Margin Call: Average European private debt pricing tightens to 614bps in 4Q23

Margin Call is a quarterly update on pricing developments in Europe’s private credit market. For more on insights on direct lending market developments, visit the European Direct Lender Rankings data report.

The pricing on private credit deals across Europe has tightened by more than a full percentage point since 4Q21, falling to an average of 614bps in the final quarter of 2023, according to Debtwire data.

While pricing saw sharp declines from the highs of 734bps in 4Q21 to the three-year lows in 2Q22, when the average dropped to 589bps, margins have been on a steady decline since 1Q23 (674bps) amid a surge in direct lending activity.

Pricing on deals may continue to tighten as we head into the final month of 1Q24, with the pressure to deploy dry powder heating up as credit funds compete with traditional bank underwriters to finance the most coveted deals.

A number of debt funds have recently pushed margins to new lows. The private equity backers of The Ardonagh Group had been initially seeking to refinance the UK’s largest independent insurance broker with an unusually tight margin of 500bps–525bps. However, the company’s debt led by Ares reportedly priced even tighter, at 475bps above the base rate.

Direct lenders are vying to finance a GBP 400m-plus dividend recap of Permira-owned UK-based wealth manager Evelyn Partners with pricing in the SONIA+ 550bps-575bps range. As negotiations between lenders and Permira remain ongoing, the deal could potentially price lower.

After a widely anticipated buyout deal with KKR – which had been expected to price at 575bps over the sterling base rate – fell apart in December, IRIS Software’s sponsor-backers are now reportedly in talks with direct lenders to refinance the company at a margin of 500bps.

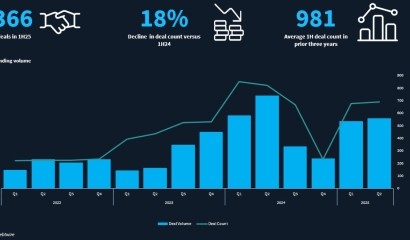

Direct lending volume reached EUR 19bn in 4Q23, surpassing the EUR 15bn transacted in 3Q23, according to Debtwire data. These figures are, however, still shy of the three-year peak levels when EUR 30bn was churned out during 2Q22 and the EUR 24bn generated in 3Q22.