AI powers hope for increased utility & energy M&A – North American Natural Resources Trendspotter

- Sector deal value down 14% in 1H25 compared to 1H24

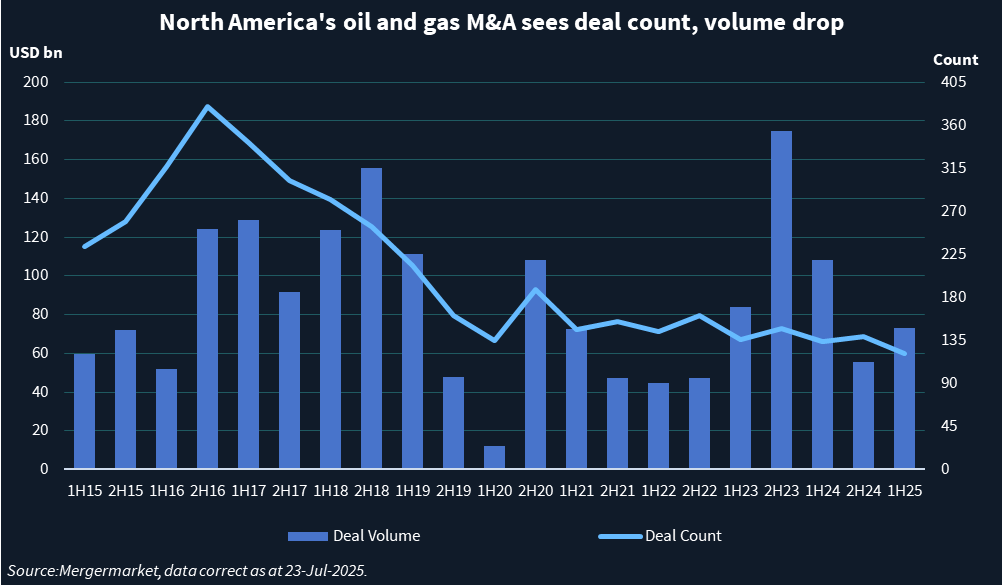

- Deal count lowest since 2H96

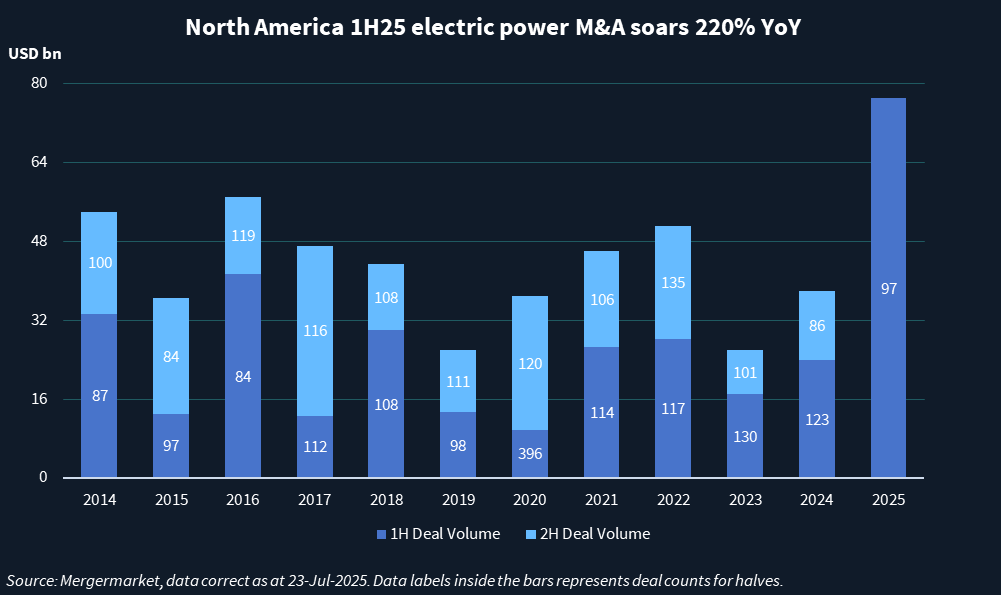

- Electric power deal value more than doubled

Skyrocketing energy demands from data centers has propelled a surge in electric power M&A, sparking hope in the subsector despite an overall drop in natural resources deals.

Artificial intelligence (AI), cloud computing, and digital infrastructure helped electric power deal volume more than double to USD 77bn in 1H25 from USD 23.8bn in 1H24. This made up for a notable decline in deal volumes in the oil and gas sector amid tariff and geopolitical uncertainty.

Overall, deal count in North America’s Natural Resources sector totaled 332 in 1H24, the lowest figure since 2H96, and deal volume dropped 14% from USD 206.7bn in 1H24 to USD 177.4bn in 1H25, according to Mergermarket data.

