Americas IPOs Gone Cold: Canada Edition

IPOs Gone Cold is a series focusing on companies that planned to list but have gone into silent running. The table is divided into two sections: Called Off and Off Radar. All data has been gathered by triangulating Dealogic’s and Mergermarket’s proprietary and aggregated intelligence, pipelines and company information. In the future, these companies may either look to resume or adapt their listing plans, or explore alternative dealmaking avenues. This edition focuses on Canada.

While the market environment has been challenging for new listings in North America, Canadian stock exchanges are feeling the brunt of it.

There have been a mere 30 listings worth CAD 180.9m (USD 136.3m) so far in 2023, compared with CAD 1.7bn raised via 77 initial public offerings during the same period last year and USD 6.7bn in 86 listings in 2021.

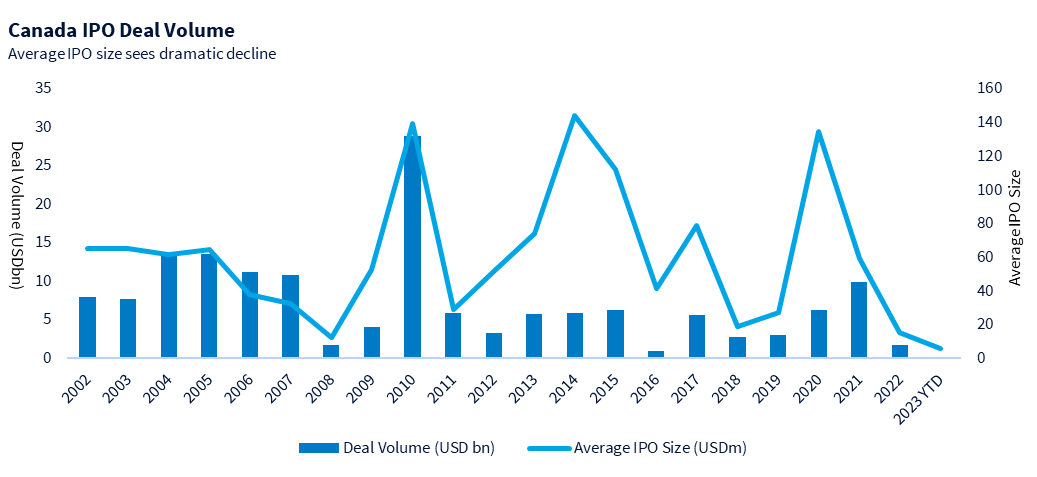

A more worrying sign, however, is the shrinking average deal size.

Among this year’s Canadian listings, Lithium Royalty’s [TSX:LIRC] CAD 150m was the biggest, followed by SolarBank’s [CNSX:SUNN] CAD 6m IPO. There were three more floats ranging between CAD 1.6m and CAD 1m, with the rest being under CAD 1m.

The average IPO deal size so far this year is CAD 5.9m – a far cry from CAD 59.4m in 2021 and nearly 23x lower than in 2020.

The last time Canadian stock exchanges saw a listing of more than CAD 1bn was in November 2021, when insurer Definity Financial [TSX:DFY] raised CAD 1.6bn at CAD 22 per share. The stock has steadily risen since, closing at CAD 34.20 per share on 10 July.

The largest-ever IPO on the Canadian exchanges came in 2010 during General Motors’ [NYSE:GM] USD 18.4bn dual listing. The automaker delisted from the Toronto Stock Exchange in August 2017 amid low trading volumes.

Another concern for Canadian stock exchanges is the heightened presence of activist funds.

There have been 35 activist campaigns launched in Canada since July 2022, when this year’s proxy season started. The campaigns represent only those that have been made public, which regularly represent only a third of all campaigns, according to Kingsdale Advisors.

Despite the decline in listings, some insiders see brighter days ahead.

Delilah Panio, vice president of US capital formation for the Toronto Stock Exchange and TSX Venture Exchange, said some early-stage companies based in the US view the Canadian exchanges as a gateway to the New York Stock Exchange and Nasdaq. Toronto offers a variety of structures and financing vehicles that allow start-ups access to capital.

“We are that incubator to get to the senior exchanges,” she said.

