Antofagasta could be in play as BHP’s GBP 39bn Anglo American pursuit ends – Morning Flash EUR

Our analysts pick out hints of future material developments in M&A and ECM situations to produce an exclusive report that offers short and long-term actionable ideas (no investment action should be taken without further investigation). If you have ideas for coverage, please email [email protected]

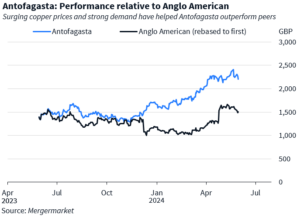

BHP’s [ASX:BHP] hopes of becoming the world’s biggest copper miner were dashed earlier this week when its negotiations with Anglo American [LON:AAL] ended without a deal.

But the failed GBP 39bn equity value transaction shone a spotlight on the broader copper mining sector and could open up dealmaking possibilities elsewhere.

Chile-based, London-listed Antofagasta [LON:ANTO] is one potential target for BHP or others looking to expand their exposure to the red metal, a commodity seen as a key ingredient in the world’s transition towards green energy.

The GBP 22bn market cap miner’s substantial copper operations, reasonable valuation and concentrated shareholding structure are among the factors which could position it as an attractive takeover candidate.

Antofagasta is one of the leading copper producers in the world. It owns four copper mines in Chile and produced a total of about 660,600 tonnes of the metal in the last year. That’s close to the production run-rate of Anglo American, which mined 826,200 tonnes of copper during the comparable period. Antofagasta is expected to improve copper production to between 670k and 710k tonnes in 2024, according to management guidance.

As well as a strong presence in Chile, Antofagasta has recently expanded into Peru. In December last year, it acquired a 19% stake in Compañía de Minas Buenaventura [NYSE:BVN], the country’s largest, publicly traded precious and base metals company. Buenaventura holds a 19.58% interest in Cerro Verde, one of the world’s largest copper mines, in a partnership with Freeport-McMorRan [NYSE:FCX] and Sumitomo [TYO:8053].

Antofagasta looks attractively priced for a deal. Currently, it trades at a 2024 EV/EBITDA multiple of 8x EBITDA, according to data provided by Fidessa* and compiled by FactSet. That’s at par with Freeport-McMorRan and a slight premium to mining conglomerates like Anglo American, BHP which trade at 6x forecasted EBITDA each, for the comparable period. Glencore [LON:GLEN] trades at 7x expected EBITDA.

A concentrated shareholding structure means any deal would require the blessing of the E. Abaroa Foundation, a vehicle of the Chilean Luksic family, which controls around 61% of the company’s ordinary shares. Jean-Paul Luksic, Antofagasta’s chairman, holds a separate 4.3% stake via the investment vehicle Aureberg Establishment.

While BHP has abandoned Anglo American for now, it has clearly signalled its ambition to increase exposure to future-facing commodities like copper. So, too, has Glencore when it saw cash and stock bids of up to CAD 35bn (USD 26bn) for Teck Resources [TSE:TECK] rejected by the target’s board last year.

That means there’s plenty of capital in search of high quality copper assets. Pure-play miners like Antofagasta could easily attract interest as a result.

*ION Analytics and Fidessa are ION Group companies