All-in July IPO window rides bullish investment wave but selectivity returning – ECM Pulse North America

July has emerged as one of the busiest windows for US initial public offerings in recent memory, marked by a steady stream of deals hitting the market and performing well. Still, some investor selectivity is returning.

Several high-profile transactions have been priced to strong demand, attracting top-notch order books and robust participation from long-only investors.

“Many of the IPOs that have come out recently have produced alpha,” said Houlihan Lokey Managing Director Dan Klausner. “That’s real momentum.”

Klausner noted that average returns for many 2025 IPOs are already significantly outperforming the S&P 500, with some up 25% to 30%, and standout performers like CoreWeave and Circle posting gains of several hundred percent.

Still, despite strong execution, the latest pricings suggest the near-term aftermarket remains unpredictable. The true test lies beyond the order book.

NielsenIQ and McGraw Hill – two of the summer’s most closely watched sponsor-backed IPOs – both traded lower in their debuts this week. The mixed performance is injecting a measure of caution into an otherwise resurgent market.

NielsenIQ, backed by Advent International, generated significant long-only interest and was oversubscribed more than seven times, according to a source close to the deal.

The firm conducted a full testing-the-waters campaign and roadshow and was viewed by mutual funds as a long-term “category winner,” thanks to margin expansion and improving leverage. Yet shares slipped 3.6% on their first day.

Market observers attributed the decline more to hedge fund churn and capital rotation amid a busy deal pipeline than any fundamental weakness in the story. Advent declined to comment. NIQ did not respond to a request for comment.

McGraw Hill also had a tough day. Backed by Platinum Equity, the education publisher was positioned as a value play, with slower top-line growth but firmer valuation support. Its shares priced USD 2 below the low end of its initial range.

The company generated USD 2.1bn in revenue in FY2025, two-thirds of which came from digital products. Digital revenue has doubled over the past four years.

Though less buzzy than its growth-oriented peers, McGraw Hill was seen as a stable, cash-generating brand. McGraw Hill declined to comment. Platinum Equity did not respond to a request for comment.

Both IPOs were viewed as well-structured offerings but ultimately underscored that structure alone isn’t enough. Performance still depends on sector, positioning and timing.

Tech bonanza

Amid the surge in issuance, technology is leading the charge. Tedd Boehly-backed insurance technology firm Accelerant Holdings and its backers raised USD 724m in an upsized IPO priced above the marketed range.

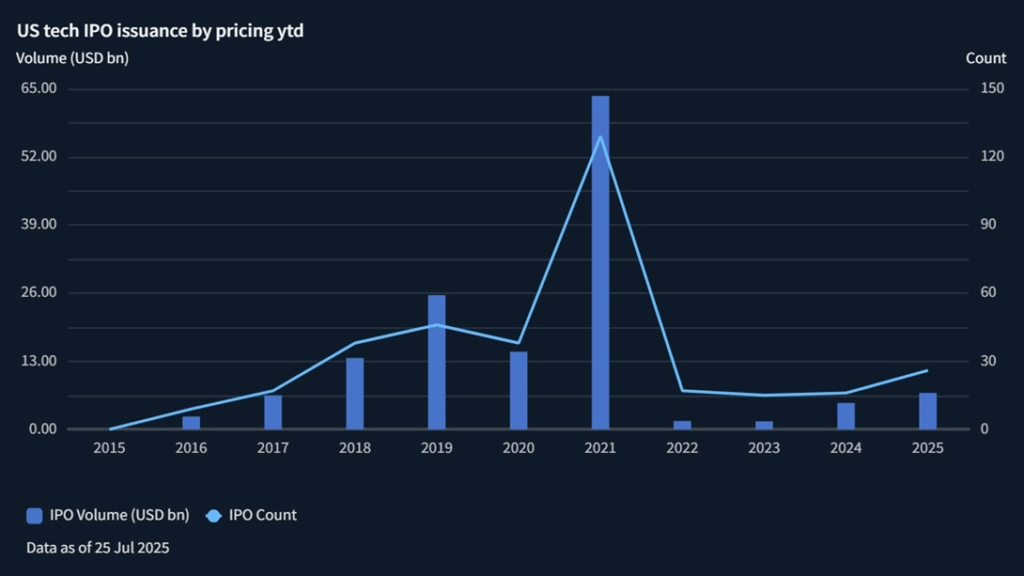

There has been eight US tech IPOs of above USD 100m YTD according to Dealogic data, with full-year projections possibly reaching 15 to 20 IPOs, according to an ECM advisor based in Silicon Valley. Total US tech listings so far this year have been worth USD 6.96bn; the figure is above full-year 2024 already, but still well below previous YTD totals before 2022.

Source: Dealogic

Encouraged by improving execution and institutional engagement, several issuers originally eyeing the first half of 2026 are now mulling 4Q25 listings, the advisor said.

Average tech IPO returns are tracking at 85% year-to-date, though that drops to about 30% when excluding Circle, this advisor noted.

Figma, expected to price next week, is targeting a USD 15bn to USD 16bn valuation – below the USD 20bn that Adobe offered in its failed 2022 acquisition, but a meaningful premium to its 2024 tender valuation.

Still, the market is watching closely to see how the deal performs, especially amid intensifying competition and rising expectations for AI-powered design tools.

While some outcomes have been mixed, the broader macro backdrop remains constructive for issuance.

With a 1 August tariffs announcement looming, corporate earnings have shown resilience despite ongoing international trade tensions.

The VIX hovers in the 15-16 range, equity indices are at record highs, and most participants expect interest rates to remain steady through the summer.

Policy tailwinds – including lighter regulation, a pro-business administration, and crypto-friendly signals – have added further momentum to names like Circle and Figma, the advisor added. More crypto-related issuers, such as Bullish, Gemini, BitGo, and Kraken are preparing to follow Circle into the public markets.

As Klausner put it, “It only takes one or two large IPOs to tip the scales.”

Despite the approach of August, companies are continuing to come forward and file for IPOs. But for now, it’s still investors setting the rules of engagement.