AVCJ Forum Explorer: Valuation correction puts shine on opportunities in APAC technology and healthcare – LTE VC Exit

Ahead of our 36th AVCJ Private Equity and Venture Forum to be held from 13-16 November, we analyze venture capital pipeline activity based on Mergermarket’s Likely to Exit (LTE) Venture Capital-backed predictive algorithm. Mergermarket’s LTE predictive analytics assign a score to venture capital-backed companies to help track and predict when an exit could occur through M&A, an IPO, a direct listing or a deSPAC transaction.

Opportunities in APAC’s technology and healthcare sectors are poised to share cent stage in Hong Kong at the 36th AVCJ Private Equity & Venture Forum on 13-16 November.

Certain segments of tech firms – those catering to large cap clientele – fared well and scored profitable exits for their investors, noted Pratip Mazumdar, Partner at technology-focused VC Inflexor Ventures. However, those with an SME focus have yet to recover from diminished valuations owing to tepid performance.

A challenging macro environment has made it difficult for companies — including start-ups — to raise funds. Companies with inflated valuations and high cash burn rates had to go through a down round, a senior executive at a cross-border financial advisory noted.

Newly minted unicorns have been steadily declining since 2Q22, with some losing their unicorn status, the executive said. Further, the effects of the Israel-Palestine conflict are yet to be seen in the funding ecosystem, he cautioned.

VC sponsors that can wait out the turbulent times will remain invested. Others that are reaching the end of a fund cycle will have to make a compromise with either lower-than-expected profits or even moderate losses, he noted.

Meanwhile, valuation correction presents great opportunity, notes Mazumdar who added that his venture firm has enough dry powder and is scouting for interesting opportunities in tech, now that the valuations have returned to earth. Inflexor Ventures predominantly invests in Indian companies or firms in Asia with an India angle, he said.

From a company standpoint, only firms with deep-pocketed sponsors or those that can turn a profit in the coming quarters will stay afloat. And these are the ones actively hoping to find favor with such VC-backed firms at attractive valuations that can translate into exits for sponsors, experts noted.

Also, investors are increasingly acknowledging the complexities of early-stage investments and are turning to collaborations with conventional growth and private equity funds, noted Nidhi Killawala, partner at the law firm of Khaitan & Co, who believes that 2024 could be a exceptional vintage for the VC industry.

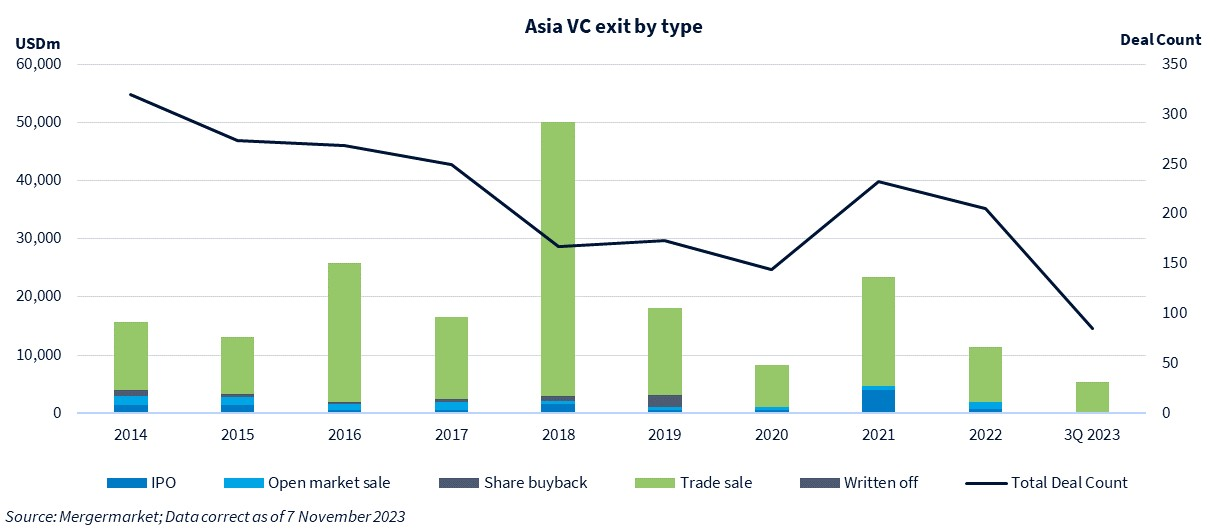

Out of the over-USD 5.3bn VC-exit deals across APAC in 2023 – trade sales comprised a major chunk with USD 5.1bn, with the remainder exiting via IPO or asset write-offs, per the data.

