Battle for fiber: Fixed-line asset buys help stoke telecom M&A — Dealspeak North America

What began as a slightly improved market for North American telecommunications M&A in 1H24 has picked up steam in recent months, sending transaction volume to levels not seen in several years.

The surge has been led in part by substantial fiber deals. Verizon Communications’ [NYSE, NASDAQ: VZ] USD 20.3bn all-cash acquisition of fiber-optic internet provider Frontier Communications [NASDAQ:FYBR], announced on 5 September, marked the year’s largest transaction.

“There’s this whole convergence theme going on between the wireless guys wanting to be your fiber-to-the-home [internet] provider,” one sector advisor said.

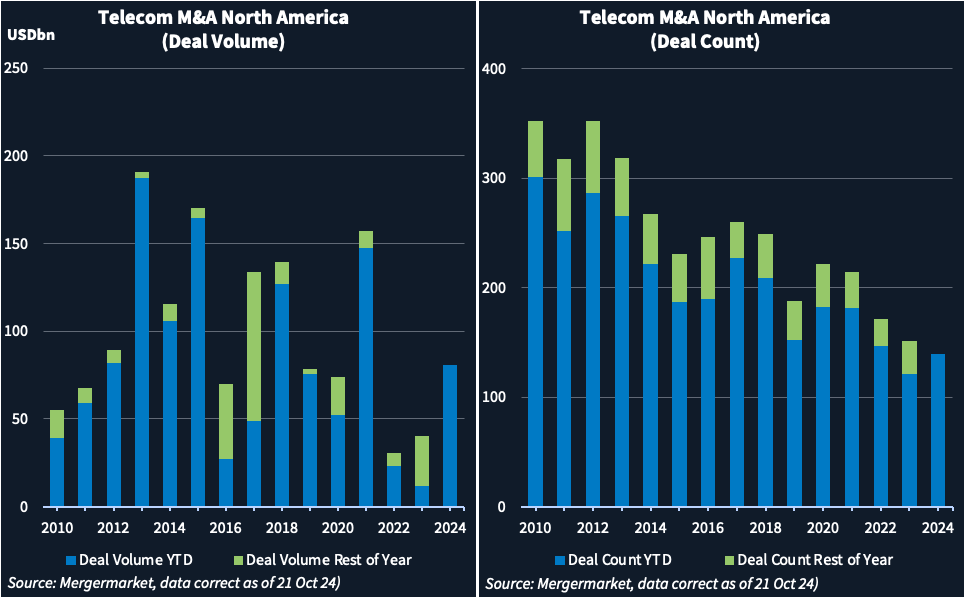

Volume for North American telecom deals announced year-to-date (21 October) reached USD 81bn, double the total for all of 2023 and the most at this stage of the year since 2021, according to Mergermarket data.

The USD 157.4bn in transactions tallied for all of 2021 was skewed upwards, however, by nearly USD 80bn worth of 5G spectrum sales by the Federal Communications Commission to several large mobile operators.

Deal count, which has trended down over the years, also has enjoyed a bounce. The 139 transactions thus far is 15% higher than at this point last year, although 2023 ended with the fewest deals in the sector since Mergermarket records began in 1995.

Fiber shopping spree

One catalyst for sector M&A involves a recent rush to snap up fiber assets.

Cellular service providers realize an up to 500-basis-point uplift to sales of premium broadband and wireless in markets where they also deliver fiber optic networks, according to sector advisors and market participants.

Some point to AT&T’s [NYSE:T] joint venture announced in December 2022 with Blackrock [NYSE:BLK] to operate commercial fiber platform Gigapower as one of the opening salvos that set the stage for this year’s activity.

In May, Windstream recombined with Uniti Group [NASDAQ:UNIT], the fiber network it had spun off a decade earlier.

T-Mobile [NASDAQ:TMUS] joined the shopping spree in recent months, investing USD 6.4bn via a pair of joint ventures to purchase and operate fiber companies Metronet and Lumos, in partnership with KKR [NYSE:KKR] and EQT, respectively.

AT&T’s fiber footprint now passes about 28 million locations, while T-Mobile’s ventures bring it closer to its goal of 10 million homes and businesses by the end of the decade.

Frontier’s announcement in February that it was in the midst of a strategic review came four months after JANA Partners called for the pure-play fiber firm to consider a sale, citing a strong market position and undervaluation.

Last month’s sale reflects a purchase price that benefited from the growing interest in fixed-line assets.

“They were smart not to do something a year and a half ago,” one sector advisor said. “There’s a lot more focus now on fiber.”

Beyond fiber

Fiber buys were not the whole story this year, however. A flurry of deals late in September helped to sustain momentum and point to the potential for continued strength into year-end.

On 23 September, Liberty Broadband disclosed it was in merger talks with Charter Communications – valuing Liberty at USD 18.2bn including debt – that would consolidate the telecom holdings of cable billionaire John Malone.

On 30 September, AT&T announced a deal to sell its 70% stake in DirecTV to private equity firm TPG for USD 3.64bn. Simultaneously, TPG also obtained the assets to EchoStar’s [NASDAQ:SATS] DISH DBS, for USD 1, plus net debt.

Who’s next

Still on the horizon is a sale of Alphabet-owned [NASDAQ:GOOG] GFiber, a process said to be in the final stages, this news service reported. That fiber optic network is available in 13 cities, across 11 states and reaches 4.1 million people.

Fiber-optic network operator FirstDigital Telecom was also working with Houlihan Lokey on a sale process late last month.

Also, Zayo – owned by DigitalBridge and EQT – is reportedly competing with TPG in the final stages of a process for the fiber and wireless assets of Crown Castle, which is said to be worth USD 8bn to USD 10bn.