Dutch bank merger creates digital infra powerhouse

- NIBC’s digital infrastructure loan book is around EUR 2bn

- Deal increases ABN’s capabilities in booming digital infrastructure debt market

- ABN may review digital loan portfolio after merger

ABN Amro’s proposed acquisition of its peer NIBC is set to combine two of Europe’s top lending teams in the digital infrastructure sector, at a time of booming demand for debt in this market.

The deal, announced on Wednesday 12 November, will see Amsterdam-listed ABN buy its smaller rival from Blackstone for around EUR 960m.

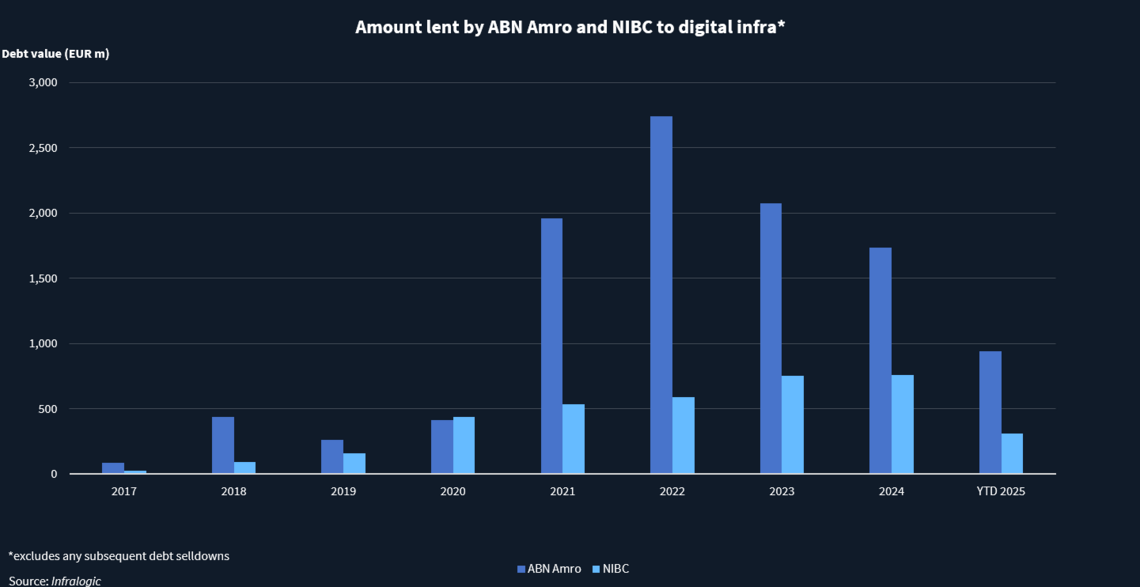

ABN ranked as the fifth-largest lender to European digital infrastructure assets over the past three years, according to Infralogic data, providing around EUR 4.8bn of debt to the sector since the beginning of 2023.

Over the same period, NIBC ranked 19th in the digital infrastructure lending table, punching well above its weight for a bank whose total assets are a mere 5% of ABN’s. It lent around EUR 1.8bn to telecoms infrastructure assets in Europe, more than banking behemoths such as HSBC or Barclays, Infralogic data shows.

NIBC’s pivot towards digital infrastructure took place roughly five years ago, around the time of Blackstone’s takeover, when the bank effectively stopped lending to sectors such as PPPs, energy and renewables, to focus fully on fibre, data centres and telecoms towers.

Today, NIBC’s digital infrastructure loan book is around EUR 2bn – representing a significant part of its total assets of around EUR 23bn and roughly half of its total corporate lending, according to the bank. ABN does not publicly disclose its infrastructure loan book.

Despite the relatively strong importance of NIBC’s digital infrastructure business, ABN executives have stressed their interest lies mostly in NIBC’s mortgage and savings business, and especially its “affluent retail clients”.

“The rationale of the deal is to gain access to [NIBC’s] wealthy individual clients for [ABN’s] private wealth banking business. The infrastructure portfolio seems to be a bit of an afterthought,” says an Amsterdam-based banker familiar with the two lenders.

Digital combination

Nevertheless, the addition of NIBC’s digital infrastructure team, which is led by Jan Willem van Roggen, is bound to have repercussions, if it’s combined with ABN’s infrastructure and project finance team, which is headed by Mick Borms.

