Luke Gillam, Partner and Head of Senior Direct Lending at Albacore, on private credit as resilient asset class

Luke Gillam, Partner and Head of Senior Direct Lending at Albacore, shared his insights in a recent ION Influencers Fireside Chat on the resilience of private credit and direct lending as asset classes.

Luke Gillam’s Background

- Current Role: Partner at Albacore Capital, Head of Senior Direct Lending.

- Experience: Over 20 years at Goldman Sachs, leading the credit capital markets team in Europe and chairing global capital committees.

- Focus: Driving the success of Albacore’s first dedicated senior direct lending fund.

Key Topics Discussed

- Private Credit as a Resilient Asset Class

- Performance: Private credit, particularly senior direct lending, has outperformed other fixed income asset classes over the past five years.

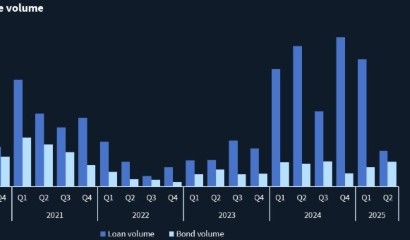

- Volatility: Lower volatility compared to liquid leveraged loans and high-yield bonds.

- Premium: Direct lending typically offers a premium of 150-200 basis points over liquid leveraged loans due to its illiquid nature.

- Evolution of the Industry

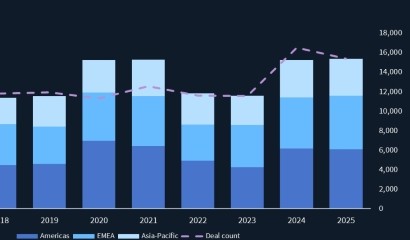

- Growth Post-GFC: The industry grew significantly after the Global Financial Crisis (GFC) as banks pulled back from leveraged corporate lending.

- Market Expansion: Initially focused on lower middle market transactions, now includes larger deals, such as the €6.5 billion Adavinto deal in Europe.

- Investor Appetite and Market Segmentation

- Focus Areas: Albacore targets middle to upper middle market deals, finding better value and credit quality.

- Market Dynamics: Smaller market segments offer higher premiums but also higher default rates.

- Deal Origination and Market Trends

- Club Transactions: Majority of deals (€50 million and above) are now club transactions, reducing reliance on single lenders.

- Relationship Building: Importance of maintaining strong relationships with private equity sponsors.

- Impact of Economic Cycles

- Recession Preparedness: Emphasis on rigorous downside analysis to prepare for potential macroeconomic weaknesses.

- Historical Perspective: Insights from past economic shocks, including the dot-com bubble, GFC, and COVID-19.

- Future Outlook

- Investment Focus: Balancing new investments with portfolio management.

- Default Rates: Current trends and future expectations in default rates.

- Geopolitical Shifts: Potential shift in investor focus from the US to Europe due to macroeconomic stability.

- Industry Consolidation

- Trends: Continued consolidation among asset managers, with larger firms growing in the private credit space.

- Albacore’s Strategy: Scaling up operations while maintaining focus on high-quality investments.

- Team and Recruitment

- Talent Acquisition: Recruiting from both sell-side and buy-side to build a strong, dynamic team.

- Future Plans: Scaling the platform and expanding the team to support growth.

Key timestamps:

00:08 Introduction to the Fireside Chat

02:02 The Case for Private Credit

04:19 Evolution of the Direct Lending Industry

06:09 Investor Appetite and Market Trends

08:39 Origination Strategies in Direct Lending

11:25 Challenges in Maintaining Relationships with Sponsors

13:14 Market Resilience and Economic Shocks

18:04 Shifting Focus: European vs. US Private Credit

20:05 Specialization in Private Credit Strategies

21:16 Future Trends in M&A Activity

22:53 Consolidation Trends Among Asset Managers

24:10 Future Plans and Business Growth

25:39 Recruitment Strategies for Scaling the Team

26:14 Key Skills for Successful Investing