AI adoption to force wave of software consolidation — Dealspeak North America

A wave of consolidation targeting software-as-a-service (SaaS) companies is expected in 2025 as the pace of adoption of artificial intelligence (AI) puts pressure on cloud-based business models.

Driving the wave will be Big Tech companies like Alphabet [NASDAQ:GOOG], Amazon [NASDAQ:AMZN], Microsoft [NASDAQ:MSFT] and Oracle [NYSE:ORCL], which are looking to layer service capabilities on top of their cloud computing infrastructure. Those struggling in the public market could also become take-private targets, amid a surge in the number of publicly listed software companies going private.

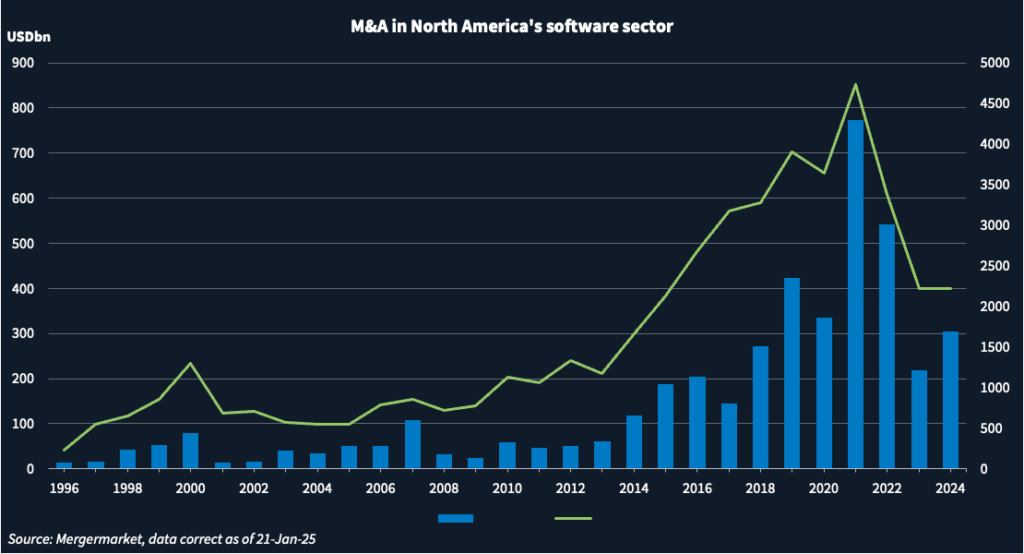

Software dealmaking volume peaked in 2021 at USD 773bn, followed by declines in 2022 and 2023. It then recovered in 2024, jumping 40% to USD 304.2bn, according to Mergermarket data. (see first chart)

“Strategic buyers are going to definitely feel more comfortable [doing] bigger deals” in 2025 due to a more favorable regulatory environment and strong stock performance, said Wayne Kawarabayashi, COO and head of M&A at tech-focused Union Square Advisors. Having prioritized internal realignment and cost-cutting in recent years, tech majors have shown improved organic growth and have healthy balance sheets. “They now have board support or even shareholder support to go do bigger things.”