The size of Europe’s digital infrastructure debt market has doubled in the past five years to around EUR 45bn, with demand for loans from data centre investors jumping sevenfold, and from fibre providers rising by nearly 80%, Infralogic data shows.

On paper, NIBC’s takeover should give ABN capabilities to do more deals in this booming market, although not necessarily a lot more balance sheet.

However, ABN may take a different approach compared to NIBC, particularly as sentiment in the fibre market has turned.

The two banks have been active lenders to fibre network providers across Europe, both backing Infracapital’s Gigaclear in the UK and EQT’s Deutsche Glasfaser in Germany, which have faced difficulties in raising new funding at attractive terms. The Dutch banks are also both lenders to Community Fibre in the UK.

NIBC has been particularly bullish in the UK, ranking as the country’s second-largest fibre lender with more than GBP 600m of debt provided over the past three years, according to Infralogic data. NIBC also backed altnets Glide, Netomnia and Voneus, while in the sector ABN has been a major lender to CityFibre.

The UK and German fibre sector are already out of favour with most banks, given widespread profitability issues, and it is doubtful that ABN will continue on NIBC’s path after a merger.

One infrastructure fund source says ABN is likely to review the combined digital loan portfolio after the acquisition, and may decide to sell down loans if its exposure to certain clients increases too much.

ABN and NIBC declined to comment.

One infrastructure debt advisor dismissed possible concerns that the ABN-NIBC merger would reduce liquidity in the digital sector, or even for fibre assets. The advisor pointed out that NIBC’s tickets are relatively small, and both banks rarely lend on the same deal.

According to Infralogic data, ABN Amro and NIBC have co-lent as MLAs on around 22 transactions to date, around 14% of their combined total.

Whereas NIBC’s tickets rarely surpass the EUR 100m mark, ABN regularly provides tickets in the multiple hundreds of millions, including EUR 567m in the refinancing of infrastructure fund-backed telecoms tower operator GD Towers this year.

ABN has already taken steps to manage its infrastructure portfolio and reduce some exposure. In January 2025, it sold a majority stake in a EUR 1.3bn portfolio of European infrastructure loans to Ares Management, which sources said included digital infrastructure loans.

Adding an extra EUR 2bn of loans from NIBC may prompt it to go to the market for more.

| Largest telecoms transactions financed by ABN Amro and NIBC | |||||||

| Transaction | Type | Country | Subsector | Investor/sponsor | Financial Close | Deal value (EUR m) | Total loan debt (EUR m) |

| Data4 Data Centres Sale (2023) | M&A | France | Data Centre | Brookfield Asset Management | 23/08/2023 | 3500 | 2175 |

| EdgeConneX Refinancing (2023) | Refinancing | Netherlands | Data Centre | EQT Infrastructure | 22/03/2023 | 2645 | 2645 |

| Deutsche Telekom Fibre Sale (GlasfaserPlus) (2022) | M&A | Germany | Fibre Optic | IFM Investors,Deutsche Telekom | 25/04/2022 | 2150 | 2150 |

| Eurofiber Refinancing (2022) | Refinancing | Netherlands | Fibre Optic | Antin Infrastructure Partners, PGGM | 29/06/2022 | 1500 | 1500 |

| Glaspoort B.V. Dutch Fibre JV | M&A | Netherlands | Fibre Optic | APG | 09/06/2021 | 1305 | 865 |

| euNetworks Refinancing (2024) | Refinancing | United Kingdom | Fibre Optic | Stonepeak | 19/06/2024 | 1260 | 1260 |

| Deutsche Glasfaser Debt Raise (2024) | Additional Financing | Germany | Fibre Optic | EQT Infrastructure, OMERS | 19/09/2024 | 1250 | 1250 |

| Glaspoort Debt Raise (2024) | Additional Financing | Netherlands | Fibre Optic | APG, KPN | 20/11/2024 | 1200 | 1200 |

| Gigaclear Debt Raise (2023) | Additional Financing | United Kingdom | Fibre Optic | Equitix, Infracapital | 15/12/2023 | 1163.3 | 1163.3 |

| Infrafibre Debt Raise (2022) | Additional Financing | Germany | Fibre Optic | Infracapital | 06/10/2022 | 895 | 895 |

| Source: Infralogic | |||||||