Under pressure: leveraged loan defaults are spiking | DebtDynamics North America

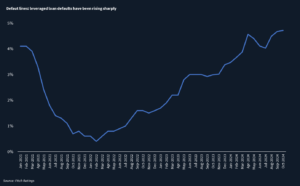

Annual loan defaults are soaring, with this year’s rate of 4.7% surpassing 4.5% seen during the economic slowdown in 2020 triggered by the advent of the pandemic. It also marks the highest default rate since the global financial crisis, when defaults peaked at 10.5%.

The trailing 12-month (TTM) US leveraged loan default rate jumped to 4.72% in October, up from 2.99% a year ago, according to Fitch Ratings.

The volume of loans that has undergone an event of default for the year to October reached USD 72.7bn, marking a 26% rise compared with a total of USD 57.6bn for the whole of 2023, and has even overtaken the default volume reached in 2020 by 12%. This year’s leveraged loan default volume is the highest in recent years, approaching levels seen during the 2009 recession, when defaults peaked at USD 77.5bn.

According to Fitch Ratings, seven issuers defaulted in October, with the total default volume reaching USD 3.4bn for the month. The largest company involved was automaker American Tire Distributors, which filed for Chapter 11 bankruptcy on 22 October, with USD 1.9bn of pre-petition funded debt.

According to Debtwire’s restructuring database, American Tire Distributors was the fourth Chapter 11 bankruptcy of the year in the automotive sector. The company cited a number of reasons for its filing, including the pandemic and the effect of inflation on inventory manifesting in reduced margins, while a market shift towards cheaper tires instead of high-end tires (in which the company specializes) hampered demand. This marks the second time the firm has filed for bankruptcy, having previously emerged from Chapter 11 in 2018.

Distressing situations

Over the past 12 months, distressed debt exchanges (DDEs) have been the primary driver of 92 leveraged loan defaults, accounting for 58% of cases. Chapter 11 bankruptcies have made up 22%, with missed payments contributing to the remaining 20%. Companies are increasingly opting for distressed exchanges over the more costly and time-intensive Chapter 11 process to manage liquidity challenges and extend debt maturities.

Notably, cybersecurity software firm Trellix conducted a DDE on USD 4.2bn of leveraged loans this August, marking the largest loan default since Lumen Technologies’ USD 6.2bn distressed exchange in March.

Sector strife

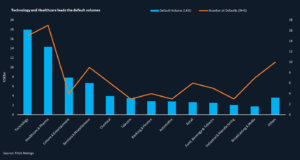

Technology and healthcare have been leading loan defaults in terms of volume and number over the past 12 months. Both sectors combined have contributed to around 45% of total loan default volume since October last year.

The healthcare sector recently has faced widespread challenges, including reductions in physician payments driven by Medicare cuts. The latest cut of 3.37% took effect on 1 January this year, with an additional 2.8% reduction proposed for next year. In addition, the implementation of the No Surprises Act on 1 January 2022 has compounded pressure by prohibiting healthcare providers from billing patients directly for amounts exceeding insurance coverage for certain emergency services.

The sector has also struggled with labor shortages, rising wages, and persistent supply-chain disruption affecting the availability of medical equipment. Moreover, a significant reduction in government pandemic relief funding, which hospitals previously relied upon, has exacerbated financial strain, contributing to widespread distress across the industry.

High interest rates and inflation have caused a reduction in discretionary spending by consumers, resulting in weaker demand for tech products and services, affecting revenue growth across the tech sector.

Looking ahead, recent Federal Reserve interest-rate cuts – 50 basis points (bps) in September and an additional 25bps last week, with the possibility of further rate cuts early next year – could benefit many borrowers. Lower rates are expected to reduce interest expenses and enhance liquidity for issuers with floating-rate loans.