Shutting up shop: post-pandemic retail sector restructurings continue – DebtDynamics North America

The COVID-19 pandemic triggered a significant transformation of the US retail landscape, fueling a dramatic shift in consumer behavior. As a result of a seismic switch to online purchases from in-store shopping, many retail firms found themselves grappling with unprecedented operating challenges, leaving some players ill-equipped or unable to adapt to the changes and forced to seek protection under Chapter 11 bankruptcy laws.

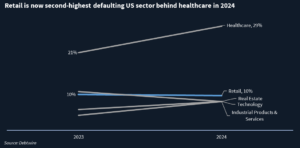

With activity yet to return to pre-pandemic norms, the situation remains volatile for many companies, as evidenced by retail restructurings reaching 10% of all Chapter 11 cases in the year to date (YTD). Debtwire’s Restructuring Database counts six cases of retail sector restructurings out of an overall total of 66 recorded in 2024 YTD. Our likely-to-distress (LTD) metric shows a further seven stressed and three distressed firms in the sector, all on the edge of possible restructuring events.

Last year, retail sector Chapter 11 filings accounted for approximately 10% of all cases, followed by real estate, consumer services technology and industrials.

Soaring inflation has also weighed heavily on several sectors in recent quarters, contributing to higher operating costs, steeper lease expenses, and a greater cost of debt for companies. In addition, it has had a marked effect on consumer behavior, as shoppers have seen their disposable income dwindle, manifesting in a decline in consumer spending.

In 1H20, online purchases spiked at 15.7% of all retail sales from 11.4%. The share of online purchases then stabilized at around 14.5% in 2021, before picking up again in 2022 and closing 2023 at 15.6%.

Among the prominent names facing financial turmoil last year were industry stalwarts such as Rite Aid, Bed Bath & Beyond, and Party City, each with substantial pre-petition funded debt exceeding USD 1bn. During the first few months of 2024, there have already been two retail firms with pre-petition debt of more than USD 1bn that have filed for Chapter 11: JOANN and Express.

Two weeks ago, JOANN, a US arts and crafts retailer, completed its restructuring by swapping debt for equity in barely 2.5 months. It was the eighth company overall in 2024 YTD to file for bankruptcy with debt exceeding USD 1bn. As a result of the restructuring, the company was provided with an exit facility comprising of a USD 600m debt facility and USD 153.4m of term loans, thereby trimming its overall debt load to USD 753m from USD 1.06bn. JOANN had been burning through cash because of lower sales volumes, higher interest expenses, and inflationary cost pressures.

Fashion retailer Express also cited the challenging macroeconomic environment as a key reason for filing for Chapter 11 in April, including reduced consumer spending and a backdrop of higher inflation.

Drugstore chain Rite Aid Corporation was the largest retail firm to file for bankruptcy protection in 2023, with liabilities totaling USD 4bn, and the company was propelled into restructuring thanks to a combination of opioid-related lawsuits and substantial upcoming debt maturities. Note, though, that the pharmacy chain had been generating net losses for the previous nine consecutive quarters because of high-interest expenses and declining sales.

Party City, a party products retailer, was another notable entry onto the restructuring list in 2023, with USD 1.3bn of liabilities. The company lost considerable traffic during the pandemic after it was forced to close all of its shops in the US, and has subsequently been hit by waning demand for products at a time of rising inflation and strong competition from online retailers.

Uncertain future for retailers

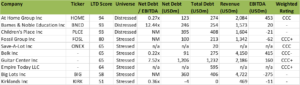

High key interest rates in response to surging inflation have made the cost of borrowing more expensive and further exacerbated operating challenges for retail companies, and we anticipate more Chapter 11 filings from firms that are currently in our distressed universe. There are presently three companies with LTD scores above 90, indicating a very high likelihood of restructuring, and seven more with LTD scores between 50 and 90, which could potentially tip over to become distressed credits.

At Home Group, Barnes & Noble Education and Children’s Place all have a high likelihood of kicking off restructuring processes in the near future, according to Debtwire data.

A year ago, home décor retailer At Home Group completed a distressed exchange of its USD 442m senior secured notes due 2029. However, the company remains highly levered and continues to burn cash because of lower sales volumes.

Barnes & Noble, a solutions provider for the education industry, was greatly impacted by the pandemic and has continued to generate a negative bottom line since 2020. The firm has a USD 380m revolving credit facility due in December and a USD 380m term loan (TL) due in April 2025. In March, Barnes & Noble admitted that it has insufficient liquidity to repay these facilities and has hired legal and financial advisors to help address the issue.

Children’s Place, a children’s apparel retailer, has also been hit by poor operating performance since the pandemic. Vying for extra liquidity, the company in February managed to secure a USD 130m TL from Gordon Brothers at a very high margin of SOFR+ 9%, and then two rounds of funding from majority shareholder Mithaq in the form of a USD 48.6m TL and USD 90m unsecured subordinated TL in March and April, respectively. However, Children’s Place this week revealed in its 4Q23 results that net losses had widened further to USD 128.8m as sales continue to fall.

We believe there has to be a significant uptick in the broader economy for retailers in our stressed universe to turn the corner and reverse the trajectory of their financial performances. The pressure of high interest rates and leverage causing onerous interest burdens, alongside squeezed liquidity because of decreasing sales, together make for a particularly challenging market for retailers, and this is likely to persist until inflation subsides.