Europe Buyout Highlights: Market Overview & Financing Trends – 1H24

8th August 2024 09:00 AM

This report is a comprehensive overview of the European buyout market using best-in-class Leveraged Finance and M&A data across ION Analytics.

To see the full report, please click below.

Key Trends in 1H24:

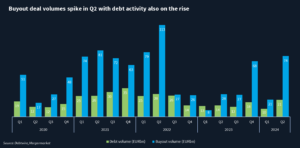

- Buyouts totalled EUR 95bn, up 168%, led by Apollo’s EUR 10.1bn acquisition of a 49% stake in the joint venture entity related to Fab 34.

- Issuance of leveraged loans recovered in 2Q24, rising 62% from 1Q24 to EUR 8.13bn and totalling EUR 13.1bn for 1H24.

- High-yield bond activity for LBOs resumed in 2Q24 with EUR 1.23bn, while half-year issuance was the lowest since 1H17.

- The technology sector topped the table with buyouts totalling EUR 36.5bn.