Aviation software deals take off – Dealspeak North America

- Deal volume and count hit highs

- Sponsors eye digital transformation

- Defense innovation provides another tailwind

Aviation software M&A is flying high, propelled by rising global defense demand and a broader digital overhaul of airline operations.

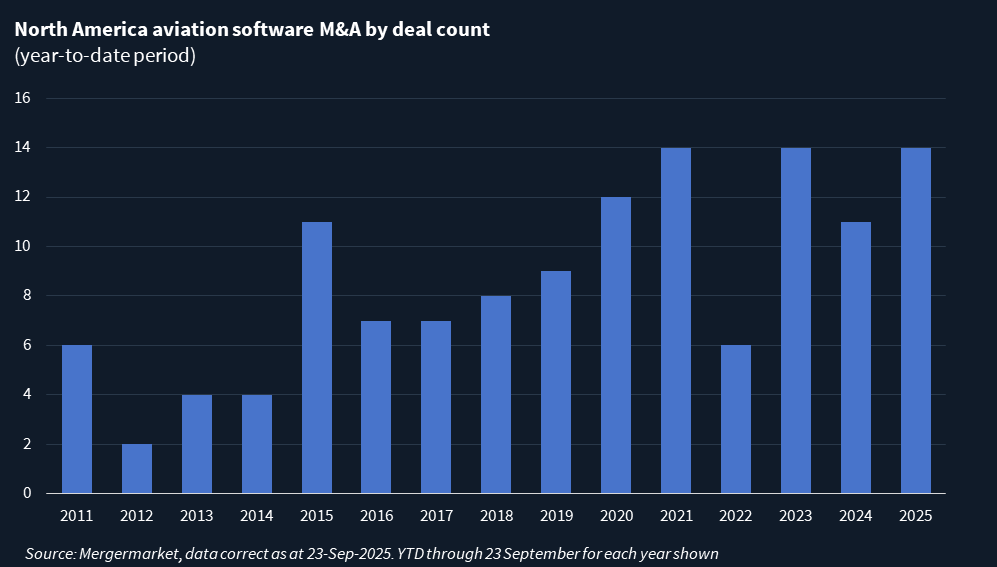

So far this year, 14 deals worth USD 12.6bn have been announced for North American targets, according to Mergermarket data. That is the joint-highest number of deals and the highest disclosed deal value at this point of the year on record.

The standout transaction: Thoma Bravo’s USD 10.55bn acquisition of Boeing’s digital aviation solutions unit in April, which multiple sponsors cited as a sector bellwether.

To be sure, Boeing was pushed to pursue that transaction – which included its high-margin Jeppesen navigation and flight planning software business – to retain its investment grade credit rating and streamline operations.

“The Jeppesen-Thoma Bravo deal captures everyone’s attention in our business,” said Rowan Taylor, founder and managing partner at Liberty Hall Capital Partners, which has made seven aviation software investments globally to date. Its latest, Paxia – whose software helps airlines cut catering spend, improve load planning, and reduce weight – marks the firm’s third platform in the space. Its others are Comply365 (2020) and Accurus Aerospace (2013).

Taylor said the deal underscores a long-term shift toward digitizing aviation workflows – a trend Liberty Hall began tracking seven years ago. “Airlines are trying to do more with less,” he said. “The emergence of AI and predictive analytics is accelerating that opportunity.”

Defense vector

Public listings and capital raises are also fueling momentum. On 14 August, Merlin Labs, an aviation software company that specializes in autonomous flight technology, announced a merger with special purpose acquisition company Bleichroeder Acquisition, which valued the company at USD 800m pre-money. Merlin, backed by Snowpoint and Baillie Gifford, develops aircraft-agnostic software for national security and civil certification.

Not strictly aviation software, but demonstrating the appetite for aviation technology was the USD 290m Series E on 15 September by Divergent Technologies, a software-defined 3D manufacturing company that is meeting growing US defense production needs.

The uptick in activity reflects a shift in US defense spending toward software solutions, said Garrett Smith, CEO of Reveal Technology, a startup whose flagship software product, Farsight, rapidly converts video from drones into 3D maps. Reveal recently closed a USD 30m Series B.

Smith noted rising interest from the US Defense Department in robotics platforms, electronic warfare, and edge-environment software.

Safety first

The product range for aviation software deals in the last year is vast, spanning safety, maintenance, compliance, and operations. Demand is being driven not only by defense needs but also by a post-COVID air travel rebound, aging infrastructure, and heightened awareness of aviation incidents and operational mishaps, said Rafael Telahun, managing director at Altaline Capital.

Altaline invested in Brazos Safety in July after four years of prospecting aviation-focused safety and compliance assets. Telahun said the firm plans to announce two additional aviation safety software deals, one in the US and one in the UK.

Another notable transaction: Insight Partners’ acquisition of Comply365. With the transaction, Comply365 simultaneously acquired Vistair. Former owner Liberty Hall rolled over meaningful equity via a single-asset continuation fund announced in October 2024. “This was a meaningful, middle-market scale acquisition,” Telahun said.

Financial sponsors remain bullish. More people are flying than ever before and airlines have the highest employment levels in their history, Taylor said. “An opportunity of that size and scale piques everybody’s interest.”