Green Arrow targets floating wind and solar strategy

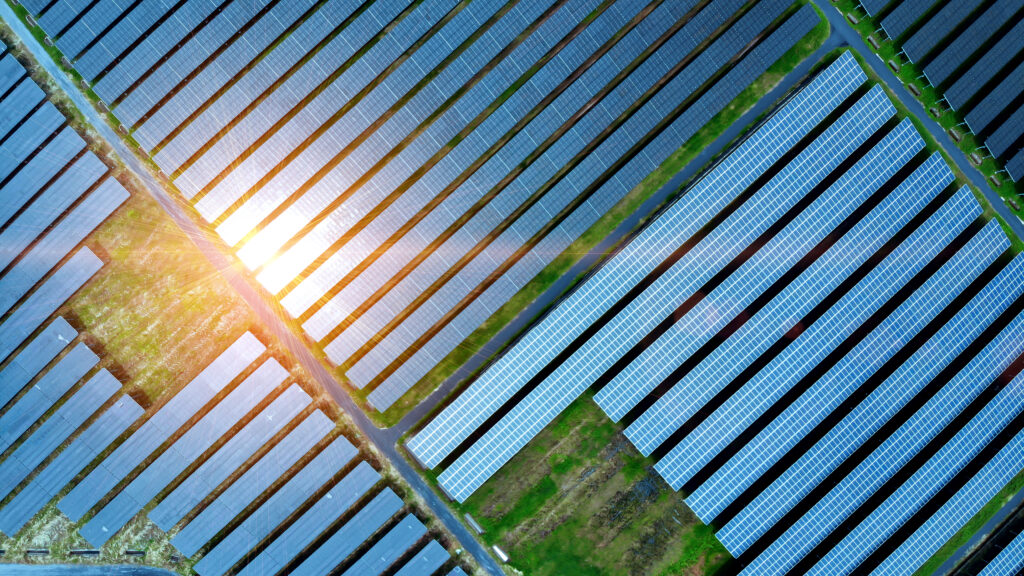

Green Arrow Capital has set its eyes on floating solar PV and floating offshore wind – two emerging energy transition segments that are starting to gain momentum in Italy.

It is doing so to differentiate itself from other managers, hoping to secure a “first mover” advantage, its co-founders Eugenio de Blasio and Daniele Camponeschi tell Infralogic.

De Blasio, who is also Green Arrow’s CEO, says the decision to bet on these new sectors alongside more traditional renewable technologies is at the core of the firm’s Green Arrow Infrastructure of the Future strategy.

“We have taken the GAIF mandate in its literal sense,” he says. “GAIF’s strategy focuses on four pillars – renewables, storage, EV charging and digital – but seeking to anticipate new market trends and emerging technologies rather than just focusing on existing ones.”

Floating solar PV technology, in particular, is still largely untested in Italy and Green Arrow intends to be among the first investors to develop it.

“We already have a pipeline of projects we are working on,” says Camponeschi, who is also CIO of the fund manager. “We are partnering with a small number of developers specialized in this segment and want to be first movers in this technology.”

Green Arrow has not disclosed the names of the developers it is working with, but Camponeschi says that its “partners hold a leadership position, having already developed projects that have been built across several countries”.

Green Arrow’s plan is to start by developing and building floating solar PV projects on inland water basins, which are easier than projects offshore, because they are less exposed to wind and waves. “We are already nearing clearance for a 20 MW project in southern Italy, which is part of a larger 100 MW portfolio,” says Camponeschi.

After finalising these deals, Green Arrow will also start considering projects on the sea.

It is a strategy that doesn’t come without challenges, but Green Arrow’s top managers believe that being early movers will eventually pay off.

Inland water floating PV projects in Italy will be able to bid for contracts for difference (CfDs) for the first time later this year, although it remains to be seen if prices will be attractive enough. Strike prices for projects above 1 MW have been set at EUR 75/MWh, below the EUR 78/MWh CfDs awarded to ground-mounted solar plants in Italy’s latest auction. Smaller projects below 1 MW can bid for higher tariffs up to EUR 90/MWh, while offshore solar tariffs are expected to be around EUR 105/MWh. Green Arrow declined to comment on whether tariffs on offer are attractive enough for floating solar.

Industry body AssoAero, which represents firms investing in Italy’s offshore renewable energy including Green Arrow, in a paper published in March called offshore floating solar as “one of the most promising technologies” in renewable energy, particularly in the Mediterranean Sea due to more favourable weather conditions than elsewhere.

The paper, however, also highlighted offshore floating solar’s challenges in Italy. They include higher construction and maintenance costs, potential environmental impact and regulatory and permitting issues, including “inadequate legal frameworks and slow permitting processes which can delay project development”.

Green Arrow also intends to combine floating solar technology with floating offshore wind.

The manager, jointly with other investors, is behind the planned Mediterranean Italian Offshore (MIO) scheme in the Gulf of Taranto in the Ionian Sea, a hybrid offshore wind and solar project with a 490 MW capacity. The project, which would require an EUR 1.5bn investment, is currently awaiting an environmental authorization from the Italian Ministry of Environment and Energy Security (MASE).

The project is behind a few others in terms of permitting – as four initial offshore wind projects with a 2.2 GW capacity have received or are about to receive its environmental clearance and are candidates to be the first such projects to be developed in Italy.

But MIO would be one of the country’s very first hybrid schemes, mixing offshore wind and floating solar PV. “Combining wind and solar energy maximizes power generation, enhances reliability, and optimizes the use of marine space through complementary resource patterns,” says de Blasio.

Betting on these new technologies is one of the ways in which Green Arrow plans to achieve GAIF’s target net returns, which are in the low double-digit range with 7-8% net annual target distributions, according to a GAIF teaser seen by Infralogic.

GAIF’s “first mover” approach has previously been tested elsewhere.

Green Arrow was among the first to invest Italy’s nascent biomethane sector, establishing a partnership with local developer Lazzari & Lucchini in 2020 to invest in a portfolio of biomethane plants.

Around three years later, the joint venture sold seven plants to Goldman Sachs Asset Management’s biogas platform Verdalia Bioenergy, which saw the deal as the first “stepping stone” towards its expansion in Italy. Camponeschi in a statement last year said the company was “extremely satisfied” with the deal, whose value was not disclosed.

The sale was the first early exit for GAIF, which has made around 30 investments and is expected to reach final close in June at its EUR 500m target.

Green Arrow is not done with biomethane. It has around 30 plants in the pipeline, including greenfield projects at various stages of development and construction, and existing biogas plants that will be converted to biomethane.

These investments have helped establish the manager as a key player in Italy’s renewables landscape. It now wants to grow further, with the aim of investing EUR 5bn in the next five years and reach a 2 GW of capacity across different renewable technologies.

The next test of whether LPs like the strategy is approaching fast, as Green Arrow is preparing to launch a larger follow-up fund, GAIF II, later this year, potentially with a EUR 1bn hard cap.