Cordiant upgrades Manhattan data center, considers US expansion

LSE-listed investor Cordiant Digital Infrastructure Management (Cordiant) last week announced an expansion of its 60 Hudson Street, Hudson Interxchange (Hudson IX) data center in New York City.

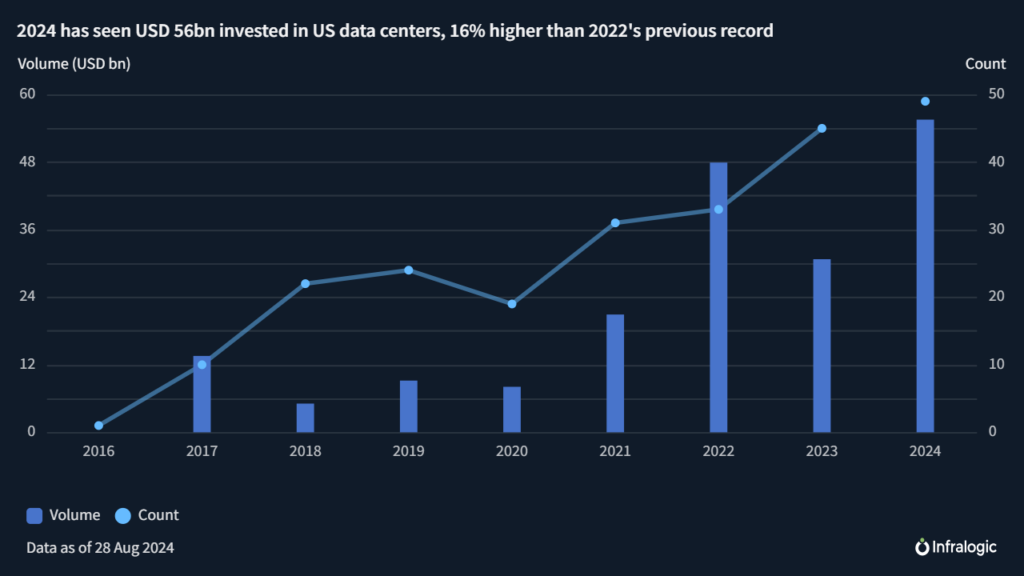

Cordiant is investing USD 15m of its own capital to construct two new data halls with 2 MW of capacity to expand the urban interconnect facility. The firm sees great potential within the broader US digital infrastructure landscape for organic and inorganic growth, Head of Telecoms Infrastructure and CEO of Hudson IX Atul Roy told Infralogic.

Montreal-based Cordiant Capital carried out an IPO for its digital infrastructure arm in February 2021.

Cordiant had a Net Asset Value of GBP 920.7m (USD 1.22bn), as of March 2024, according to its 2023 annual report. Its European holdings include České Radiokomunikace (CRA), a multi-asset digital infrastructure platform in the Czech Republic where Roy said Cordiant is building the country’s largest data center (24 MW); Emitel, an independent broadcasting and telecom infrastructure operator in Poland; Speed Fibre Group, an open access fiber infrastructure provider; and Norkring België, which operates 25 communication and broadcast towers in Belgium.

The digital infrastructure manager’s portfolio, which spans infrastructure assets across the towers, fiber, and data center sectors, acquired Hudson IX, then named Datagryd, from Fortress Investment Group in 2022 for USD 74m. Under Cordiant’s management, the facility has undergone a strategic shift from a wholesale model to a retail one, significantly accelerating customer acquisition and revenue growth, Roy said.

“In the short time since the acquisition, we’ve transformed Hudson Interxchange into a more commercially viable operation,” Roy said. “Our ability to provide interconnect services has attracted a new wave of customers, and the demand for more powerful computing solutions continues to rise.”

North American expansion

Hudson IX represents less than 5% of Cordiant’s overall portfolio, yet it plays a strategic role in the firm’s digital infrastructure strategy. The company is currently conducting due diligence on four additional assets in the US market, each larger than Hudson IX, as part of its ongoing expansion efforts, Roy said. These opportunities align with Cordiant’s focus on both organic and inorganic growth, with a particular emphasis on facilities that enhance its interconnection capabilities.

While Cordiant has not yet divested from any of its assets, Roy said that the firm’s US asset has attracted interest from investors, particularly pension funds with allocations to digital infrastructure. They have proposed joint ventures or co-investment opportunities, which could open new avenues for growth and expansion.

Roy also told Infralogic that Cordiant is approaching the first close on a GP/LP fund targeted at North America and Europe. He gave no further details.

The Hudson IX expansion project is emblematic of Cordiant’s broader strategy of “buy, build, grow,” a philosophy that has driven the firm’s investments across its digital infrastructure assets, Roy said. The Cordiant portfolio delivered GBP 142.1m in EBITDA for the fiscal year up to 31 March 2024, 10.2x when measured by enterprise value upon acquisition divided by portfolio companies’ EBITDA at acquisition, Roy said.

The company’s returns have outstripped initial mandates, delivering more than the listed company’s 9% target, and have supported a progressive dividend increase to GBP 0.042 per year, which at the current higher share price of GBP 79.15 is 5.3%.

Market demand drives expansion

With a permanent capital base and a focus on long-term value creation, Cordiant is well-positioned to capitalize on the growing demand for digital infrastructure, Roy said.

The planned expansion at 60 Hudson Street is driven by the increasing demand for high-density computing power.

The company has already started the construction of the two new data halls with 2 MW of capacity. The additional capacity will be used to support high-density compute infrastructure at the rack level enabling AI applications. Hudson IX has already secured Letters of Intent (LOIs) for 1 MW in the first new data hall, with expectations that the space will be filled quickly by both existing and new customers.

“Our clients are scaling their operations rapidly, requiring ever more powerful racks,” Roy explains. “The infrastructure at 60 Hudson Street, particularly its power capabilities, positions us uniquely to meet these evolving needs.”