As market participants take stock of their exit pipelines in APAC, Mergermarket’s LTE VC-backed predictive algorithm presented ample exit opportunities in the technology and healthcare sectors. These scores factor in our proprietary intelligence as well as various data points to predict exit potential.

Source: Mergermarket

Insilico Medicine – LTE VC exit score of 58

Hong Kong and New York-based biotechnology firm Insilico Medicine, reportedly filed for a USD 200m IPO in Hong Kong in June this year, down from its previous USD 300m IPO plan in the US. It was valued at USD 895m in its July 2022 round where it raised USD 95m from Qiming Venture Partners, B Capital, Warburg Pincus, Saudi Aramco’s venture capital arm and Pavilion Capital. Its previous investors include WuXi, Sequoia Capital China, Hillhouse, Baidu Ventures and Lilly Asia Ventures.

BharatPE – LTE VC exit score of 51

BharatPE, India-based fintech platform was reportedly in talks for a USD 100m round in September this year at USD 2bn enterprise value, a USD 1bn discount as compared to its USD 3bn valuation in 2021. Separately, the company was also working with Citi to gauge investor interest in an IPO, Mergermarket reported. Backed by Peak XV (erstwhile Sequoia Capital), Tiger Global, Dragoneer Investor Group and Steadfast Capital among others; the investors are believed to be exploring a partial or total stake sale via the IPO.

Market Kurly – LTE VC exit score of 40

South Korea’s grocery delivery platform Market Kurly announced in May this year that it decided to postpone its flotation on Korea exchange KOSPI. Kurly, which raised USD 210m in a pre-IPO, round was valued at USD 3.3bn in December 2021. However, its current valuation is reportedly at USD 669m. Its investors include DST Global, Sequoia Capital China, Hillhouse Capital, Aspex Management and MiraeAsset Venture Investment among others.

Swiggy – LTE VC exit score of 41

Swiggy, an Indian grocery and food delivery platform, was in early-stage discussions to raise fresh equity via an internal round amid the company’s preparations for going public, per a local media report in May this year. Existing investors such as SoftBank, Prosus and Alpha Wave were in conversations to put in around USD 300m in a down round with Swiggy’s valuation possibly being slashed by 30% compared to around USD 10.7bn in 2022. The company has plans to list in India in 2024.

Impact Therapeutics – LTE VC exit score of 54

Biopharmaceutical company Impact Therapeutics switched its potential IPO venue from Hong Kong to Shanghai, Mergermarket reported in July this year. It is in talks with domestic private equity funds and state-owned funds for a pre-IPO round at a USD 414m valuation. In March 2022, it raised an undisclosed amount from Dingxin Capital, CCBT, C&D Emerging Capital, Bestride, Exome Asset Management led by Sam Isaly, along with existing shareholders Lilly Asia Ventures (LAV), China Summit, and Yuexiu.

Saluda Medical – LTE VC exit score of 38

Medical equipment maker Saluda Medical reportedly closed a USD 150m equity financing round this April, led by Wellington Management, along with Fidelity and new investor TPG. Existing investors Redmile Group and Action Potential Venture Capital (APVC) also participated. While APVC came onboard in 2017, Redmile Group funded Saluda in 2019.

Kyoto Fusioneering – LTE VC exit score of 31

Kyoto Fusioneering, Japan-based developer and manufacturer of components for nuclear fusion projects, is eyeing a Series D round in two to four years, Mergermarket reported in June this year. In May, it closed a USD 79m Series C round led by JIC Venture Growth Investments. Its other investors include Coral Capital, DBJ Capital, Electric Power Development (J-POWER), INPEX [TYO:1605], JAFCO Group [TYO:8595], JGC MIRAI Innovation Fund of JGC JAPAN, K4 Ventures GK of Kansai Electric Power [TYO:9503], Mitsubishi [TYO:8058], MUFG Bank, and SMBC Venture Capital.

Airwallex – LTE VC exit score of 36

Singapore-based payments platform Airwallex is building out its global payment infrastructure ahead of a potential IPO, Mergermarket reported this month. The firm’s investors include Tencent [HKG:0700], Sequoia Capital, Hillhouse, Gobi Capital, Lone Pine Capital, Square Peg, Salesforce Ventures and Mastercard. All options are on the table for future funding needs, including a potential Series F before an IPO.