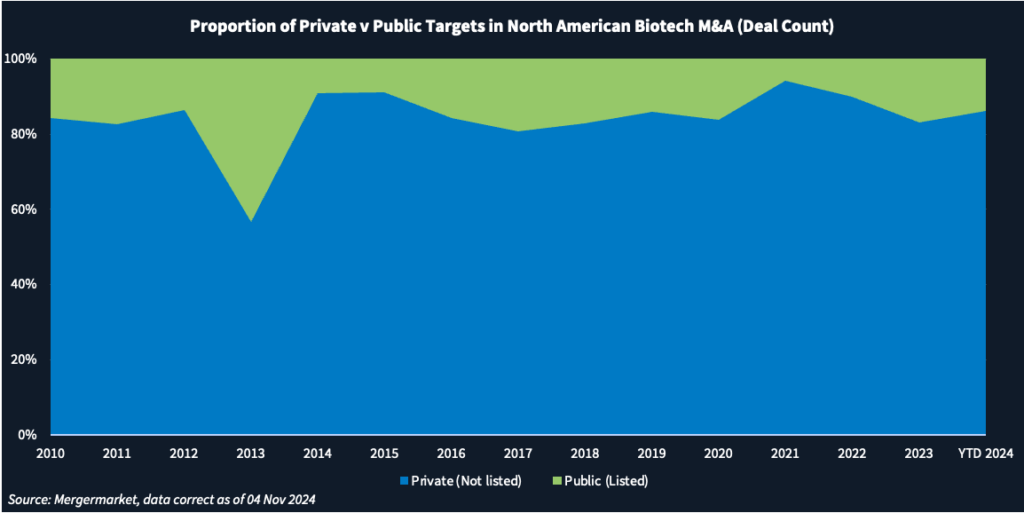

In 2021, a record 493 private companies were acquired compared with just 30 public companies, the lowest since 2015, according to Mergermarket data. Last year, 313 private companies and 64 public companies sold, the rise in public company M&A driven by much lower public company valuations. This year a bigger proportion of private companies have been targeted. (see next two charts)

‘An unbelievable innovation cycle’

Oncology, autoimmune and metabolic therapies are leading areas of investment. The use of artificial intelligence in designing new drugs also has attracted huge investment. A notable example of the latter is Xaira Therapeutics, a Seattle-based AI biotech startup still in stealth mode that landed USD 1bn in funding in April.

“We’re in an unbelievable innovation cycle in biotech,” said Srini Akkaraju, founder and managing general partner of Samsara BioCapital, at the Bio Investor Forum. “There are a lot of companies doing amazing things. That opportunity is better today than it was five years ago.”

Several biotech startups presenting at the Bio Investor Forum could become blockbuster takeout or IPO candidates over the next two years. Many are entering Phase 2 or 3 trials for their drug candidates and are currently fundraising. They include cancer therapy companies Rakuten Medical, Geneos Therapeutics and Pacylex Pharmaceuticals.

Inimmune, an immunotherapy and vaccine adjuvants company, is also raising USD 20m to fund an efficacy trial for a cancer therapy and could draw bids from vaccine makers for its more mature adjuvants business, said CEO Alan Joslyn.

Dermatology company Alphyn Biologics also anticipates an exit on the back of two Johnson & Johnson [NYSE:JNJ] acquisitions in May: its USD 850m acquisition of Proteologix and a USD 1.25bn deal for Numab Therapeutics’ investigational antibody NM26.

In biotech, beauty is being found in the smaller things.