Behavioral health set for 2025 revival – Dealspeak North America

- Autism services in demand, bringing high valuations

- Interventional psychiatric practices come into favor

- Shift from hospitals to outpatient, digital care models

The behavioral health sector is poised for a resurgence in M&A in 2025, with autism and intellectual and developmental disabilities (IDD) taking center stage, said industry sources.

Investors continue to be drawn to behavioral health due to a significant unmet demand for care, said Whit Knier, partner in the healthcare services division of investment bank Solomon Partners. Autism therapy, especially applied behavior analysis (ABA), is expected to see robust transaction activity, he added.

Demand for autism services is exceptionally high, the segment is entirely outpatient focused, and the market remains fragmented despite some consolidation over the last decade. Because of these strong fundamentals, autism platforms currently command the highest valuations within behavioral health, said Dan Beuerlein, managing director at Brentwood Capital Advisors (BCA).

Well-run autism assets can command multiples in the mid-to-high teens of EBITDA, with even small providers often seeing high valuations, said Nancy Weisling, senior behavioral health advisor at investment bank The Braff Group.

The IDD space should also see renewed activity, especially around home- and community-based services, the sources said.

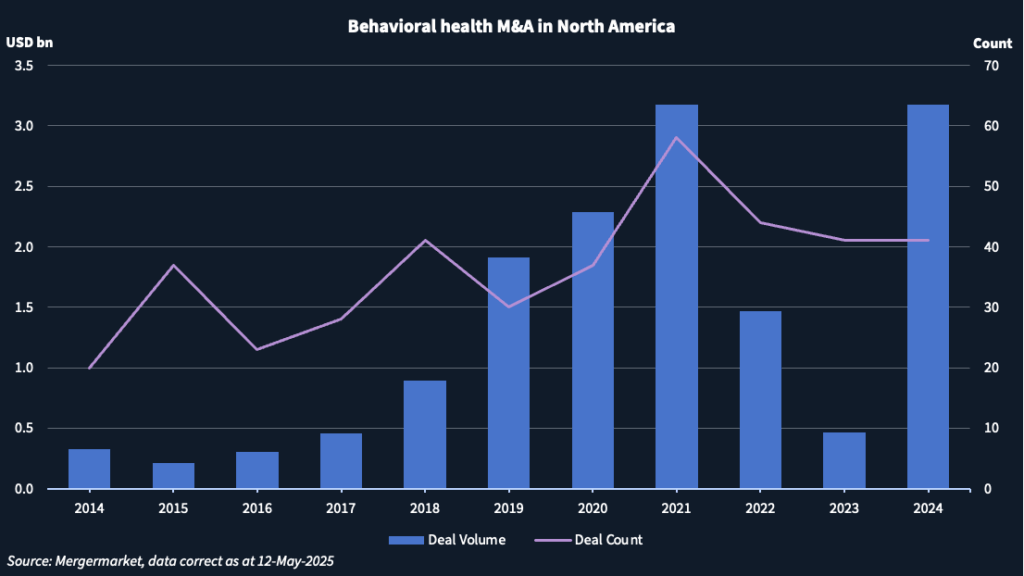

Besides autism and IDD, behavioral health also includes mental health, substance abuse disorder, at-risk youth, and eating disorders. According to Mergermarket data, most deals in behavioral health do not disclose their value, making transaction count the best indicator of M&A interest. Dealmaking in North America peaked at 58 transactions in 2021 but fell to 41 last year, flat with 2023.

