AVCJ Forum Explorer: APAC hopes consumer and services exits will see region break free from dealmaking doldrums – LTE Sponsor exit

Ahead of our 36th AVCJ Private Equity & Venture Forum to be held between 13 and 16 November, we analyze private equity pipeline activity based on Mergermarket’s Likely to Exit (LTE) predictive algorithm. Mergermarket’s LTE predictive analytics assign a score to sponsor-backed companies to help track and predict a potential exit through M&A, an IPO, a direct listing or a deSPAC transaction.

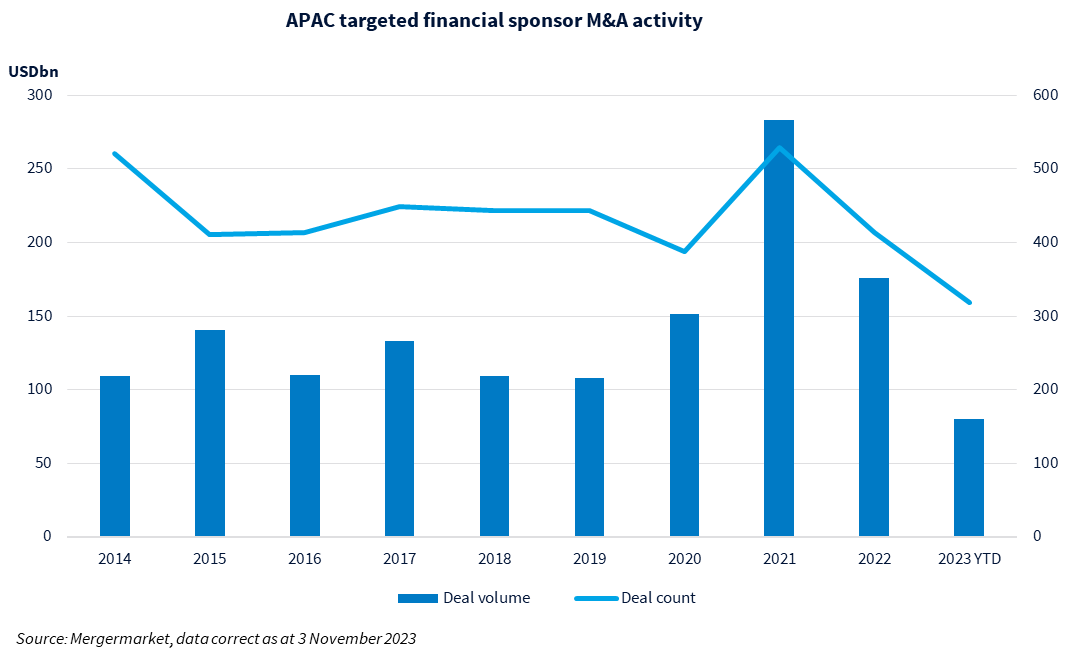

Dealmakers are pinning hopes for a recovery of sponsor-backed M&A activity next year after decade-low PE dealmaking in APAC, given the ample deal pipeline in the consumer and service sectors, dealmakers said.

Still, light at the end of the tunnel is being shed by big-ticket exit deals, including Bain Capital’s sale of its stake in Japanese human resources software developer Works Human Intelligence to Singapore’s GIC for JPY 350bn (USD 2.6bn) in 4Q23 and 2024, they added.

High USD interest rates and valuation gaps between vendors and bidders continue to constrain dealmaking to some extent. The US Federal Reserve held its benchmark interest rates steady at a 22-year high of 5.25%-5.5% last week.

Consumer and services contenders

Consumer deals are anticipated to play a pivotal role in M&A activity for 2024, with numerous assets coming to the market since 2H 2023, including Trustar Capital’s Hong Kong-based condiment maker Amoy Food, Navis Capital Partners’ New Zealand-based egg producer Mainland Poultry, Crescent Capital Partners’ Australian natural beauty products maker Nude by Nature, CVC Capital Partners’ Japanese street-fashion brand A Bathing Ape and Malaysian fast food franchise operator QSR Brands.

Consumer goods companies have proven to be resilient financial performers even during economic downturns, they explained.

