Bank and insurance M&A sees momentum after 48% gain in 2024—North American Financial Services Trendspotter

- Wealth management, private credit attractive segments

- Overseas life insurers seeking US targets

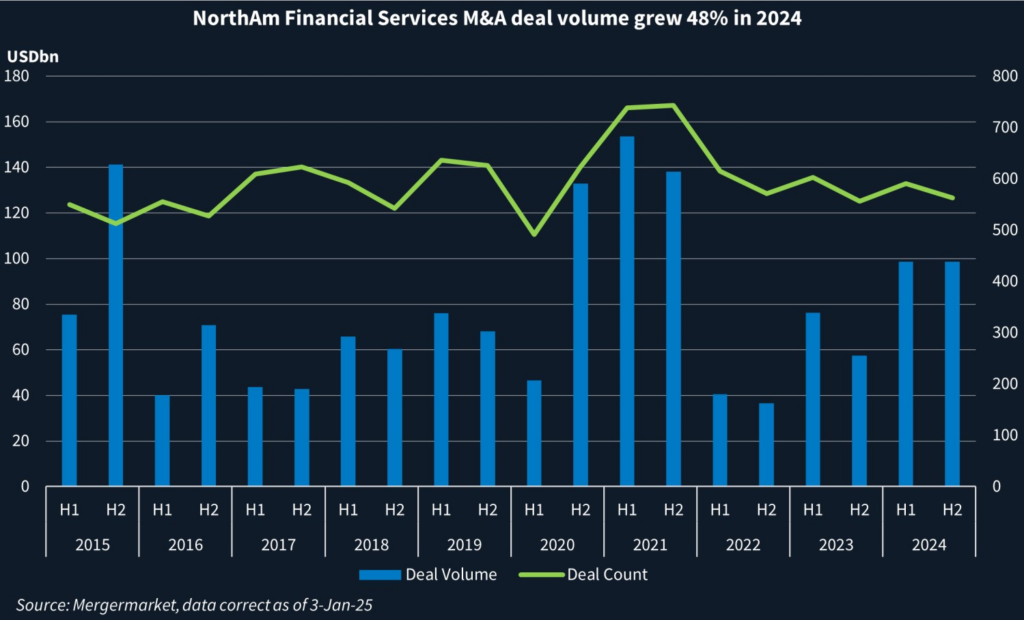

Financial services deal volume surged 48% in 2024 driven by elevated sponsor activity and the five largest individual transaction values announced since 2022, according to Mergermarket data.

The USD 197bn in deal value recorded last year was the third highest since 2015 and caps a steady recovery since the rise in interest rates that tanked M&A in 2022.

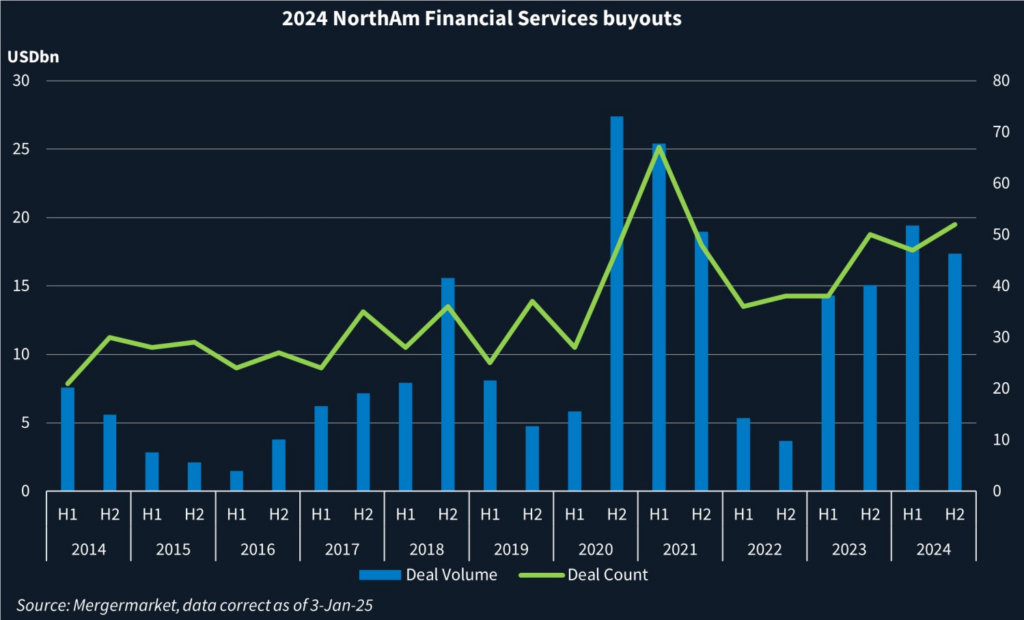

Sponsor buyout volume reached USD 36.8bn, the highest since 2021. The sector saw USD 23.9bn in exits, the largest number since 2010.

