Loan Highlights 1Q25

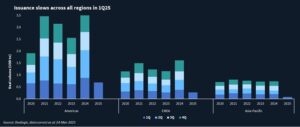

The first three months of 2025 saw a slowdown in loan issuance across the regions of the Americas, EMEA and Asia-Pacific (APAC). As at 24 March, Dealogic data shows the loans market printed USD 1.04tn-equivalent in 1Q25, 28% down on 1Q24 (USD 1.46tn).

Last year represented a recovery for the market against a backdrop of declining interest rates – the best year since 2021. However, 1Q25 results so far raise question marks over growth sustainability. Issuance volumes have fallen in year-on-year (YoY) comparisons in all three regions, although part of the gap could potentially close in the final days of the quarter.

Issuance in the Americas totalled USD 687bn in 1Q25, 25% below USD 880bn in 1Q24. In quarter-on-quarter (QoQ) comparisons, the fall is 35%, although volume figures were higher than in 2020, 2022 and 2023.

In EMEA, loans amounted to USD 268bn in the first quarter, 30% less than 1Q24 and 41% below 4Q24 volume. This is the lowest first-quarter volume in the past five years, when the average was USD 331bn.

Figures for APAC, which had reached USD 84bn at the time of writing, may yet increase before quarter-end. Nevertheless, issuance is still far from previous marks. The average for first quarters between 2020 and 2024 was USD 207bn, with 2020 being the previous lowest point at USD 183bn.