Primary market shows signs of revival, momentum to continue in 2H23, but at a cost

Driving the action, interest rates and inflation have stabilized and market sentiment regarding an imminent recession in the US has improved, prompting borrowers with upcoming refinancing needs to get off the sidelines, the sources said. Still, the uncertain outlook means issuers will need to make concessions to fuel interest from the buyside, they added.

Among the most noteworthy transactions so far this month, Arconic Corp is in the market looking to raise USD 1.9bn of debt to partially fund Apollo Global Management’s USD 5.2bn buyout of the aerospace parts manufacturer. As part of the debt financing package, the company yesterday kicked off a bond offering for a USD 900m senior secured note due 2030. This follows marketing on a seven-year USD 1bn first lien secured term loan B that launched last week offering SOFR+ 475bps, and an OID guided at 97-97.5. The TLB syndication timeline was accelerated from the initial 1 August commitment deadline and is expected to wrap up later this week, concurrent with the bond offering. The debt package also includes a USD 725m senior unsecured note due 2031 to be offered privately. Apollo and minority investor Irenic Capital Management have also committed to writing a roughly USD 2.3bn equity check.

Procurement support provider OMNIA Partners also closed a seven-year USD 1.65bn term loan partly backing the company’s acquisition of certain non-healthcare assets from healthcare business solutions provider Premier for around USD 800m in cash, according to news reports. The term loan was upsized from USD 1.625bn at launch and the spread was tightened to SOFR+ 425bps OID 99 from an initial margin guidance of 450bps-475bps with a 97.5-98 OID. The credit facility, which will also go toward refinancing existing debt, includes a USD 155m delayed draw term loan and a USD 250m revolver.

Meanwhile, Chatham Asset Management-owned RR Donnelley priced an upsized USD 285m junior lien secured offering via Jefferies last week. Proceeds from the deal – which carried a 95.3 OID and 9.75% coupon for an 11% yield – funded a takeout of existing debt, including a portion of its 10% PIK holdco notes due 2031 held by Chatham, as reported.

Improved sentiment regarding the magnitude of an economic downturn in the US based on the latest macroeconomic data is fueling market expectations that the second half of the year will see a gradual uptick in the volume of new issuances.

“Data is improving and the latest inflation numbers make me think that the US is on the right path. We think that if there is a recession, it will be a mild one and this should be very positive for fixed income,” David Norris, portfolio manager at TwentyFour Asset Management told Debtwire.

US GDP was revised up to 2% annualized advance in the first quarter by the government on 29 June, up from 1.3% from their prior estimation. Household spending rose at 4.2% rate, the strongest pace in nearly two years. At the same time, inflation gauges were revised down by the Fed leading the market consensus to expect the Central Bank’s rate hiking process to be nearing the end.

The US regional banks crisis also did not have profound effects on the broader banking system, further boosting market sentiment. “It seems like we’re not heading for a hard landing, which is bringing the market back to life,” added Norris.

Meanwhile, a rally in the high yield secondary over the last few weeks has also bolstered optimism in the new issuance market, said one buysider. Mirroring the improved performance in high yield secondary trading, SPDR Bloomberg High Yield Bond ETF last traded at USD 92.20, versus USD 91.95 on 30 June.

“If a borrower has debt maturing in 2025 or even in 2026, they better be refinancing it soon, while the window is open,” the buysider noted.

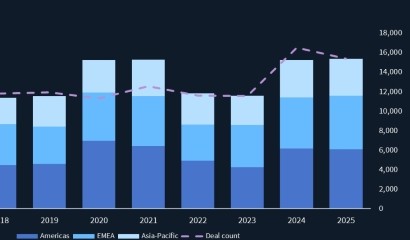

There are USD 98bn of high yield bonds and loans maturing in 2023. The number rises to USD 289bn in 2024 and USD 558bn in 2025, according to data from Dealogic.

Most 2023-2024 maturing debt was refinanced in 2020-2021, while the market was still robust, Chris Blum, head of corporate finance and leveraged finance at BNP Paribas told Debtwire.

“During the pandemic years, transaction volumes were incredibly high as companies valued liquidity and the bond market was never better,” said Kenneth Wallach, co-head of global capital markets practice at Simpson Thacher.

