Rite Aid judge extends solicitation exclusivity through late May

Rite Aid, which recently indicated it would move forward with a restructuring transaction under its Chapter 11 plan, has obtained an extension of its exclusive right to solicit votes on the plan until 27 May.

Judge Michael Kaplan of the US Bankruptcy Court for the District of New Jersey entered an order on Thursday (11 April) extending the solicitation exclusivity period. Rite Aid requested the extension two months ago, and in its initial request, the company sought to extend both its exclusive plan filing period to 29 April, and the corresponding solicitation period to late-June. Judge Kaplan’s ruling extends only the solicitation period, but also specifies that he is not restricting Rite Aid from seeking further extensions of the plan filing or solicitation period in the future.

The exclusivity extension comes amid a flurry of activity in Rite Aid’s Chapter 11 case. Earlier this week, the company reported that it would not pursue a sale restructuring—which was one option laid out in the disclosure statement for the company’s Chapter 11 plan—and would instead move forward with a debt-for-equity exchange through a “plan restructuring.” Rite Aid has described the plan restructuring as a transaction that would give holders of its senior secured notes a pro rata share of 100% of the equity in the reorganized company.

The company has also recently lined up several asset sales, including a USD 2.75m deal that would transfer ownership of its Health Dialog Services Corp care coordination business to Infomedia Group Inc, which operates as Carenet Health, and a number of sales of real estate assets.

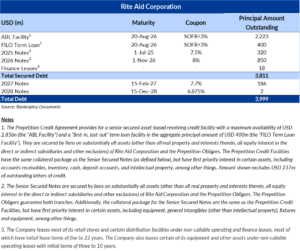

Additionally, Rite Aid disclosed earlier this week the terms of its proposed exit financing to support the reorganized business’s operations after emerging from the Chapter 11 process. That financing consists of USD 350m in takeback senior secured notes, an asset-based revolving facility of USD 2.25bn to USD 2.65bn, and a USD 300m ABL first-in-last-out exit facility.

Earlier in the company’s Chapter 11 case, it obtained bankruptcy court approval to sell its Elixir pharmacy benefit management business to MedImpact Healthcare Systems, which had served as a stalking horse bidder for those assets with an offer that set a closing purchase price of USD 567.5m.

Rite Aid filed for bankruptcy in October 2023 with USD 3.45bn in committed debtor-in-possession financing from prepetition secured noteholders under a restructuring support agreement (RSA). The retail pharmacy also came into the process with the Elixir stalking horse bid, while noteholders signed onto the RSA also agreed to credit bid a portion of their debt for most of the company’s otherwise unsold assets, minus hundreds of stores that the company has sought to close.

Related links:

Exclusivity extension order

Case Profile

Debtwire Dockets: Rite Aid Corporation

Debtwire Restructuring Database: Rite Aid Corporation (Access required)