Reviewing the offshore restructuring progress of Chinese property developers 2.0 – APAC Restructuring Insights Report

10th February 2025 03:19 PM

Document

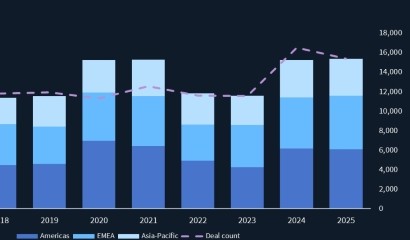

It has been nearly four years since the collapse of the Chinese property sector, yet much of the rebuilding work remains unfinished. This report — powered by Debtwire’s Restructuring Database — provides an overview of the restructuring efforts undertaken by Chinese property developers that have issued offshore bonds.

Below are the key takeaways that will be expanded upon in the attached report.

- As of this report’s date, 64 developers have either defaulted on their offshore bonds, engaged in a workout process, or both, since the wave of defaults began in the second half of 2021.

- LVGEM (China) Real Estate Investment, which failed to redeem its USD 26m-equivalent private notes upon their early January maturity, became the 61st developer to default offshore since July 2021.

- Three developers — Ganglong China Property Group, Huijing Holdings, and Road King Infrastructure — completed offshore restructuring processes without ever defaulting on their bonds. Including these cases, 36 developers have completed 54 restructuring processes, covering 159 offshore bonds with a combined USD 56.6bn in principal since July 2021.

- Holistic offshore restructurings have had a poor track record. Of the 11 developers that completed a holistic offshore restructuring process involving multiple offshore bond tranches since July 2021, five later defaulted again.

- Among those five, RiseSun Real Estate Development is the only one to have cured its second default and is not currently in a restructuring process. Meanwhile, Modern Land (China) has yet to hire advisors after missing an offshore bond payment in December 2024. China South City Holdings (CSC) has hired advisors but has not officially launched a process. Golden Wheel Tiandi Holdings (GWTH) and Guangzhou R&F Properties (R&F) have both initiated creditor solicitation for their respective schemes of arrangement.

- Including GWTH and R&F, 41 developers have hired offshore advisors and are currently undergoing either a restructuring or a liquidation process. As shown in the chart on page nine of the attached report, six of these developers — Tahoe Group, Sichuan Languang Development, China Evergrande Group, Sinic Holdings (Group), Fantasia Holdings Group, and Kaisa Group Holdings — appointed restructuring professionals more than three years ago but have yet to complete their processes. Additionally, 19 developers hired an advisor more than two years ago, and 12 others engaged advisors over a year ago.