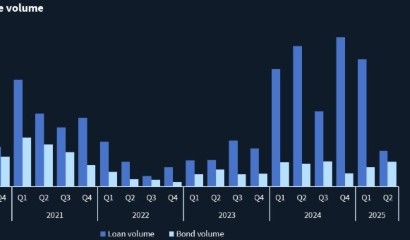

Total issuance for US marketed high yield bonds reached USD 429bn from 595 deals in 2020 and USD 462bn from 636 transactions in 2021, according to data from Dealogic. The number fell to USD 104bn from 134 transactions in 2022.

Cautious optimism

Though 2023 has been a good year for US junk issuance compared to 2022, the market will remain in a defensive stance until borrowers and investors are able to gauge the full magnitude of the upcoming US economic downturn. There’s been USD 92bn of high yield bond issuance year-to-date through June, according to Dealogic data, 89% of the total volume issued during all of 2022.

The primary market saw challenges in 2022 mainly due to a strong inflationary environment and rising interest rates. “In 2020 and 2021 companies took advantage of positive market conditions to push out debt maturities and get more runway before needing to raise more capital,” said Wallach.

The war in Ukraine also unsettled the economic outlook, particularly for companies with significant exposure to Europe, while the trade tensions and the economic outlook for China also had negative impacts on the primary market, according to Wallach.

The still-uncertain outlook is keeping investors more selective, according to three additional buysiders.

“It could take a while before you see [an influx of broadly marketed] unsecured debt as a part of the capital structure on providing financing for LBOs,” said Grant Moyer, Head of Leveraged Finance at MUFG. Currently, the bridge caps for CCC rated credit are just too expensive and too close to the cost of equity, he noted. Hence, “you’re seeing all senior secured financings supporting these LBOs inherently giving slightly lower leverage at around 4x to low 5x, versus the 6x-7x we were seeing before.”

Terms are also wider than they were compared to 18 months ago, according to Moyer. “We’re still seeing pricing relatively elevated and still fairly conservative flex if you’re an underwriter. Market flex used to be 100bps-125bps. Now, we’re getting 150bps-175bps with a bigger portion to OID than we used to see. We expect that to continue until the market shows real stability.”

The average institutional loan margin for B rated loans has so far remained consistent on year-over-year basis, hovering at 432bps in 2Q23 compared to 433bps in 2Q22, according to Debtwire data. The overall lack of movement is mainly due to an increase in issuance from higher rated firms, which are more able to tap the syndicated markets than riskier credits in the current environment, Debtwire’s June US Leveraged Insights noted.

However, margins seem to be on the rise when looking at individual ratings categories, the report further highlighted. The weighted average margin on BB rated credits has edged up a tad higher to 338bps in 2023 YTD through June compared to five years ago when the average margin was at 277bps and ten years ago when the average margin was at 313bps. Similarly, for B rated loans, the average margin has risen to 441bps for 2023 YTD compared to 389bps five years ago and 402bps 10 years ago, according to the Debtwire report.

The percentage of bonds issued as senior secured instruments over unsecured notes remained at 50% in June – far above historical averages of around 30%-40%, the Debtwire report further highlighted. Along with the safety of bonds that are secured over assets, a greater percentage of higher rated issuers have tapped the bond markets thus far in 2023 with 56% of issuers having a BB rating, up from 43% last year.

BB rated companies currently represent a sweet spot in the market, according to Patrick Ryan, head of global banking and credit practice at Simpson Thacher. “They have higher yields for investors than investment grade with a lower risk profile than most non-IG companies, and also tend to be active users of capital, including for acquisitions,” Ryan said.

While the primary market remains in a defensive stance, the private credit market is expected to gain traction as an alternative source of capital, as seen in Arconic’s USD 725m privately placed unsecured bond tranche.

“We’re still in the early innings of seeing the impact as the large maturity wall is still out there, so we will need to see how it plays out. Fixed rate bonds will likely be more attractive to investors once interest rates stabilize or even start to decline,” Wallach said.

“Borrowers might not have a choice other than going to direct lenders if the broadly syndicated loan market (BSL) [and high yield market] is not open to them,” noted one of the buysiders. “If direct lenders start doing bigger deals, then the question will be if the borrowers want to pay 300bps–400bps higher to direct lenders when the BSL market reopens.”