More power

The surge in dispatchable power demand in the last 18 months has driven private equity, independent power producers, and utilities to invest in operating gas plant portfolios to meet capacity needs.

“There’s potential investment here for those spearheading the data center movement,” said Morgan Hollins, a partner in White & Case’s Mergers & Acquisitions practice. “Hyperscalers may potentially invest capital into the power facilities that they are looking to site side by side to use that power. These companies have the capital, and the assets are a good revenue source for power companies.”

The two largest deals in the overall Natural Resources sector in the first half of the year involved electric power assets: Constellation Energy’s USD 29.4bn Calpine buy and NRG Energy’s USD 12.5bn pending acquisition of LS Power’s portfolio of natural gas generation facilities along with commercial and industrial virtual power plant platform CPower.

Gas and geothermal power have “less sensitivity” to margin fluctuations than renewables, Hollins said. “Margins and revenues on renewables are so small that the numbers are crucial,” she said, adding that renewables’ intolerance to profit margin fluctuations could set 2H25 up for a series of minority divestments to mitigate risk.

Renewable M&A volume totaled USD 11.2bn in 1H25, 20.8% more than the USD 9.3bn in 1H24 but a far cry from the USD 28.3bn in 1H22, according to Mergermarket data.

“[Investors] who have been holding a lot of renewables may be looking to share the risk without completely divesting their assets, selling down the portfolios to give other parties a share [in the risk],” Hollins said.

Justin Stolte, global chair of Latham & Watkins’ Energy & Infrastructure group, suggests that settling into the Big, Beautiful Bill, could result in a spike in renewables deals.

“[When] there’s more certainty on what the rules are … that will lead to an uptick in activity, whether it be on project development or project finance, or in the M&A space,” he said. “Having some certainty there will … eventually lead to more activity in the renewable space.”

Fringe renewables and clean fuels – like carbon capture sequestration, renewable natural gas, and other biofuels – are segmented perfectly for scale in 2H25, said Chris Rozzell, managing partner and co-founder at Cresta Fund Management. Companies with scale in renewable natural gas (RNG) have a current advantage, as cost-per-unit is crucial in the subsector, he added.

“The RNG space is still highly fragmented with many smaller players. That sets the stage for consolidation and platform building, and we expect to see transaction sizes scale meaningfully as the segment continues to mature and gain traction,” he said.

Buying spree over

The most recent M&A wave in the oil and gas sector appears to have come to an end. Deal value in 1H25 totaled USD 73.3bn, the lowest first-half value in the last 3 years, according to Mergermarket data.

Several M&A processes were pulled or put on hold amid uncertainty related to US tariffs policy and OPEC+ pumping more barrels.

As prices stabilize, however, sellers are evaluating relaunching those processes, said J.P. Hanson, managing director and global head of Houlihan Lokey’s Oil & Gas group. Something similar happened following the COVID-19 pandemic, when a big log jam broke, resulting in a wave of deals including ConocoPhillips/Concho Resources and Devon Energy/WPX Energy.

Natural gas assets are likely the first to hit the market amid a surge in demand for the fossil fuel driven by data centers and artificial intelligence, said Stephen Trauber, managing director, chairman, and global head of Energy & Clean Technology at Moelis.

ConocoPhillips is currently selling assets in the Mid-Continent region, which produces significant amounts of gas, Trauber said. GeoSouthern Energy is evaluating shedding assets in Haynesville Shale, and Chord Energy could sell in Marcellus Shale, he added.

Two other large gas producers that could also become targets are Aethon Energy Management’s Aethon United and First Reserve-backed Ascent Resources, Trauber added.

Japan’s Mitsubishi is reportedly in advanced talks to acquire Aethon’s assets for about USD 8bn. And this news service reported in March that First Reserve is working on a single asset CV for its stake in Ascent, with PJT Park Hill advising on the process.

Sponsor exits, which in 1H25 were led by the pending USD 5.6bn sale of CPP Investments-backed Encino Acquisition Partners to EOG Resources, are expected to continue in 2H25 with Kayne Anderson-backed Sabinal Energy and IKAV Capital Partners recently agreeing to sell assets to Mach Natural Resources for a combined USD 1.3bn.

“I think you’ll see the few sponsors that remain with meaningful positions at different basins look at whether it’s the right time to monetize,” said Latham’s Stolte.

Carnelian Energy Capital, for instance, might pursue an exit from Grit Oil & Gas, in which it initially invested in early 2017, said Houlihan’s Hanson.

This news service has also reported that Post Oak Energy-backed UpCurve Energy is evaluating strategic options, including a public listing.

Strategics, on the other hand, might be more reluctant to part ways with inventory as unconventional basins mature, said Stolte.

As a result, there might be more deals involving companies swapping assets, Moelis’ Trauber said.