According to Dealogic, 20 more companies have filed or plan to list in Canada later this year.

| Company | Company Nationality | Prospective Exchange | Sector |

|---|---|---|---|

| Alida Inc. | Canada | Toronto Stock Exchange | Computers & Electronics |

| Anteros Metals Inc | Canada | Canadian National Stock Exchange | Mining |

| Coco Pool Corp | Canada | TSX Venture Exchange | Finance |

| Constellation Capital Corp | Canada | TSX Venture Exchange | Finance |

| eSentire, Inc. | Canada | Toronto Stock Exchange | Computers & Electronics |

| EVP CPC Inc | Canada | TSX Venture Exchange | Finance |

| Hopefield Ventures Two Inc | Canada | TSX Venture Exchange | Finance |

| Hybrid Power Solutions Inc | Canada | Canadian National Stock Exchange | Computers & Electronics |

| JFH Acquisition Corp | Canada | TSX Venture Exchange | Finance |

| McEwen Copper | Canada | Toronto Stock Exchange | Mining |

| Midori Group INC. | Canada | NASDAQ Stock Market & New York Stock Exchange | Services (other) |

| Newterra Resources Inc | Canada | Canadian National Stock Exchange | Mining |

| Oa Capital Corp | Canada | TSX Venture Exchange | Finance |

| Odessa Capital Ltd | Canada | TSX Venture Exchange | Finance |

| Prestwick Capital Corp Ltd | Canada | TSX Venture Exchange | Finance |

| Pulsar Helium Inc | Canada | TSX Venture Exchange | Oil & Gas |

| Questcorp Mining Inc | Canada | Canadian National Stock Exchange | Mining |

| Rektron Group Inc | Canada | Canadian National Stock Exchange | Finance |

| Rocket Gold Corp | Canada | Canadian National Stock Exchange | Mining |

| Space Kingdom Digital Capital Corp | Canada | TSX Venture Exchange | Finance |

| Stonecreek Capital Inc | Canada | TSX Venture Exchange | Finance |

| V Ten Capital Corp | Canada | TSX Venture Exchange | Finance |

Off Radar

This section includes companies that were in the early stages of planning a listing but have not updated their plans. Companies included in this list could have been at a very early preparatory stage – considering a listing; hiring an advisor; planning a dual-track review; or just appointing an advisor.

| Company | Country | Sector | Last Reported Listing Stage | Prospective Exchange |

|---|---|---|---|---|

| Hopper Inc. | Canada | Internet / e-commerce | Preparing for listing | Nasdaq Capital Market / Canadian Stock Exchange |

| Paystone Inc. | Canada | Services (other) | Preparing for listing | Toronto Stock Exchange |

| Shallow Reefs Gold | South Africa | Mining | Preparing for listing | Toronto Stock Exchange |

| Else Nutrition GH Ltd. | Canada | Consumer: Foods | Preparing for listing | New York Stock Exchange / Nasdaq Capital Market |

| Lithium Royalty Corp | Canada | Financial Services | Advisors appointed | Toronto Stock Exchange |

| Morgan Solar Inc. | Canada | Energy | Preparing for listing | NA |

| Nassential Ltd | United Kingdom | Agriculture | Looking for underwriter or legal advisor | Canadian Securities Exchange |

| AXES.ai | Canada | Computer software | Preparing for listing | Toronto Stock Exchange |

| Valsoft Corporation Inc. | Canada | Computer software | Preparing for listing | NA |

| Tess, Inc. | Canada | Computer software | Looking for underwriter or legal advisor | Nasdaq Stock Market |

| OneSoft Solutions | Canada | Computer software | Looking for underwriter or legal advisor | Nasdaq Stock Market |

| Potloc Inc. | Canada | Internet / e-commerce | Preparing for listing | Toronto Stock Exchange |

| Visier Inc. | Canada | Computer software | Preparing for listing | Nasdaq Stock Market / New York Stock Exchange |

| Andiamo Exploration Limited | Eritrea | Mining | Advisors appointed | Canadian Securities Exchange / Australian Stock Exchange |

| Teija Resources | Niger | Mining | Looking for pre-IPO funding | Canadian Securities Exchange |

| Lightspace Technologies, SIA | Latvia | Industrial: Electronics | Advisors appointed | TSX Venture Exchange |

| Nature's Vault | Canada | Financial Services | Preparing for listing | NA |

| Sharethrough, Inc. | Canada | Media | Listing application filed | NA |

Called Off

This section includes companies that had planned to list but have withdrawn their IPOs. The rationale for withdrawing the listing has been mentioned.

| Company | Country | Sector | Prospective Exchange | Withdrawal/Postponement reason |

|---|---|---|---|---|

| Article | Canada | Internet/e-commerce | NASDAQ | Market conditions |

| LEAA Health Technologies | Canada | Healthcare-Hospitals/Clinics | Canadian Stock Exchange | Market conditions |

| MCC Arifmetika | Russia | Financial Services | Toronto stock exchange | Market conditions |

| TouchBistro | Canada | Computer software | Toronto Stock Exchange | Market conditions |