1789 Capital targets breakout returns from late-stage US innovation – partner

1789 Capital, a politically connected growth equity firm, is actively deploying capital into a growing pipeline of late-stage technology companies with IPO potential across a variety of verticals, partner Paul Abrahimzadeh told this news service.

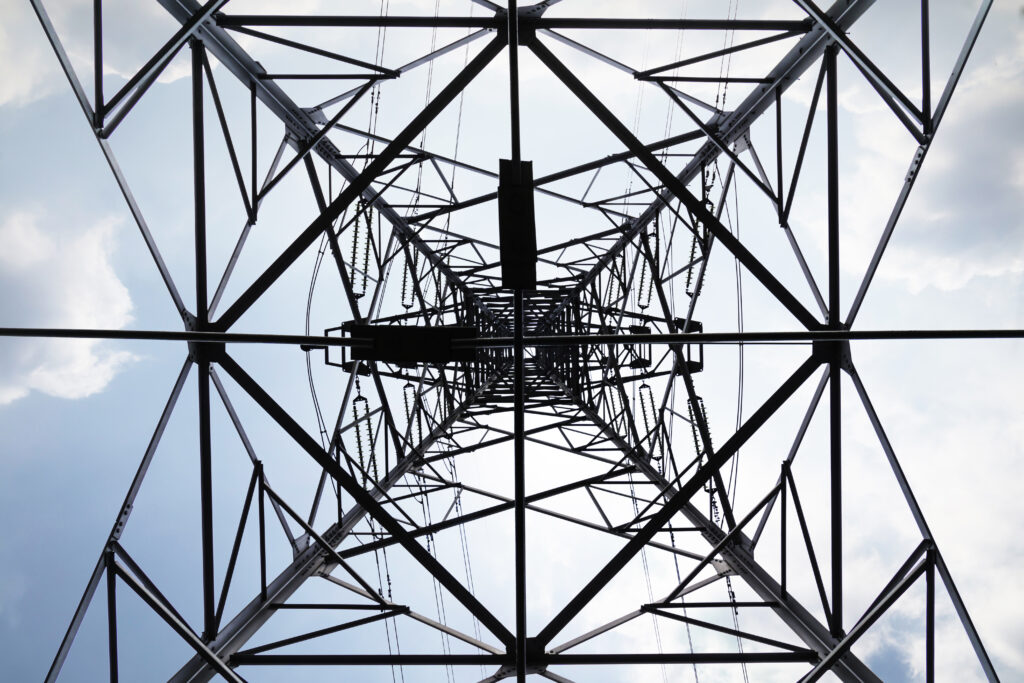

The firm is currently reviewing more than 20 targets across AI and software, defense-tech, fintech, space, and digital infrastructure and data centers. Target companies also span energy-related sectors including geothermal and nuclear, as well as rare earth minerals, he said.

Based in Palm Beach, Florida and counting Donald Trump Jr. as a partner since late 2024, 1789 Capital is targeting late-stage investments spanning Series C onwards.

The firm is deeply bullish on capital markets, Abrahimzadeh said, arguing that a new “super-cycle” in IPOs and M&A is underway, particularly in secular growth sectors like AI, software and defense-tech.

“The economy is strong, and capital markets are back in risk-on mode. Equity markets rebounded within weeks after shocks, and investors are returning to growth,” he said.

1789 Capital is targeting total returns of three to five times its invested capital over two to four years. To reach those goals, it targets companies with total addressable markets exceeding USD 10bn and minimum annualized revenue growth of 25% over multiple years, with many portfolio companies currently growing at 50% to over 100%, he said.

“The US has underperformed its G20 peers in terms of GDP growth since the financial crisis, but we’ve created more high-growth private companies than any other country,” Abrahimzadeh said. “If we double down on those, we think we can re-rate US growth.”

Established in 2022, 1789 Capital has previously invested in Elon Musk’s SpaceX and xAI. Earlier this year, it led a Series C round in Firehawk Aerospace, a Dallas-based company specializing in high-performance propulsion technology. The firm also participated in the June USD 2.5bn Series G round of Anduril, a producer of autonomous weapons and related defense software, led by Founders Fund.

Other investments include inference AI hardware and software company Groq, financial software platform Plaid, health-tech disruptor BlinkHealth, cryptocurrency-based prediction engine Polymarket, and creator economy platform Substack.

The firm expects to wrap fundraising for its debut fund by August, having recently secured an additional USD 200m commitment that brings total assets under management above the USD 1bn threshold. Deployment is now underway, and planning for Fund II is expected to begin in the second half of 2026. The Fund I portfolio already includes more than 20 investments.

Abrahimzadeh said there is a limited window to back these category leaders before they become public or are bought, adding, “and we want to own them right before they inflect.”

1789 Capital was founded by former Bank of America executive Omeed Malik and financier Christopher Buskirk.

Abrahimzadeh, who joined in February following a 24-year investment banking career, most recently as co-head of North America ECM at Citibank, is focused on origination, deal structuring, capital raising and strategic initiatives.

Donald Trump Jr. specializes in new investment origination, capital raising, and strategy, according to his firm bio.

The investment team is in New York this week for the public debut of online firearms seller GrabAGun, which listed via a merger with Colombier Acquisition Corp. II, a SPAC sponsored by Malik.