There is also little doubt that services-related assets will deliver a bounty of opportunities in the coming year, the sources added. Quadrant Private Equity’s Australian childcare services provider Affinity Education, VIG Partners’ South Korean funeral services provider PreedLife, Partners Group’s Australian childcare services provider Guardian Childcare and Education are on the menu of next year’s potential deals.

“The services industry has long been favored by sponsors due to strong cash flow,” said an advisor. In addition, services-related assets offer stable growth potential as they often provide essential services that are in demand, making the businesses less susceptible to global headwinds, he elaborated.

As market participants take stock of their exit pipelines in APAC, Mergermarket’s LTE predictive algorithm presented ample exit opportunities in the consumer goods and business services sector. These scores factor in our proprietary intelligence as well as various data points to predict exit potential.

LTE Sponsor-backed Exit Watchlist

LTE Sponsor-backed Exit Watchlist

| Company Name | Financial Sponsor | Sector | Geography | LTE Score |

| Affinity Education Group Ltd | Quadrant Private Equity Pty Lt… | Business Services | Australia | 78 |

| Burger King Japan Co Ltd | Affinity Equity Partners (HK)… | Consumer & Retail | Japan | 77 |

| BKR Co Ltd | Affinity Equity Partners (HK)… | Consumer & Retail | South Korea | 76 |

| Geoyoung Corp | Blackstone | Healthcare | South Korea | 75 |

| Teg Pty Ltd | Silver Lake | Consumer & Retail | Australia | 74 |

| PreedLife Co Ltd | VIG Partners Co Ltd | Business Services | South Korea | 73 |

| Amoy Food Ltd | CITIC Capital Holdings Ltd | Consumer & Retail | Hong Kong (China) | 73 |

| Guardian Childcare & Education | Partners Group Holding AG | Business Services | Australia | 73 |

| Golfzon County Co Ltd | MBK Partners Ltd | Communications, Medi… | South Korea | 72 |

| Mainland Poultry Ltd | Navis Capital Partners | Consumer & Retail | New Zealand | 71 |

Source: Mergermarket, data correct as at 7 November 2023

Affinity Education – Business Services, LTE score of 78

The sale process of Australian childcare services provider Affinity Education has been suspended by its owner Quadrant Private Equity, the country’s buyout firm, until next year, as it preferred to wait for the Australian Competition and Consumer Commission’s (ACCC) final report on the domestic childcare services market, according to local media in October 2023. The sponsor has hired Barrenjoey and Jefferies as financial advisors. Buyout firms Affinity Equity Partners and Carlyle were identified as potential bidders. Affinity Education was acquired by Quadrant Private Equity from Australia’s Anchorage Capital Partners for AUD 650m (USD 417.5m) in 2021, as per local media reports.

Burger King Japan – Consumer & Retail, LTE score of 77

Burger King Japan owner Affinity Equity Partners was exploring the formation of a continuation fund for the Japan operation of the fast-food chain Burger King and other assets including South Korea’s Burger King operator BKR, as Mergermarket reported in June 2023. The Hong Kong-headquartered PE firm was reported to kickstart the sale process of Burger King Japan and BKR in early 2022 but eventually dropped the plan in the same year, per this news service’s reports. Japanese general trading company Sojitz [TYO:2768], South Korean fried chicken and restaurant franchise BHC, buyout firms CVC Capital Partners, KKR and Elevation Equity Partners had shown interest in the assets. Affinity Equity Partners acquired Burger King Japan from South Korean conglomerate Lotte at KRW 10bn (USD 7.6m) in 2019, according to local media reports.

BKR – Consumer & Retail, LTE score of 76

Hong Kong-headquartered Affinity Equity Partners was weighing a secondary transaction for its Burger King business in South Korea and Japan – BKR and Burger King Japan, together with other assets, Mergermarket stated in June 2023. The buyout firm originally planned to exit the assets via trade sale but switched to the formation of a continuation fund due to the cancellation of the auction, per this news service’s reports. BKR was sold to Affinity Equity Partners by South Korean VIG Partners for KRW 210bn (USD 159m) in 2016, according to Mergermarket’s coverage.

