ASIC looks at foreign practices as it enhances scrutiny of deal leaks to media

- ASIC will consult industry on any proposed changes

- Advisors supportive of enhanced monitoring

- Australian equity market relatively clean

Australia’s ASIC, which has publicly voiced concerns about deal leaks to media, is looking at practices in other jurisdictions as it is enhancing scrutiny in the Australian market, according to a spokesperson for the corporate watchdog.

ASIC Chairman Joe Longo recently opined in local media that the regulator would more closely monitor leaks of transaction information during fund raising, merger and takeover activities. “We have also commenced a targeted review of firms’ handling of confidential information in response to the apparent leaks to media outlets,” he noted. The regulator’s firmer stance has prompted talks of Australia potentially adopting the “put up or shut up” rule from the UK.

The regulator is not “at this point in time” actively considering changing existing settings but is “currently examining a wide range of practices in other jurisdictions to understand the regulatory framework in which they operate and their effectiveness in those jurisdictions”, the spokesperson said, adding what works in one jurisdiction may not work elsewhere.

“Any proposed changes to existing settings in Australia would involve conversations with industry as an initial step,” the spokesperson also noted.

Three M&A corporate communication advisors and an M&A lawyer told Mergermarket that they are supportive of ASIC taking deal leaks more seriously. All deal parties loath leaks as confidentiality is a critical discussion and commitment around their advisory engagement, they argued.

“As an adviser I hate leaks, which more often than not are deal killers not deal helpers. I like the deals that I have probably worked on for months to actually happen – both from a commercial perspective but also from a professional perspective,” said one of them.

A second advisor noted that deals have been lost as a result of leaks and “they (leaks) continue because there are no consequences.”

The lawyer suggested ASIC is dead serious about making an example of its concerns and the next leak is likely to be pursued vigorously. “I suspect leakers will heed in its warnings and lie low for a while.”

Leaks usually emanate from multiple sources that include advisors who missed a mandate, advisors/companies wanting to up the ante at sensitive stages of a deal, funders, sales teams, investors, disgruntled board members, investors, the advisors pointed out. The first advisor also said “maybe some high-profile ones that are actually outliers have skewed what is actually a pretty well behaved market.”

A leaked story is not a consequence of investigative journalism, but more planted information to influence a deal or score points, they agreed, adding that some practitioners who complain are also part of the “game”. There is a distinction between idle chatter that sometimes get reported and informed leaks that are typically accurate, as well as between breaking news from asking questions and reporting on planted leaks, they also agreed.

ASIC’s December Corporate Finance Update is clear that it expects advisors to listed entities to have “policies, procedures and appropriate controls to limit access to confidential information to only those who require it.”

Australia’s Takeover Panel is also looking into this matter, with Panel CEO Allan Bulman noting that they are in regular contact with ASIC around a range of issues.

Last year, the Australian Financial Review published confidential details of a Takeovers Panel review into a bid for document productivity company Nitro Software from bidders KKR owned Alludo and Potentia Capital, including who was leading it. The Panel complained about the “growing prevalence of apparent contraventions of the confidentiality and publicity restrictions.” It had seen instances of leaks to the media around potential transactions that have not been announced. The Panel said that it “is concerned to see the conduct eliminated” and that “steps will be taken where there is a breach.”

In an unprecedented move the Panel requested statutory declarations from participants in a takeover to confirm that neither they nor their directors, officers, employees, agents or advisors had disclosed confidential information.

In a recent report Rebecca Maslen-Stannage, chair of Herbert Smith Freehills observed that ASIC has upped the ante on enforcement, overtly signaling use of its notice and examination powers to identify leakers and enforce compliance. “ASIC has had enough of media reporting ahead of fundraising, merger and takeover activity, based on leaks,” she noted. “Broadly, entities must implement a formal leak policy outlining steps to prevent, monitor and react to any leaks of proposed transactions… ASIC enforcement processes are onerous, and best avoided by a wide berth. It’s a good time to take extra care to mitigate the risk of leaks.”

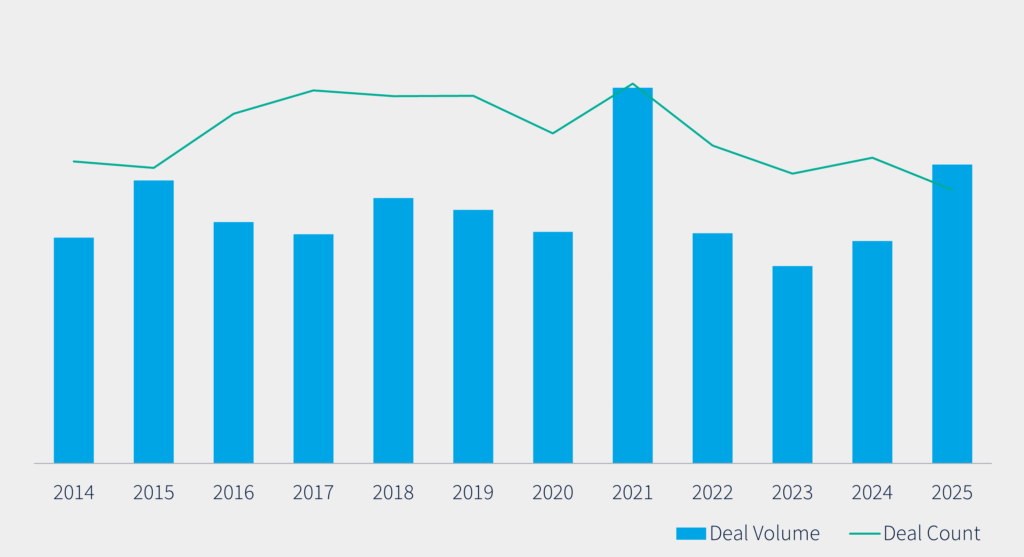

The ASIC spokesperson acknowledged that trading ahead of market price sensitive announcements is low in Australia compared to international peers, particularly ahead of M&A transactions. This incorporates trading that occurs ahead of announcements beyond just media leaks. “The practice of leaking is not new, and the motivations are no doubt varied, but where such a story is published in market hours it generally has an impact on that stock.”

In its equity market cleanliness report released last month, ASIC found in the last five years (to 30 April 2024) there were two periods of temporary deterioration in market cleanliness. The first was during the COVID-19 pandemic when global markets experienced high market volatility and trading. The second was in late 2023 as corporate activity increased. “Our regulatory interventions to address the deteriorations included targeting pump and dump activity, intervening on chat rooms, reviewing ‘finfluencer’ activity and undertaking targeted reviews where we observed leaks ahead of market announcements.”

In the 2024 financial year, ASIC almost doubled the number of new insider trading investigations commenced over the previous financial year.