Scott McClurg, Head of Private Credit at HSBC Asset Management, on how to identify a niche in private credit

In a recent fireside chat, Scott McClurg, Head of Private Credit at HSBC Asset Management, shared his insights on identifying a niche in private credit and the opportunities and challenges that come with it. Here are the key takeaways from the conversation:

Background and Role: McClurg leads the private credit business at HSBC Asset Management, which was established eight years ago. The team has expanded from infrastructure debt to direct lending, with a focus on the lower mid-market segment.

The Advantage of Being Part of a Bank: HSBC’s banking platform provides a significant advantage in terms of origination, with 220,000 people who can originate deals. This allows the private credit team to focus on specific strategies and geographies, cutting out the noise from inbound leads.

Structuring the Team: To succeed in private credit, Scott emphasizes the importance of having a team with a proven track record in the market. He looks for people who are curious, hungry to learn, and have a strong understanding of the bank and the market.

Educating Investors and Borrowers: HSBC Asset Management will educate investors about the benefits of private credit, including unrivalled access to origination and a lower risk profile. For borrowers, the team provides a one-stop solution that combines banking and credit expertise.

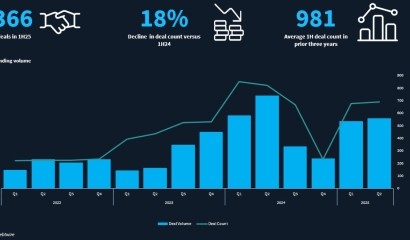

Concerns and Opportunities: Investors are concerned about navigating the private credit market, which is often misunderstood. Scott believes that the market is resilient, and there are opportunities in underserved areas such as the lower mid-market segment.

Consolidation in the Industry: McClurg expects to see some consolidation in the industry, with larger managers acquiring smaller ones. However, he believes that there will still be space for smaller managers who can differentiate themselves and provide attractive portfolios to investors.

Strategies and Outlook: Scott is bullish on transition-themed strategies, which he believes will create a shortage of liquidity in the market. He is also optimistic about direct lending in the private equity-backed space, where private equity firms identify and nurture high-growth businesses.

Aspirations: McClurg’s personal aspiration is to continue growing the private credit business, supporting high-growth businesses, and learning about new opportunities. For HSBC Asset Management, the goal is to scale the private credit business, filling in key areas of opportunity across credit strategies and leveraging the bank’s origination capabilities.

Key timestamps:

00:09: Introduction to ION Influencers’ Fireside Chats

00:35: Scott McClurg’s Background and Role at HSBC Asset Management

01:40: Evolution of Alternative Assets Discussion

03:18: HSBC’s Unique Position in the Private Credit Market

04:55: Relationship Dynamics with Borrowers

06:11: Managing Inbound Leads and Focus Areas

07:32: International Expansion and Local Origination

09:35: Advantages and Disadvantages of Being Part of a Bank

11:05: Independence from the Bank and Decision-Making

12:00: Team Structure and Hiring Strategy

13:48: The Significance of HSBC Brand and Name

14:43: Differentiation and Niche of HSBC Asset Manager

16:28: Investor Concerns and Media Coverage

17:49: Assessment of Private Credit Market Risk

19:59: LPs’ Relationship and Consolidation

20:58: Manager Perspective and Market Balance

21:43: Sponsor Involvement in Private Credit

22:16: Bullish Strategies

22:56: Transition to Less Carbon-Intensive Economies

23:24: Direct Lending and Private Equity

23:51: Stability of Private Credit

24:33: Aspirations for the Future

25:14: HSBC’s Growth and Strategy

25:38: Conclusion