Brookfield keen to build projects amid fewer M&As

Brookfield Asset Management aims to build more greenfield projects as acquisition options remain subdued, the investor’s APAC managing partner of renewable power and transition, Daniel Cheng told Infralogic.

“A lack of M&A deals doesn’t mean there’s a lack of opportunities or that the work stops,” he said.

“There are many ways to play the market, and the size and scale of our business allow us to find pockets to remain active throughout the cycle.”

Brookfield has more than 2 GW of operational wind projects in China as well as a 540 MW solar development platform. Its India portfolio totals about 42 GW of wind and solar assets, either operational or in development.

The Canada-based manager will focus on building renewables projects across the region for government and corporate customers, including hyperscalers, said Cheng.

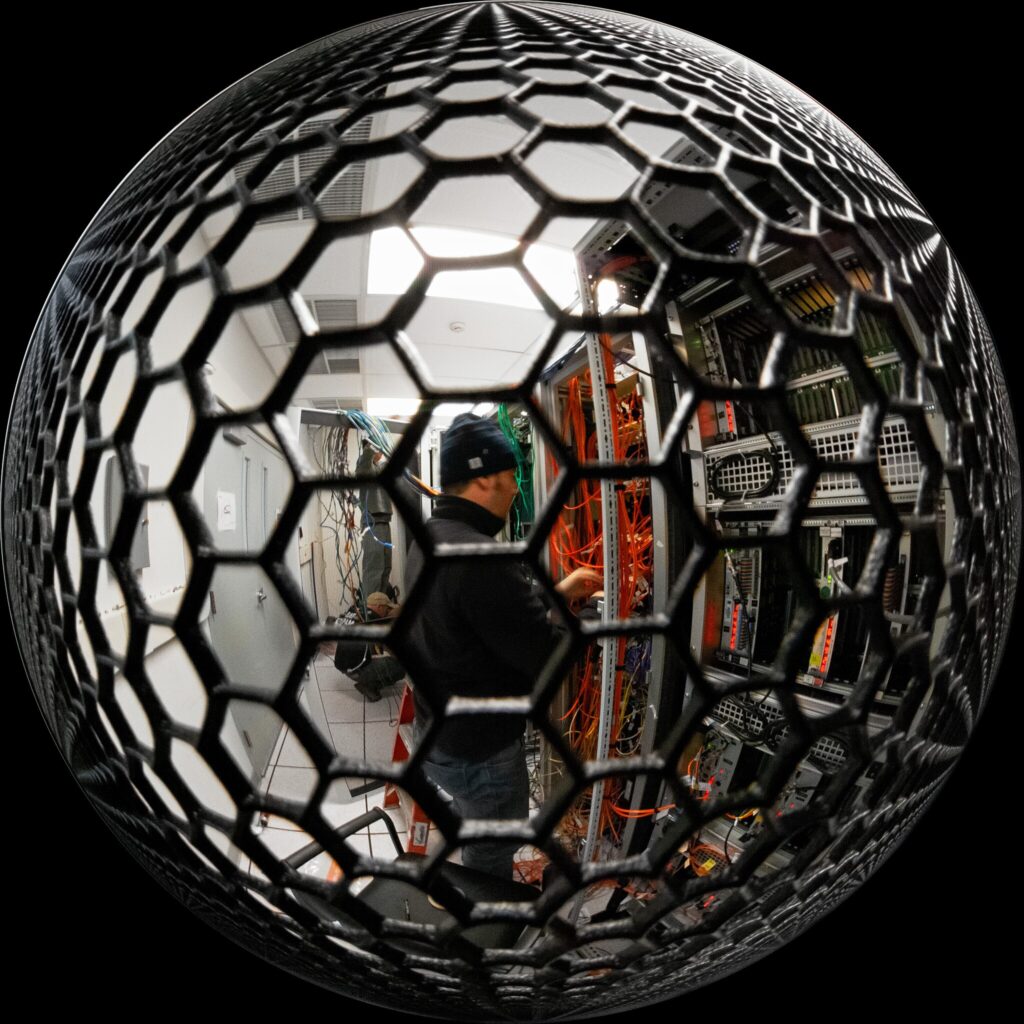

“We’re in active conversations with large corporate technology customers that have a presence in APAC, regarding their data centre and renewable power requirements,” he said.

Renewable energy has become the lowest-cost source of bulk power production, which has accelerated its demand, particularly from corporates, he said. Corporate customers require customised solutions and prefer using long-term partners, as opposed to multiple suppliers.

Japan has been moving to this model as its electricity demand increases, and Brookfield has held talks with corporates across industrials, trading houses, hyperscalers and technology firms there, Cheng said.

In addition to Japan, the manager sees “compelling” renewables opportunities in markets such as South Korea, Australia, and Vietnam, he said.

Other opportunities in energy transition include biofuels, battery storage, the electrification of transport, and green molecules, said Cheng. Industrial decarbonisation partnerships also provide a differentiated angle to invest in renewables in a more derisked way, he added.

On APAC’s renewables M&A, Brookfield expects the market to pick up in the latter part of 2025 and into 2026 – particularly for wind and solar – on the back of improving policy visibility, he said.

Fewer deals were launched in the first half this year – 56 potential transactions – compared with 86 a year earlier, according to Infralogic data.

Global Infrastructure Partners’ Vena Energy has been on the hunt for fresh equity while Pacifico Energy’s Japan sale has seen a choppy, stop-and-start process. Singapore’s Equis is currently in the market for a new backer.

“In any case, we invest for the long term and through cycles,” said Cheng, adding that “many of the best investments we’ve made, happened in times of uncertainty.”

Brookfield counts India’s Leap Green and South Korea’s Hanmaeum Energy among its renewables investments in the region. It is currently fundraising for its second Global Transition Fund and the emerging markets-focused Catalytic Transition Fund.