LevFin Highlights 9M24: Issuance thrives on strong demand and falling borrowing costs

Powered by Debtwire data, LevFin Highlights reviews leveraged finance market activity across North America, EMEA, and APAC in 9M24. All data correct as of 27 September 2024.

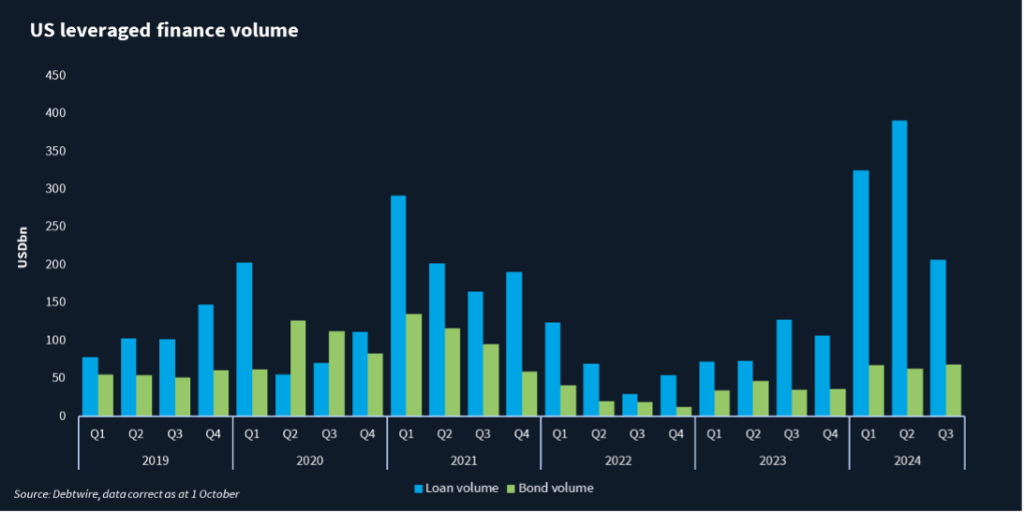

Leveraged finance (LevFin) issuance across the US and European institutional loan and high-yield (HY) bond markets rose 279% year-on-year (YoY) to USD 1.4trn in the first nine months of 2024. Strong investor demand and the falling cost of borrowing propelled the rebound in market activity, with refinancing and opportunistic repricing transactions driving year-to-date (YTD) volumes.

Both mergers & acquisitions (M&A) and leveraged buyout (LBO) transactions bounced back from the historical lows seen in 2023. Renewed liquidity and tightening spreads helped syndicated markets regain their share of the large-cap LBO space from private credit funds, which had stepped in to fill the void during the more volatile periods over the last two years. The availability of cheaper financing attracted a raft of borrowers to refinance private credit debt in the broadly syndicated markets this year, giving a boost to the much-needed supply of new paper.

With collateralised loan obligations (CLOs) on track for record issuance this year and HY funds drawing in net inflows amid cooling inflation and expectations of monetary easing, technical conditions have been largely supportive for issuance.

However, worse-than-expected macroeconomic indicators in the US at the start of August triggered a brief sell-off across credit markets. Though a rally was quick to follow, the spike in volatility nevertheless dampened loan and bond issuance that month.

As primary markets swung back into action in September, a batch of large LBO deals emerged from the loan and bond pipeline, including those backing US financial technology firm Envestnet, US educational technology company Instructure Holdings, German motors and large drives unit Innomotics, and UK-based parcel delivery firm Evri.

However, the scales in the post-summer pipeline remained tipped in favour of refinancing transactions, but a surge in M&A/LBO activity could be on the cards in the coming quarters if central banks keep the ball rolling on interest rate cuts.

The European Central Bank (ECB) made two 25bps cuts in June and September, lowering its deposit rate to 3.5%, while the Bank of England also lowered the rate by 25bps to 5.0% in August. The Federal Reserve cut the target rate by 50bps to 4.75%-5.00% in September.