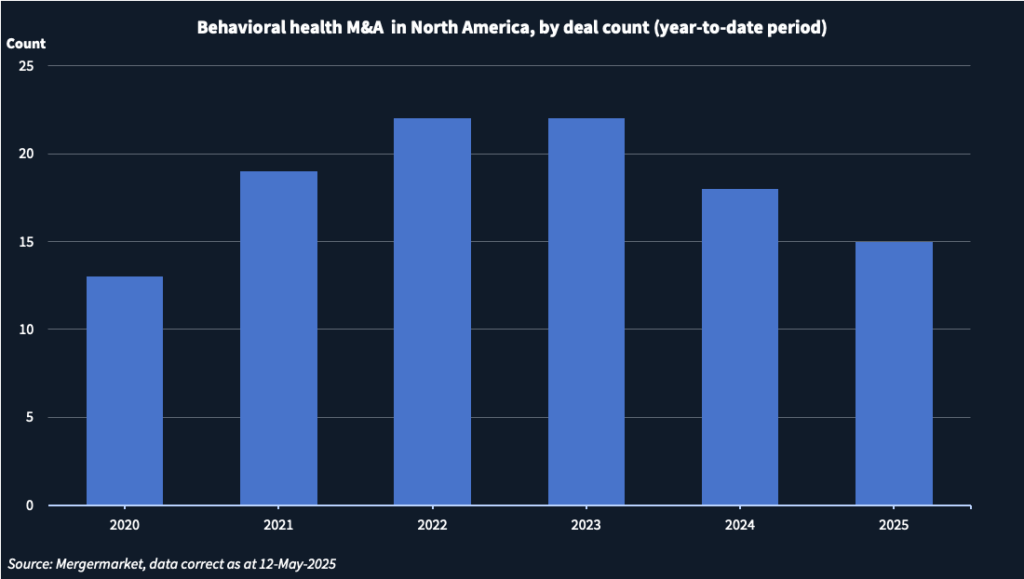

Year-to-date, 15 transactions have been recorded, marking the slowest start since 2020. However, with 11 deals announced in the first quarter of 2025, it was the best three-month period since the second quarter last year.

Shifting models

Behavioral health, like traditional healthcare, is shifting away from institutional settings such as hospitals toward models emphasizing partial hospitalization programs (PHP), intensive outpatient programs (IOP), traditional outpatient care, and digital care, said L.A. Galyon, managing director at BCA.

“We continue to like outpatient mental health, as do most of the private equity investors targeting behavioral health,” said Burk Lindsey, managing director at BCA. Volume growth is strong, and provider capabilities and services continue to expand.

Post-COVID, most buyers and investors are focused on mental health services, with interventional psychiatric practices (IPPs) coming into favor in the past year, particularly with private equity sponsors, several sources said. IPPs typically combine non-invasive procedures and technologies, such as transcranial magnetic stimulation (TMS) and ketamine, with traditional medication therapy to treat mental health conditions.

Because such practices require many billable hours to scale, buyers have struggled to find assets with more than USD 1m in EBITDA, Weisling said. When they do, they pay a premium. She recently saw one IPP practice with less than USD 10m in revenue trade for 2x revenue.

IPP practices often address the psychiatrist shortage, as they typically require only one psychiatrist for medication management, with nurse practitioners providing most other services, Weisling noted.

One-on-one talk therapy continues to see high demand, but “it’s tough to extract a lot of profitability” from traditional mental health services, Knier said. Consequently, some investors are looking to acquire or add-on higher-end lines of business such as IPPs, though they are typically reserved for patients needing escalated care, he added.

Adolescent care is another increasingly coveted add-on or standalone platform, noted Knier.

Facing challenges

While the overall fundamentals of behavioral health remain strong, certain sub-sectors face headwinds, including residential eating disorder treatment centers, which are losing market share to virtual providers. This shift has caused well-known platforms such as Discovery Behavioral Health, Monte Nido and Eating Recovery Center to scale back operations, the sources said.

“So many patients are young adolescent girls, and families do not want to ship them across the country to a residential setting if they have telehealth options,” Weisling said.

Medicaid funding uncertainty and market volatility may create near-term choppiness and cause investors to favor certain segments of the market, the sources said, although they remain bullish on overall market growth.

Some buyers tend to be selective in their desired service model, with center-based businesses usually topping the list, followed by school settings and in-home care, the sources said.

“Payers favor outpatient settings like PHP and IOP over residential programs due to their lower cost but similar outcomes,” Galyon noted.

For autism, most private equity buyers prefer practices with a high percentage commercial insurance, the sources said. Medicaid “has always been a reliable and steady payer” but “everything is up in up in air right now under the Trump administration,” Weisling added.

The ongoing shift to in-network models is a positive long-term development but presents short-term hurdles for capital raising and recapitalizations for companies with out-of-network exposure, according to Galyon. “Substance use disorder treatment continues to be costly, and payors are seeking to align with programs with high clinical efficacy,” he said.

With the eventual march toward value-based care, any behavioral health company with demonstrable clinical efficacy and outcomes will top investor and buyer wish lists, the sources said.