LevFin Highlights 1H24: Rebound in issuance underpinned by strong investor demand

Powered by Debtwire data, LevFin Highlights reviews leveraged finance market activity across North America, EMEA, and APAC in 1H24. All data correct as of 2 July 2024.

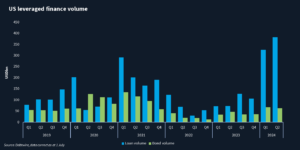

Leveraged finance (LevFin) issuance across the US and European institutional loan and high-yield (HY) bond markets in 1H24 more than tripled from a year ago, ballooning to USD 1trn. The rebound in issuance has been driven mainly by refinancing activity, while the undersupply of new-money paper amid strong investor demand has given rise to a deluge of loan repricing exercises on both sides of the Atlantic.

LevFin markets regained their appeal in 2024, as interest-rate hikes plateaued and fears of recession subsided. A rosier macroeconomic outlook and the prospect of rate cuts propelled investors to funnel money back into HY funds, while collateralised loan obligation (CLO) issuance also surged this year.

However, growing investor appetite for LevFin paper was not met by a meaningful revival in mergers & acquisitions (M&A) in the first half of the year. Although year-to-date (YTD) issuance for M&A transactions, including leveraged buyouts (LBOs), ticked up compared with a rather desolate 2H23, the gap in buyer and seller valuations continued to hinder dealmaking.

While LevFin bankers expect incremental increases in M&A financing in the coming quarters, the current pipeline indicates that a surge in M&A-related loan and bond issuance is not on the cards for 2024.