Take-privates take off

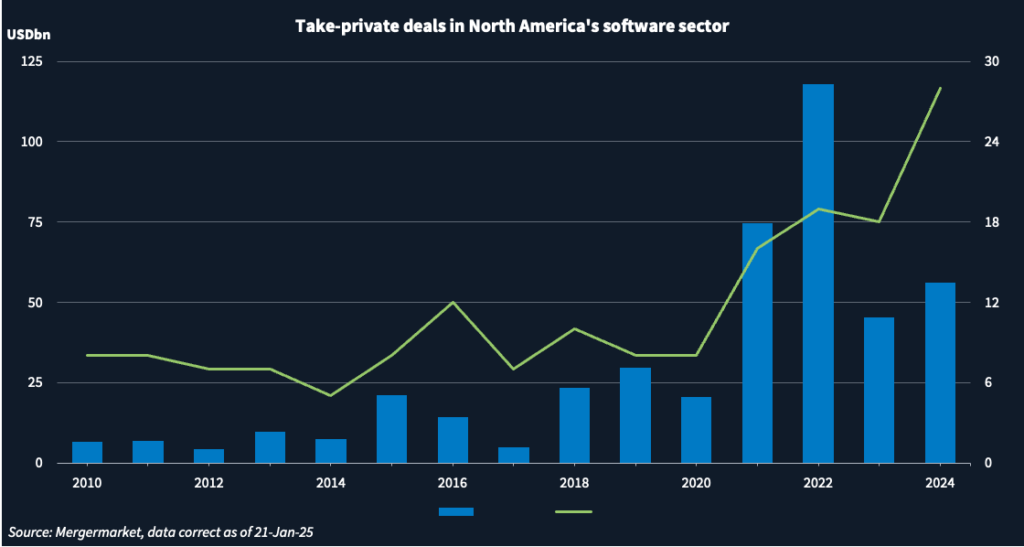

Take-private transactions in North America’s software sector hit a record 28 in 2024, up sharply from 18 in 2023 and 19 in 2022, according to Mergermarket (see next chart).

Meanwhile, take-private deal volume reached USD 56.2bn in 2024, up 24% compared to 2023 but down 52% from the all-time high of USD 117.9bn in 2022, the year Twitter went private for USD 41.3bn, along with Citrix Systems for USD 16.6bn, Zendesk (USD 10.4bn) and Anaplan (USD 10.3bn).

While the average size of a take-private deal was USD 2bn in 2024, significantly down from 2022’s average of USD 6.2bn, there are signs bigger deals are coming.

One is the pending USD 8.4bn buyout of Smartsheet [NYSE:SMAR] by Vista Equity Partners and Blackstone, announced last September.

Buyout firms are increasingly targeting small and mid-cap SaaS companies where growth is slowing, said a Silicon Valley fund manager.

Companies like Box [NYSE:BOX], Dropbox [NASDAQ:DBX], Informatica [NYSE:INFA], Twilio [NYSE:TWLO], UiPath [NYSE:PATH], and Amplitude [NASDAQ:AMPL] are all potential targets, he said.

All of those, except Informatica, are in the Bessemer Venture Partners’ Cloud Index and suffer from beaten down valuation multiples of between 3.4x and 4.2x enterprise value/ annualized revenue. SaaS companies in the index that saw valuations flourish during the pandemic – such as Zoom [NASDAQ:ZM] and Toast [NASDAQ:TOST] – also have similarly depressed multiples. The index average is 8x EV/ revenue.

Many worry that seat-based pricing models of many SaaS companies are under threat. AI might reduce the number of users subscribers need, thereby lowering income, said the fund manager. What is more, IT spend is slowing and being diverted to AI, while many customers suffer from “subscription fatigue,” added a sector advisor.

SaaS companies with market caps between USD 2bn and USD 10bn are ripe targets for financial sponsors, according to the fund manager. In addition to Blackstone and Vista, Thoma Bravo, Silver Lake and Francisco Partners have all been active buyers of SaaS companies, noted another advisor.

Going big

Big tech – including Microsoft, Amazon, Alphabet, and Oracle – will compete against private equity for those same assets but also could target larger companies with market caps of up to USD 20bn, said the fund manager.

Scott Devitt, an analyst at Wedbush Securities, thinks hyperscalers could go much bigger – targeting market caps of up to USD 50bn or even USD 100bn – especially under a more business-friendly, Republican-led administration.

They could now emulate Salesforce’s [NYSE:CRM] blockbuster acquisition playbook of a few years ago, he said. The software giant bought messaging application Slack for USD 28.1bn in 2020 and data visualization firm Tableau for USD 16.3bn in 2019.

Hyperscalers are likely to acquire growing software companies whose capabilities they can integrate into their cloud computing platforms, replacing in-house versions that fail to gain traction, he said. Software verticals they target could range from cybersecurity – where Zscaler [NASDAQ:ZS] is a potential target – to data consumption – where the likes of MongoDB [NASDAQ:MDB] or Datadog [NASDAQ:DDOG] are possible candidates, he said.

Even venture-backed SaaS companies could come into the frame, especially with the IPO market still mostly closed. Many such startups have struggled to raise capital – especially with investors focused on placing AI bets – and that could force them to sell, said Kawarabayashi.

Firms like Pendo are more likely to get sold than IPO, added the second advisor. AI-native SaaS startups are a different story – many of those grow at a much faster pace and should see big IPOs, he predicted. Wiz believed it was on such a pathway and consequently rebuffed Alphabet’s purported USD 23bn approach in July.

“There’s a respectable list of companies that are good high-quality names and their best ending may be to sell themselves,” said Devitt. “Now that it’s easier to buy, it creates quite an environment.”

by Mark Andress and Troy Hooper, with analytics by Izaz Ansari