Advisors in the space see steady tailwinds in wealth management, insurance and private credit and favorable conditions developing for consumer finance.

Regulatory clarity

Market players expect Donald Trump’s return to the White House to foster a more accommodating dealmaking environment, said James Abbott, partner and co-head of the business transactions group at Seward & Kissel law firm.

“There’s an expectation that tax rates are going to stay favorable, and that deregulation is going to be a thing,” Abbott said. “Financial services are very regulated.”

Exemplifying the heightened regulatory scrutiny for large deals is Capital One’s [NYSE:COF] USD 35.31bn offer to buy Discover Financial [NYSE:DFS], which was announced in February 2024 and has still not cleared regulatory hurdles for completion.

Bradley Justus, a partner at Axinn, Veltrop & Harkrider, said in recent years, regulators have scrutinized potential overlap down to the bank branch level, lengthening times for deal closure and driving up M&A costs.

The incoming administration’s emphasis on government efficiency should tamp down the “unnecessarily long review process”, Justus said.

“Now you might still see aggressive [adverse] decisions, but I think that it’s more likely that they will get those aggressive decisions quicker,” he said.

Two of the four largest deals of the year were announced in December. Asset management goliath BlackRock [NYSE:BLK] agreed to purchase credit manager HPS Investment Partners for USD 14bn.

Private credit firms have seen their valuations swell as asset managers look to diversify their offerings, two deal advisers said.

Insurance

Arthur J. Gallagher’s [NYSE:AJG] USD 13.5bn agreement to buy AssuredPartners from GTCR Holder Rauner and Apax Partners was among the deals that pushed North American brokerage deal value to the largest in a generation at USD 40.52bn. Stone Point Capital’s USD 13.3bn transaction to acquire Truist Financial’s [NYSE:TFC] insurance business was close behind.

Khelan Dattani, managing director of Capstone Partners’ fintech and financial services deal advisory team, said insurance brokerage activity has been strong in risk-bearing insurance underwriting, annuities, specialty property & casualty and excess & surplus assets.

“We’re active in all these areas,” he said.

Life insurance carriers saw deal value double year over year to USD 14bn, bolstered by Nippon Life Insurance’s agreement to increase its stake in Resolution Life Group to full ownership in an USD 8.2bn transaction.

Meiji Yasuda Life Insurance added to the trend of Japanese carriers seeking growth in the US with its deal to buy StanCorp Financial Group from Allstate [NYSE:ALL] for USD 2bn.

Consumer finance and wealth management

Deal activity picked up toward the end of 2024 in mortgage and consumer finance as the Federal Reserve cut interest rates, Dattani said. Interest from investors is “definitely M&A oriented, but some of it could be growth financing as well”, he said.

Consumer credit firm Castlelake is rumored to be testing the market for a sale of Concora Credit at a USD 1bn valuation.

Wealth management activity could rebound from the malaise of the last two years, said Seward & Kissel’s Abbott. Some of the PE-backed consolidators who have become so big that it has become difficult to grow with rollups might turn to each other for consolidation, he said.

CI Financial [TSX:CIX], one of the largest wealth management players in North America, agreed to a take private by alternative asset manager Mubadala Capital for CAD 12.1bn, or USD 7.3bn.

Steward Partners, a large independent wealth manager with USD 38bn in assets under management (AUM), is said to be considering a sale. Cynosure Group and The Pritzker Organization hold minority positions in the company.

Shopping in the US

Other signals of potential deal activity come from outside North America. One of 2024’s largest dealmakers, Meiji Yasuda indicated that it has a particular interest in seeking more targets in the US.

Italian life insurer Generali [MTA:G] is said to be interested in acquiring asset managers in the US.

Among sponsor-backed companies, advisory firm Teneo is reported to be seeking out more investors in a deal that would value it at USD 2bn. CVC Capital has held a majority position in the firm since June 2019.

Hellman & Friedman and Altas are considering an IPO for consolidating insurance brokerage Hub International, this news service reported.