Geo-Young – Healthcare, LTE score of 75

Geo-Young backer Blackstone [NYSE:BX] had selected Morgan Stanley to arrange the potential sale of its stake in the South Korean pharmaceutical distributor, as reported by local media in July this year. An Asian drug distributor Zuellig Pharma was called out as a potential bidder, but denied the report soon after local media covered the matter last month. In 2019, Blackstone [NYSE:BX] acquired a total 69.1% stake in Geo-Young for KRW 1.1trn (USD 832.9m) from the country’s Anchor Equity Partners, according to a local report.

TEG – Consumer & Retail, LTE score of 74

Australian ticketing and entertainment company TEG owner Silver Lake engaged Goldman Sachs to explore dividend recapitalisation to expedite the deal as the sale process has been protracted, according to Mergermarket’s report in October 2023. The American sponsor hired Jefferies to sell TEG earlier this year, but negotiations stalled. The two main contenders are Blackstone and a KKR-Qantas consortium. TEG was sold to Silver Lake from Hong Kong’s Affinity Equity Partners at a valuation of AUD 1bn (USD 643.5m), local media reported.

PreedLife – Business Services, LTE score of 73

South Korean PE firm VIG Partners hired Bank of America as a financial advisor to sell PreedLife, a South Korean funeral services provider, as local media reported in September 2023. JPMorgan was reported as the financial advisor to the transaction in 2022. In 2020, VIG Partners acquired PreedLife for an undisclosed sum, local media reported.

Amoy Food – Consumer & Retail, LTE score of 73

Amoy Food owner Trustar Capital planned to kick off the Citi-advised sale process of Hong Kong-based condiments maker Amoy Food in September, as per Mergermarket’s report in July 2023. The Chinese PE firm acquired the entire stake in Amoy Food from Ajinomoto [TYO:2802], as announced in 2018. The sale was reported to fetch about USD 70m-80m, according to a newswire.

Guardian Childcare and Education – Business Services, LTE score of 73

Australian childcare operator Guardian Childcare and Education owner Partners Group were holding out for a higher price in the sale process, according to local media reports in September 2023. The company planned to buy Morgan Stanley Real Estate Investing (MSREI)’s Australian childcare asset Australian Childcare Projects (ACP) ahead of the launch of an expected sale process, as reported by Mergermarket in August. Partners Group hired Morgan Stanley to sell Guardian, and the investment bank was arranging stapled debt financing to back the planned exit, this news service revealed in February. Buyout firms Affinity Equity Partners and Carlyle were named among the potential bidders, per local media. Partners Group acquired a controlling stake in Guardian Childcare and Education from Malaysia-based PE firm Navis Capital Partners for an enterprise value of about AUD 440m (USD 283.5m), as announced.

Golfzon County – Communication, Media & Entertainment, LTE score of 72

MBK Partners, a South Korean buyout firm, was exploring an exit from the country’s golf resort business Golfzon County after it abandoned an IPO plan earlier this year, according to Mergermarket’s report in May 2023. Samsung Securities, NH Investment & Securities and Morgan Stanley were among the lead managers for the planned float. MBK invested in Golfzon County in 2018 and had rolled up the business through bolt-on acquisitions of local golf courses. MBK controls about a 70% stake in Golfzon County, while Golfzon Newdin [KOSDAQ:121440] owns the rest, local media reports noted.

Mainland Poultry – Consumer & Retail, LTE score of 71

Mainland Poultry, a New Zealand-based egg producer, has confirmed a sale process and the appointment of Luminis Partners, as reported by local media in September 2023. The Navis Capital Partners-owned company was reportedly being eyed by an Australian PE firm Pacific Equity Partners. In 2017, a 75% stake in Mainland Poultry was acquired by the Malaysian PE firm for around NZD 300m (USD 177.6m), while other shareholders include Guthrie’s Bay Trustees (14.2%), Murray Valentine (7.1%) and Jeff Winmill (3.2%), according to local media.

by Eva Ng, Jessica Wong and Wong Ka-chun, with analytics by Mimi Lee and Manu Rajput