Diversification key for Macquarie’s APAC strategy

Multiple global shocks have reinforced the need to invest in a broad range of assets, Macquarie’s Asia chief tells Jessica Wong.

Macquarie sees diversification as the “main principle” for the Macquarie Asia-Pacific Infrastructure Fund (MAIF) series, Verena Lim, CEO of Macquarie Group Asia, told Infralogic.

“Whether it was COVID, high interest rates, and now the US tariffs – the biggest lesson we’ve learnt is the importance of ensuring proper diversification in our portfolio construction to offset macroeconomic instability,” she said.

“We still have to consider broader economic volatilities, but we…take a long-term view.”

Macquarie is currently fundraising for its fourth and largest MAIF vehicle, with a target of USD 5bn. Lim, who is also head of MAIF investments, declined to comment on fundraising.

Predecessor fund MAIF III (USD 4.2bn, vintage 2021) will not make any more new deployments, said Lim. Around 10% of MAIF III’s capital remains, reserved for working capital and bolt-ons.

Including co-investments, MAIF III deployed over USD 9bn in nine deals and wrote USD 900m-USD 1bn in average cheques, a source familiar said.

“We are very busy with our deal pipeline and don’t like to pause deploying between funds,” she said.

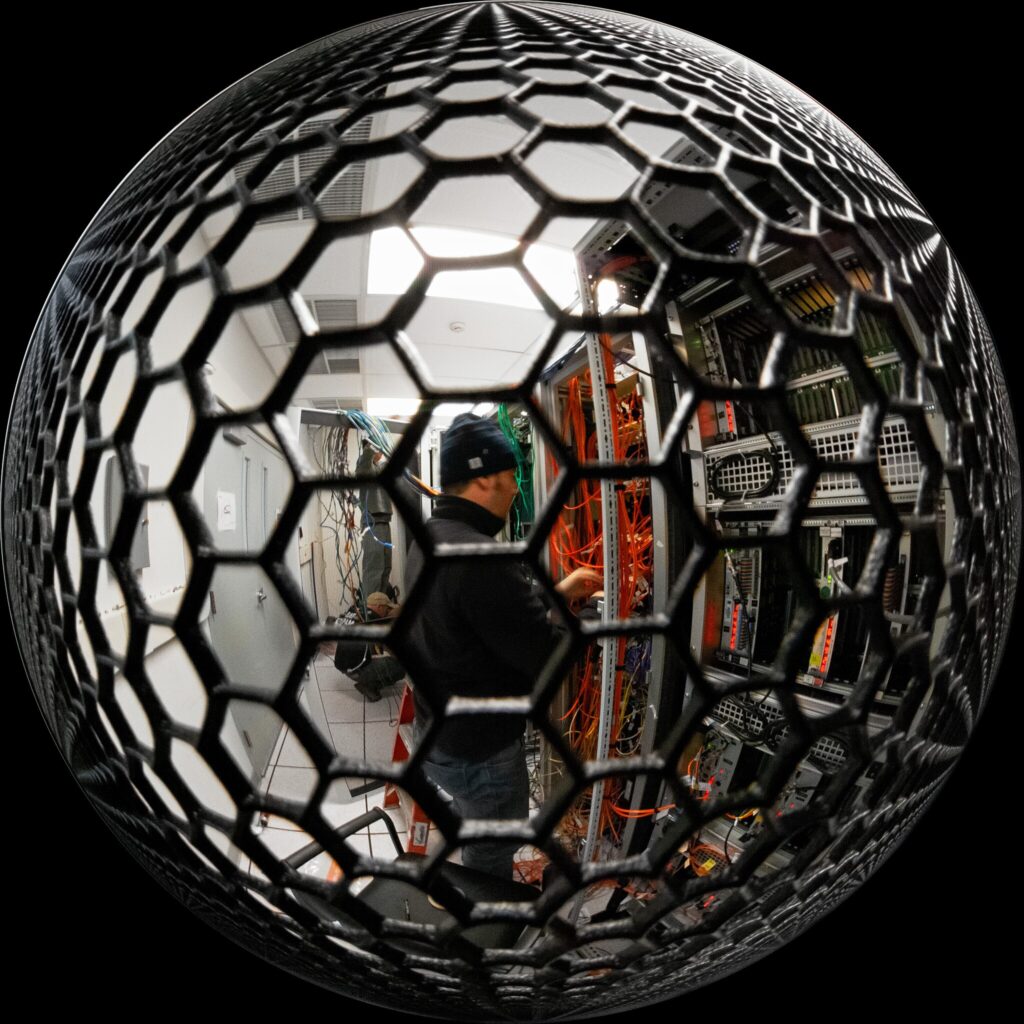

For the MAIF series, Macquarie sees opportunities in digital infrastructure, urbanisation, energy transition, and social infrastructure, said Lim.

Around half of MAIF’s capital goes to developed markets, including South Korea, Japan, Singapore, Australia and New Zealand, she said. The remainder goes to developing Asia such as the Philippines, Indonesia, India, and Greater China.

Within digital, Macquarie will consider deals in fibre, towers, and data centres in mature and maturing economies, she said. The COVID pandemic heightened the need for sustainable, quality digital infrastructure in emerging economies, said Lim.

In developed markets, there is also a need for digital transformation, she said. An example of this is Macquarie Asset Management’s partial acquisition of Japan-based Rakuten Mobile’s mobile network for up to USD 2bn with a consortium in August 2024.

For urbanisation, Macquarie will focus on toll road investments in India, as well as Southeast Asia, where there is strong GDP growth, Lim said. The manager holds a 681km portfolio of nine highways through India’s Andhra Pradesh and Gujarat, which could fetch up to USD 2bn in a potential exit.

On social infrastructure, Lim said there may be opportunities in “certain markets”, given ageing demographics and a rising middle-income population.

Ready for “more complex” Asian deals

The manager will look at more complex opportunities in Asia, such as take-privates, said Lim. “We are excited about Japan where there have been lots of changes in policy and the corporate mindset. We welcome these opportunities and won’t shy away from them,” she said.

Macquarie hopes to see more corporate carveouts in Asia as well, given its experience in buying non-core assets from local conglomerates in South Korea, she said.

“We are in a privileged position when it comes to sourcing opportunities. All transactions by MAIF III were sourced on a proprietary, bilateral basis,” said Lim.

Macquarie Asset Management employs close to 100 infrastructure professionals in Asia. Macquarie Group operates from offices in Australia, mainland China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Taiwan, and Thailand.

[Editor’s note: The last paragraph has been amended post-publication to clarify that Macquarie Group, not Macquarie Asset Management, operates from the listed offices.]